Photographer: Tiffany Hagler-Geard / Bloomberg

Photographer: Tiffany Hagler-Geard / Bloomberg

Hell week for hedge funds will be remembered for all that is in it Reddit traders ’damage caused by running a handful of the shortest names in the US $ 43 trillion stock market.

But exactly why the institutional benefits were imposed reducing their market exposures at the fastest pace since the pandemic-spurious March run?

One reason is that their models called for risk.

As a flood of money sold stock as GameStop Corp. and AMC Entertainment Holdings Inc. in compliance, the trading signals that guide how the smart money invests turn red.

Canar Value at risk, this widely used crude metric showed just how vulnerable the short-term population was to losses based on historical price movements.

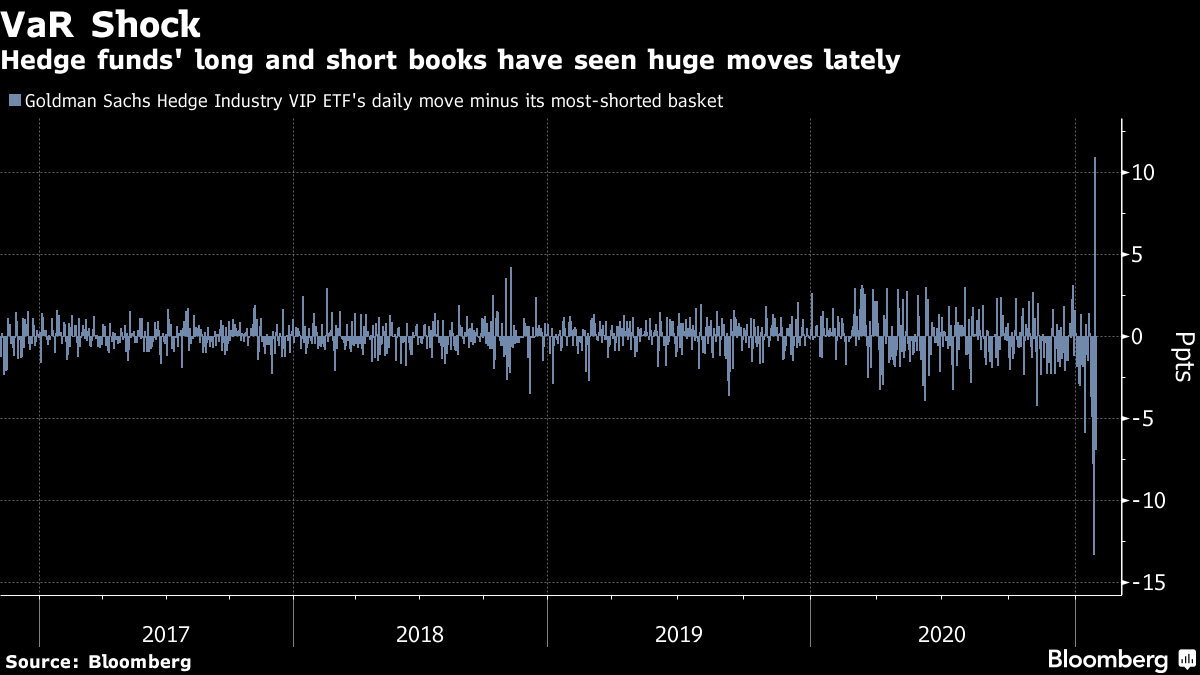

As day traders battled Wall Street, volatility in 50 companies doubled on the Russell 3000 last week. At the same time, the shortest stocks in hedge funds accumulated so hard that they outperformed their favorite lengths to an unprecedented level.

With institutional clients worrying about it, the benefits cut appropriate positioning across the board – while retail investors, who are free from such restrictions, raise cost.

