Photographer: Chuanchai Pundej / EyeEm / Getty Images

Photographer: Chuanchai Pundej / EyeEm / Getty Images

Famous animal spirits are running wild all over Wall Street, but the numbers are pushing and the market for these bulls is even crazier than it seems.

Global stocks are now worth around $ 100 trillion. American companies have raised a record high of $ 175 billion in public listings. Some $ 3 trillion of corporate bonds are traded by negative result.

As the virus spreads, the economic cycle stays on life support and businesses get overwhelmed with new locks.

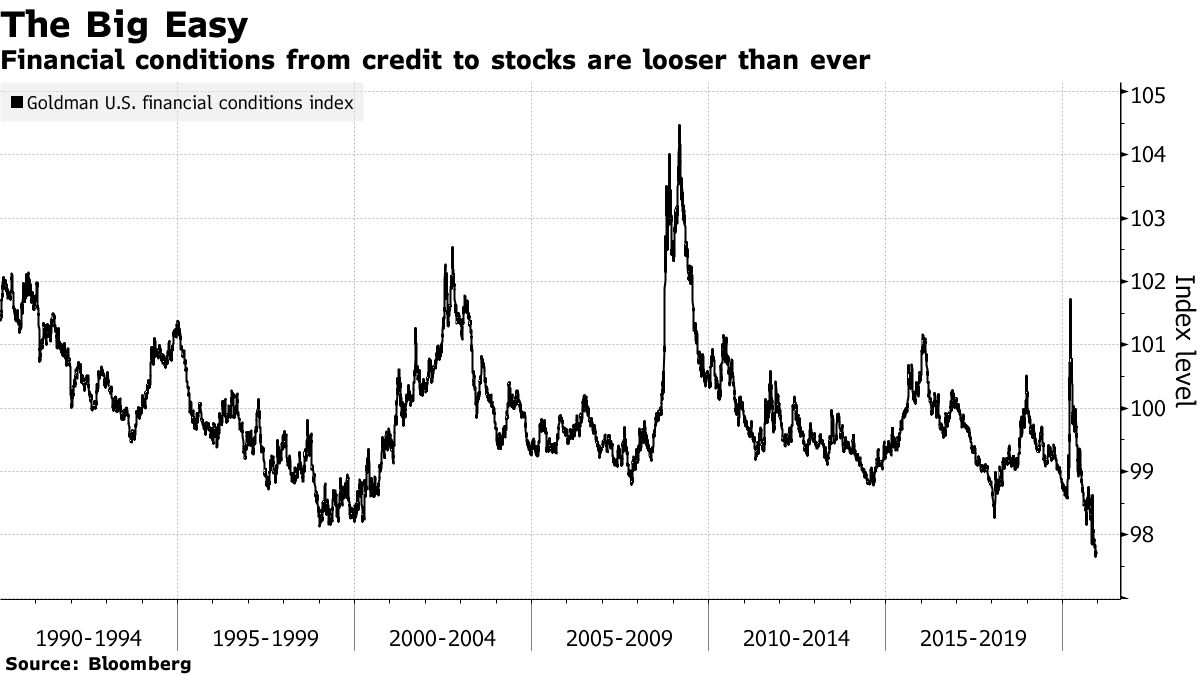

Driven by endless cash incentives and post-pandemic betting worlds, day traders and institutional pros alike enjoy the easiest financial situation in history.

“Signs of sentiment are moving into euphoria,” said Cedric Ozazman, chief investment officer at Reyl & Cie in Geneva. “People are now jumping in to invest amid fears of missing Santa Claus rally. ”

Read More: BofA Flag selling signal for stocks as investors rip out money

Here are the signs of a market freeze in this year of death, disease and economic crisis.

