In a a tumultuous year for stocks, few stories have been as dramatic as the break for Tesla Inc.

Electricitycar manufacturer Billionaire-led Elon Musk will begin trading as a member of the S&P 500 Agenda on Monday, marking a series of 2020 milestones. Now, stock has long been led by fanatical believers in the company’s illustrious founder has gone mainstream after an eight-fold rise this year.

Here are six charts that show what a wild ride it has been, and why the variability may be far from over.

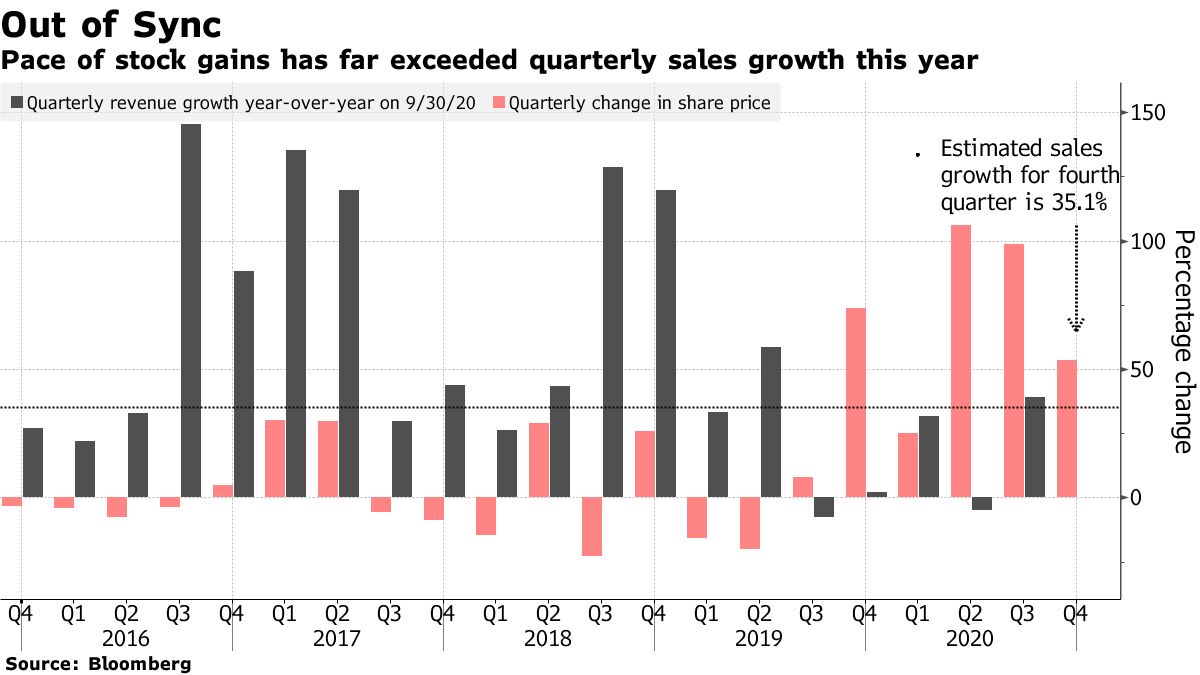

The long view

Tesla’s revenue growth has been sparse this year, but its shares are poised for their sixth straight quarterly gain as traders focus on long-term potential.