“When the risk models go hard, you get dirty,” said Benn Dunn, who helps these managers monitor risk as president of Alpha Theory Councilors. “What hedge funds are holding long, they need to get rid of to reduce their exposures – so that the risk is commensurate. ”

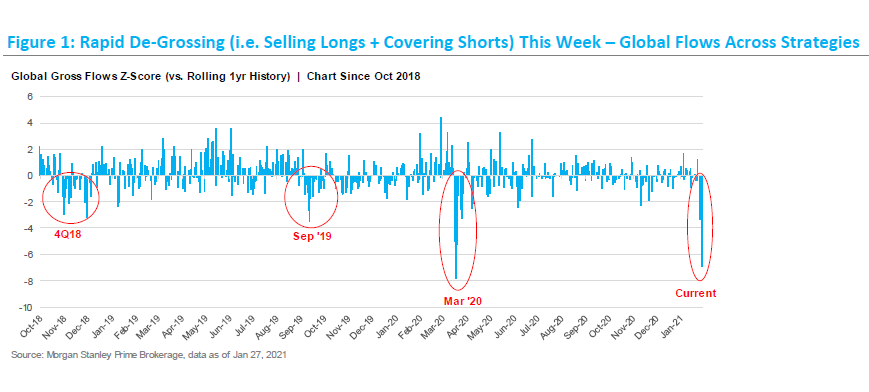

According to Morgan Stanley ‘s main breach, last Wednesday’ s fall in hedge fund disclosures was historic, according to a prescriptive rule for normal distribution of statistical data.

At 11 normal movements away from the average in data dating back to 2010, this dislocation was the fastest since the outbreak of the pandemic in March – when the biggest shift in ten year.

Source: Morgan Stanley Fracture

Value at risk, initiated by JPMorgan Chase & Co. in the 1990s, trying to figure out what most assets can lose in most cases: at a maximum of $ 50 million in a day, 95% of the time. While a person may be free to risk the risk of a major drawdown, hedge funds that serve institutional clients such as pensions are usually tied to a game plan that prevents overdrafts.

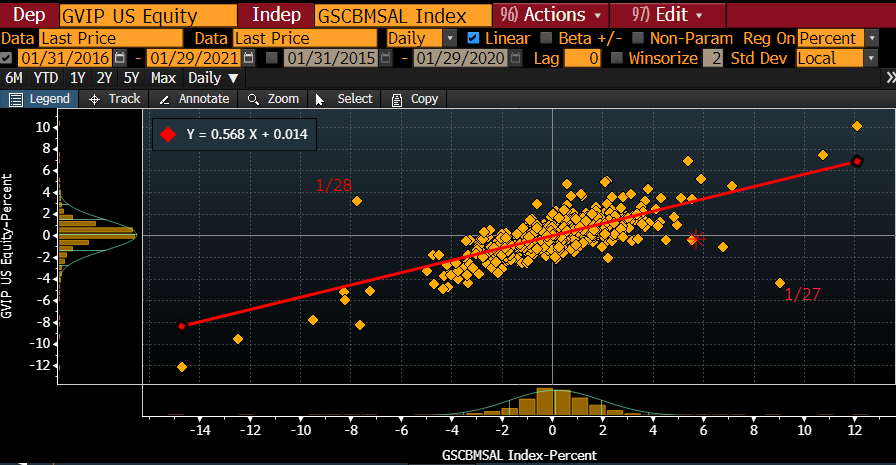

The challenge last week for the smart money was that reliable trading patterns broke. Let’s say short stock builder GameStop and long Peloton Interactive Inc. On most days, when the two are moving in the same direction, one is a hedge for the other. But the last one rose while the second one fell – a negative and costly combination.

“If you are short and something else is long, and the relationship comes down, that will definitely increase your risk,” said Melissa Brown, global head of applied research at Qontigo, which provides tools for risk assessment.

On Wednesday, hedge fund monitoring monitoring hedge fund (GVIP) spread seven normal movements from the average compared to Goldman Sachs Group Inc’s basket. of Russell 3000 stock with the highest short interest. Based on 250-day data, that is outside the statistical norm.

Of course, that is based on a standard distribution of data, which is not well known, especially in today ‘s complex markets. But it offers a simpler picture of how the institutional population has caused unprecedented variability to the institutional group.

This chart shows the link between popular hedge fund ships and summaries. Last week saw a number of movements that were large and clearly longer than usual expected.

There are a number of interconnected drivers in removal and the dust has not yet been resolved as the sales team is re-entering the shortest names. Beyond those cut to positions as higher volatility pushes up VaR, consumer solutions and peripheral notifications may have weighed as well.

But by extension, the frenzy of the week may still be another sign of a worrying trend in financial markets: the smallest statistically similar movements are occurring more frequently, something called fat tails.

“I’ve seen sales in all sorts of places,” Dunn said on Friday. “You see things on the market that don’t make sense. ”

– Supported by Lu Wang, and Sam Potter