Boom IPO

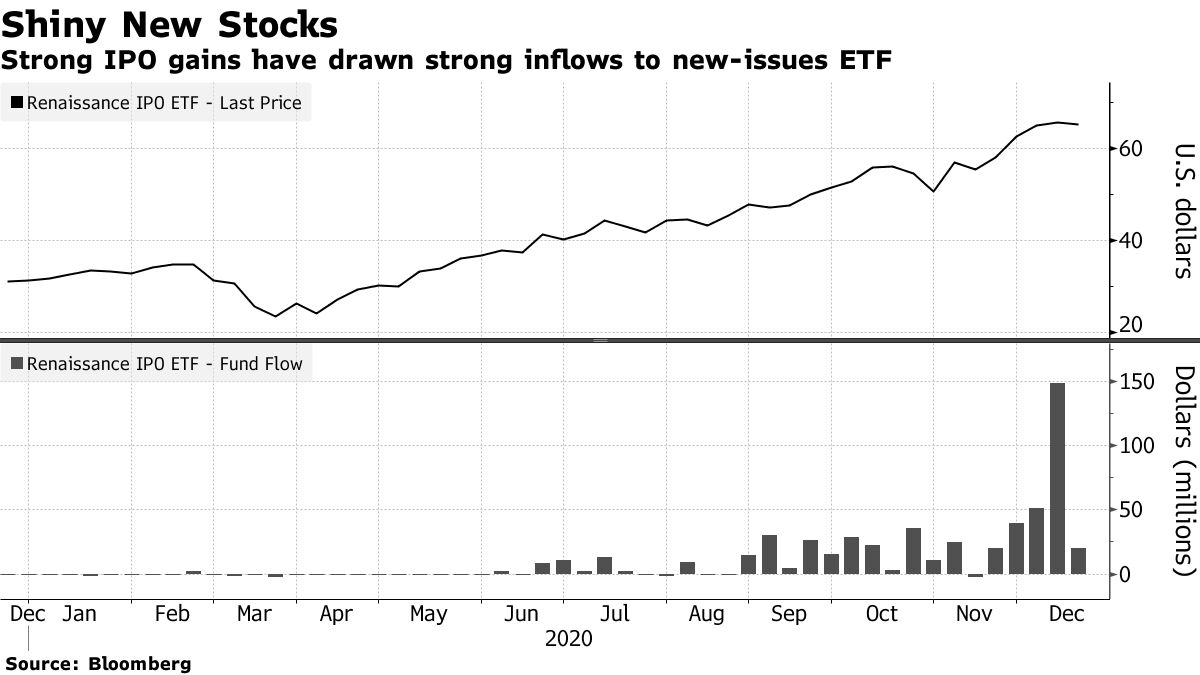

Nothing shows a stock peak like a run to the public markets. Debuts from Snowflake Inc. to Airbnb Inc. first public offering book this year to $ 175 billion higher than the U.S., data compiled by the Bloomberg show.

Special construction vehicles that raise funds for a “blank check” company to build anything it wants to raise more than $ 60 billion in 2020. That’s more than the previous decade combined.

Investors still can’t get it enough. The first-day yield for IPOs averaged 40% this year, the highest ever in 1999 and 2000, according to one estimate.

All of that has attracted unprecedented interest in IPO Recovery’s trading funds tracking new listings, up more than 100% this year. Even SPACs that have not announced a build-up target of nearly 20% in 2020, Bespoke Investment Group fa-near.

“If that’s not a sign of exile, we don’t know what it is! ”Special analysts wrote in a note.

Stock Rally

Robinhood traders have been making a speech at Wall Street this year discussing everything from technology options for airline shares. With these retail investors running the equities rally along with institutional gains, the S&P 500 is trading with multiple sales of around 16% above the 2000 peak.