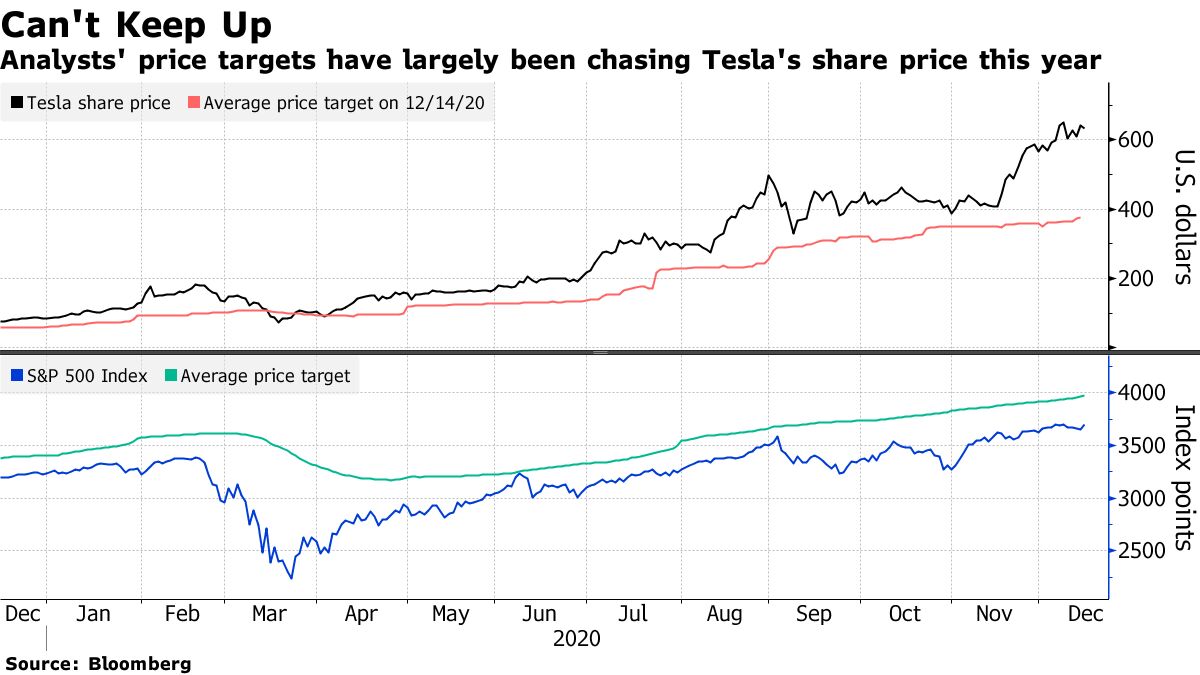

Fast moving target

Analysts have had a hard time keeping up with Tesla investor harassment, which has kept them driving the stock higher despite the downside. disappointments and warnings about the stock being “highly valued. Tesla shares closed at $ 695 on Friday. At this time last year, the 12-month average price target on Wall Street was $ 58.30.

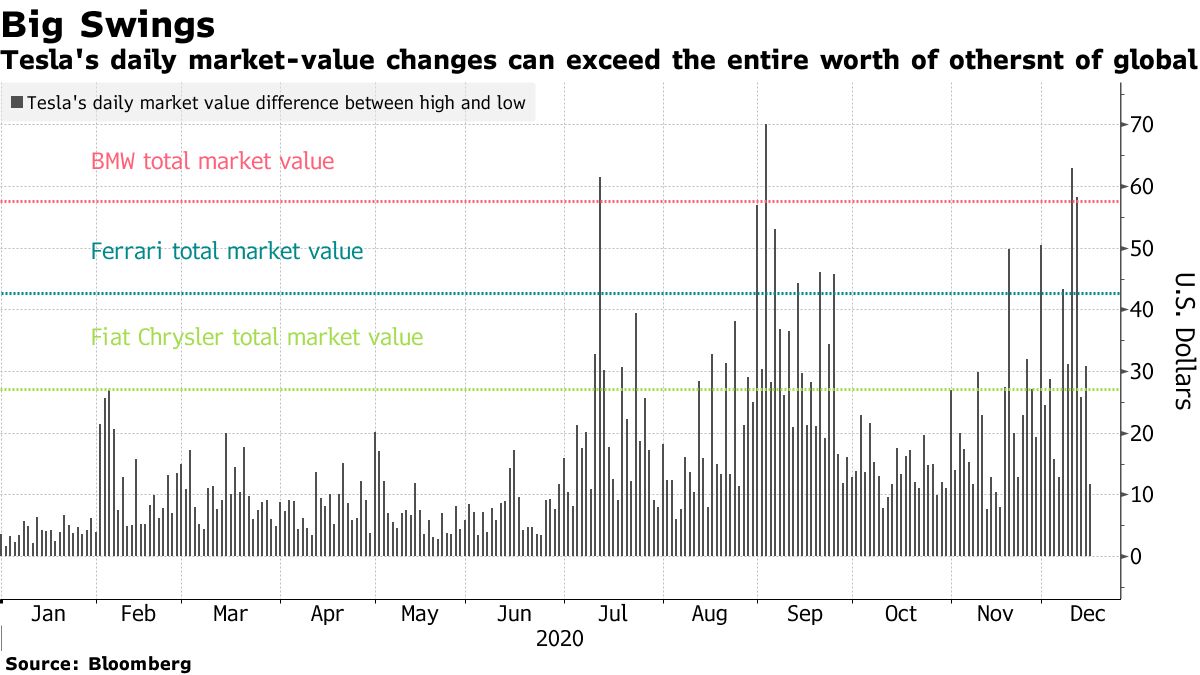

Terrible movements

Tesla has been one of the most volatile stocks in the U.S. this year. It is now common for the value of one-day movements in Tesla stock to exceed the market capitalization of major manufacturers such as Fiat Chrysler Automobiles NV, Ferrari NV or BMW AG.