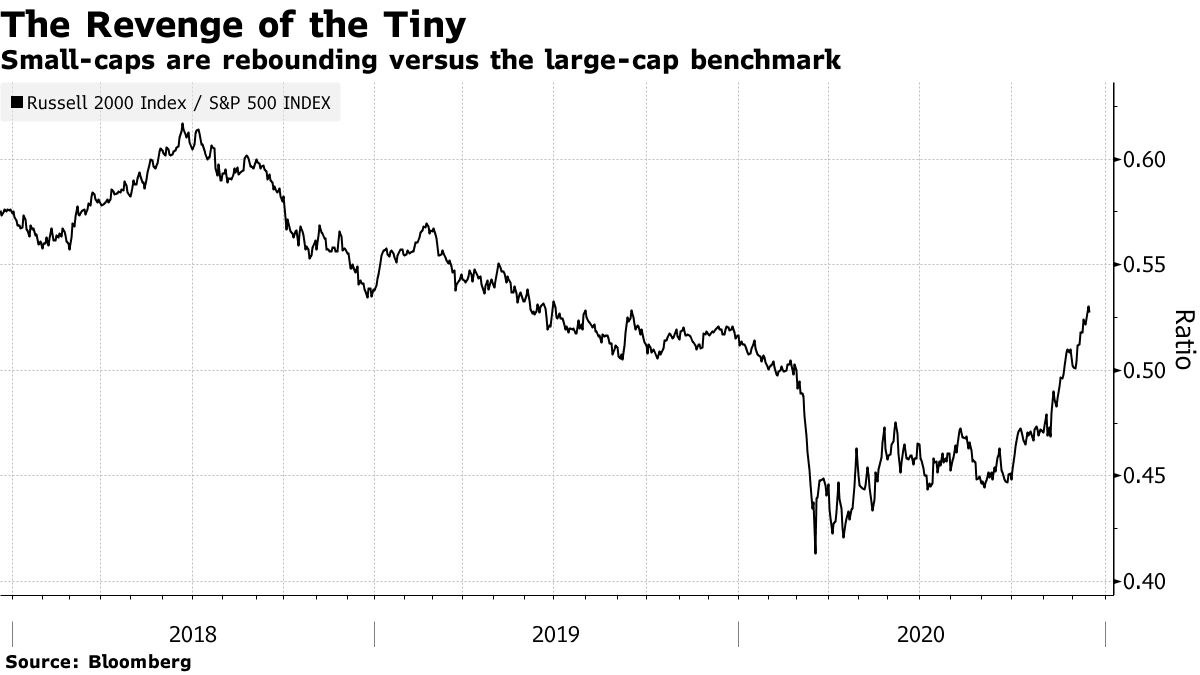

Everything is going up. Goldman Sachs ’basket of the shortest stocks in Russell 3000 has risen about 40% in this quarter, three times the broader index. High beta shares are close to their highest compared to those with low volatility since 2011.

Each time the Russell 2000 has taken over 95% off the pool, it has gone on to lose money over the next three months, according to SentimenTrader. It is now up about 100% from the March low.

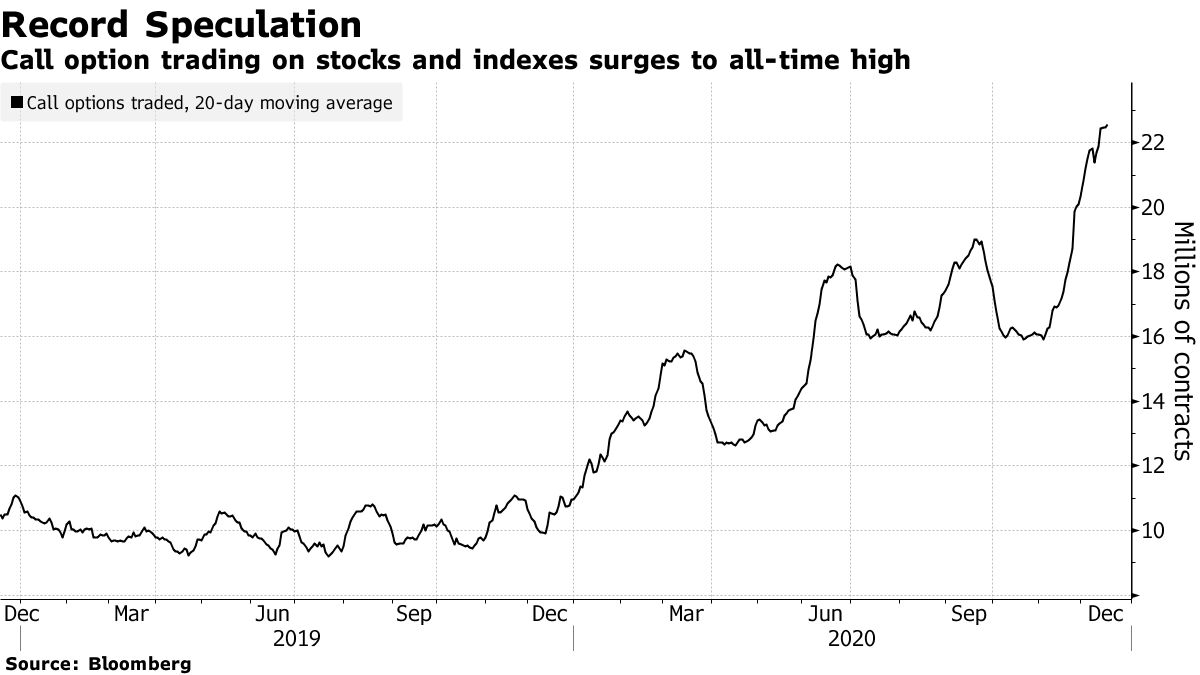

Options Frenzy

Bullish retail investors have fallen into the complex world of derivatives like never before this year. Over the past 20 days, the highest average of about 22 million call contracts is traded daily across U.S. exchanges.

Cboe’s loss-to-loss ratio has fallen nearly a decade low – a sign that traders have rarely been as hellish as running upside down in single stocks.

Union Mania

Animal spirits in corporate boardrooms are another infamous sign of a market cap. This quarter is shaping up to bi an strongest for contract-making activity since 2016 after the third highest quarter. S&P Global Inc. buying IHS Markit Ltd. and Advanced Micro Devices Inc. takes over Xilinx Inc. among the inhibitors.

With corporate cash volumes rising in recent years and trading volume as a percentage of market value still below the long-term average, it is possible that recent activity is only the beginning.

Europe coming together

Even the European IPO market, which is much smaller in size than the one in the US and not as used as big first-day pops, is going bananas.

Among the 44 companies listed on European exchanges since November 9 – the day’s news of coronavirus vaccination stopped bulls in equities – the average gain has been at 16%, according to data released by Bloomberg compiled. About 70% of them trade above their IPO price.

“With higher equity valuation, IPOs are once again a viable exit route for sponsors,” said Darrell Uden, ECM global co-head of RBC Capital Markets.

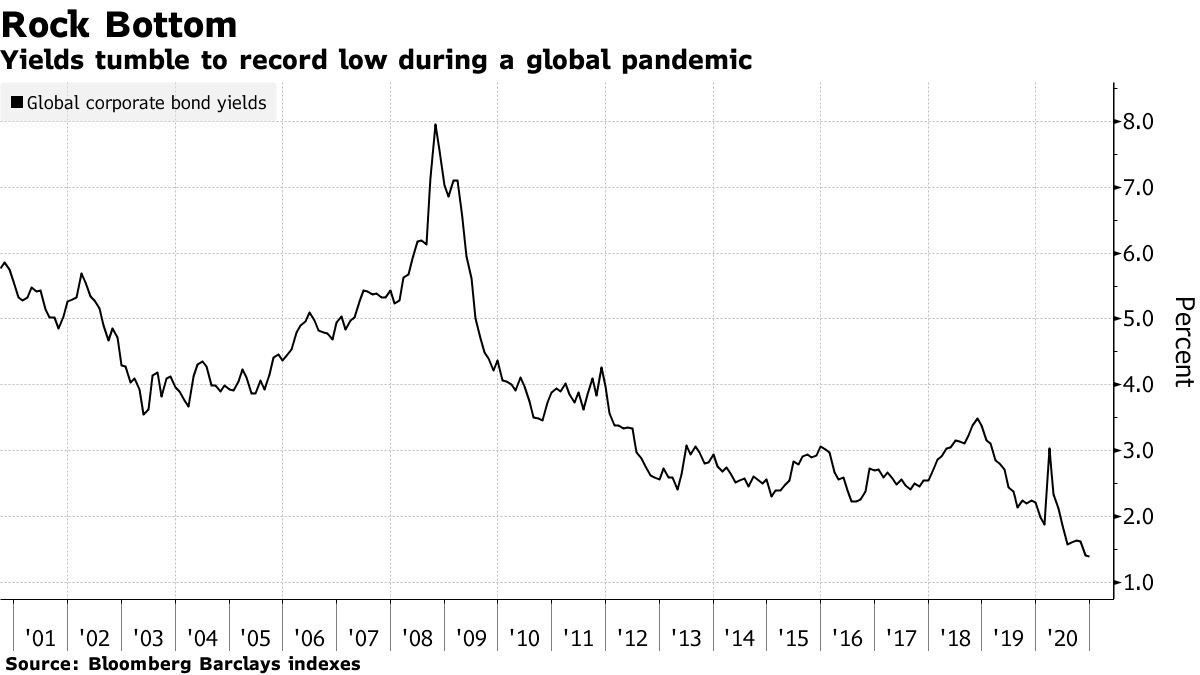

Rebound credit

In a world of nearly $ 18 trillion in negative yield debt, investors have been forced to enter risky corporate bonds at higher valuations.

In the U.S., yields on junk bonds have fallen well below levels at which lenders could offer high yields earlier this year.