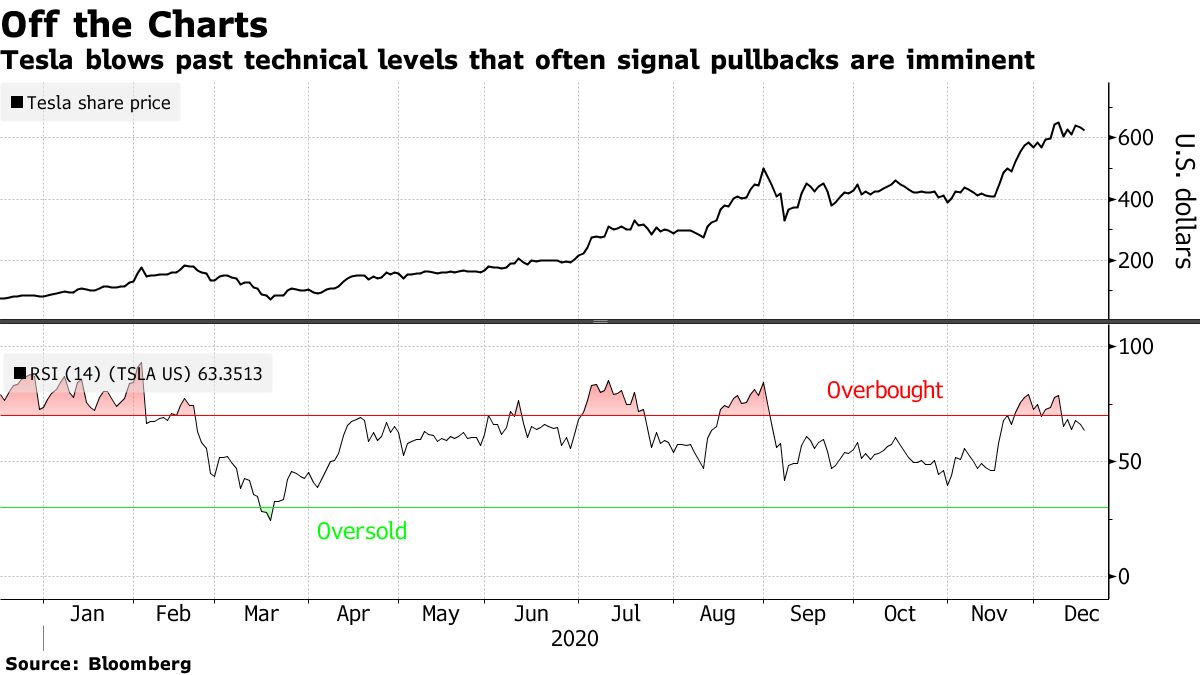

Technical Extremes

Tesla’s 14-day strength index exceeded the “overbought” range by almost three out of every 10 trading days this year, usually a sign that stocks are ready to go. back. Not so for Tesla, which closed Friday at an all-time high.