Even Carnival Corp., the fallen angel shipping company, has gradually cut funding prices this year. The collection of corporate debt with a negative yield is now at over $ 3 trillion.

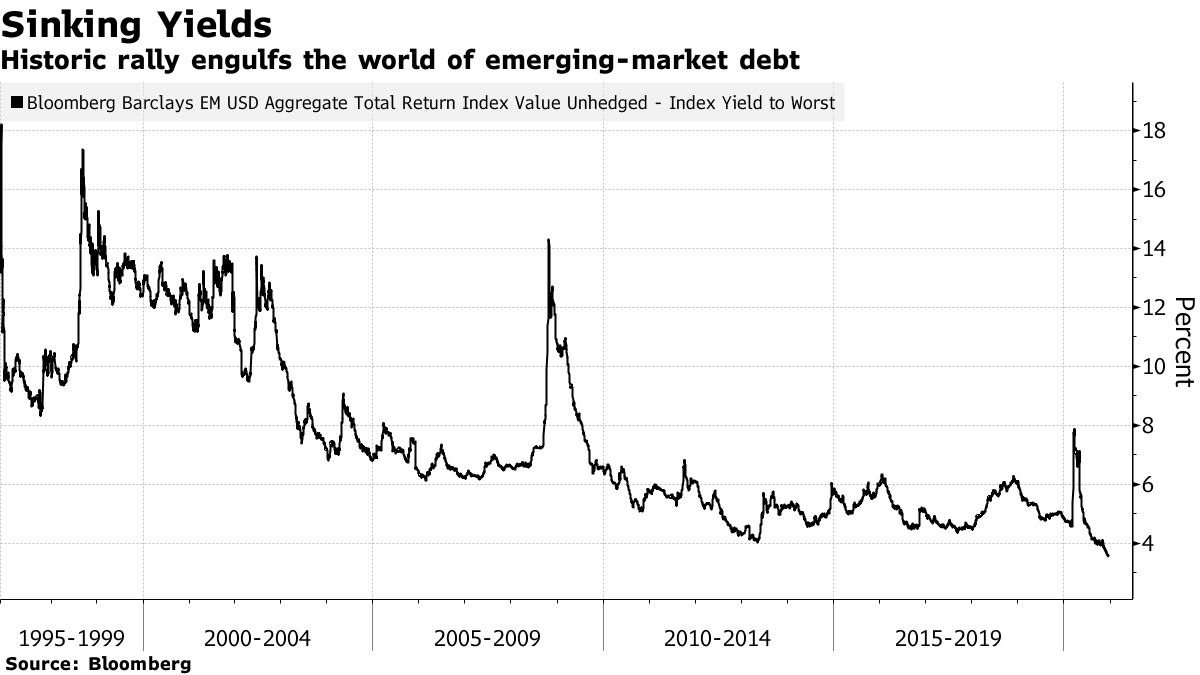

Emerging markets

Naturally yes rising times for emerging market countries sell more than $ 730 billion in dollar and euro bonds in 2020, more than in any previous year.

Even with political turmoil, Peru sold the lowest-yield bonds yielding from a developing government economy. Ivory Coast had a nominal euro debt with a lower yield than last year, despite its involvement in the G-20 debt relief campaign and an ongoing program from the International Monetary Fund.

Bitcoin back

To diehards, Bitcoin’s rise of more than 200% this year on a wave of new money shows that the time for crypto has come. For many on Wall Street, it’s just the latest sign of reckless exile.

“We see it and other cryptocurrencies as ‘digital tulips.’ We have no way of valuing them, ”Yardeni Research analysts including Ed Yardeni wrote in a note. “We look at Bitcoin price action as a measure of speculative surplus. ”

The variant is a hard pill to swallow for the most part but there are the likes of JPMorgan Chase & Co. and Nomura Holdings Inc. fa-near enough interest, from family offices to following moves quants.

Read More: Asset Managers See Bitcoin Crowd trade with institutional leaps and bounds

The real money is surfing a wave of profitability for long-term assets, from solar energy to Tesla Inc. shares, as investors seek interest in the technology of tomorrow – valuations will be damaged.

– Supported by Justina Lee, Yakob Peterseil, Tasos Vossos, Swetha Gopinath, Eddie Spence, Selcuk Gokoluk, Cormac Mullen, Lu Wang, and Albertina Torsoli