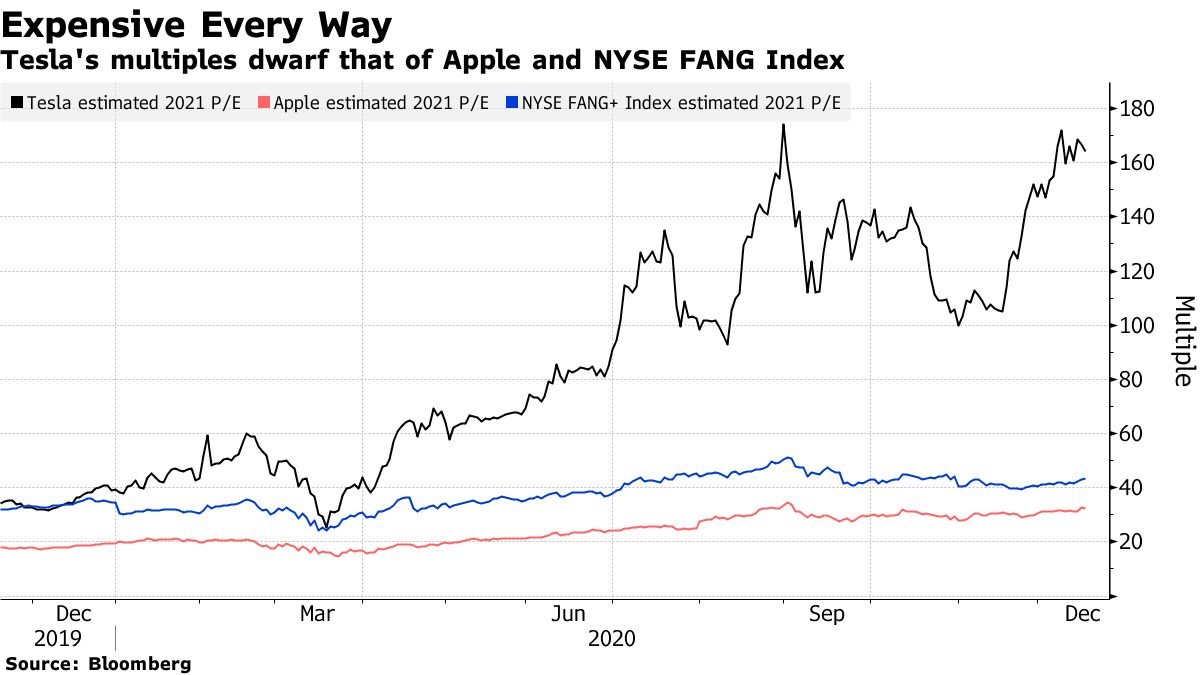

Valuable rich

How Tesla should be valued is one of the most contentious issues between bulls and bears. Goldman Sachs says the stock is worth $ 780; JPMorgan’s price target is $ 90. Tesla’s valuation, either price-to-earnings or price-to-sale, is significantly higher than that of both Apple Inc. and NYSE FANG + Index of megacap technology segments.

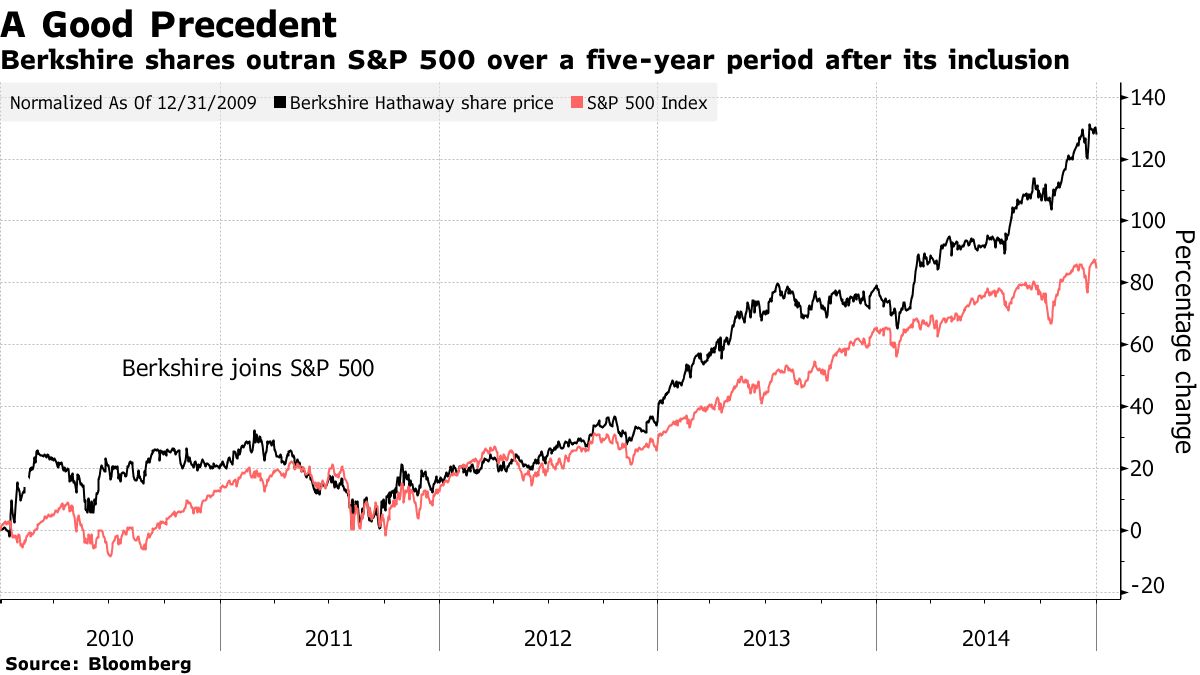

The way forward

Skeptics say Tesla’s move could break after it was introduced into the S&P 500 as one of its heaviest members, but there is a precedent for the rally to continue. Like Tesla, Berkshire Hathaway Inc. down in the galley with heavy pressure and, after a short sale, started again to exceed the benchmark over the next five years.

– Supported by Karen Lin, Jan-Patrick Barnert, Kenneth Sexton, and Brendan Walsh