Many Americans do not do their maths when they retire.

More than 75% of people planning to retire don’t know how much money they need before taking the leap, according to a 2020 Four Pillars of the New Retirement study by investment firm Edward Jones.

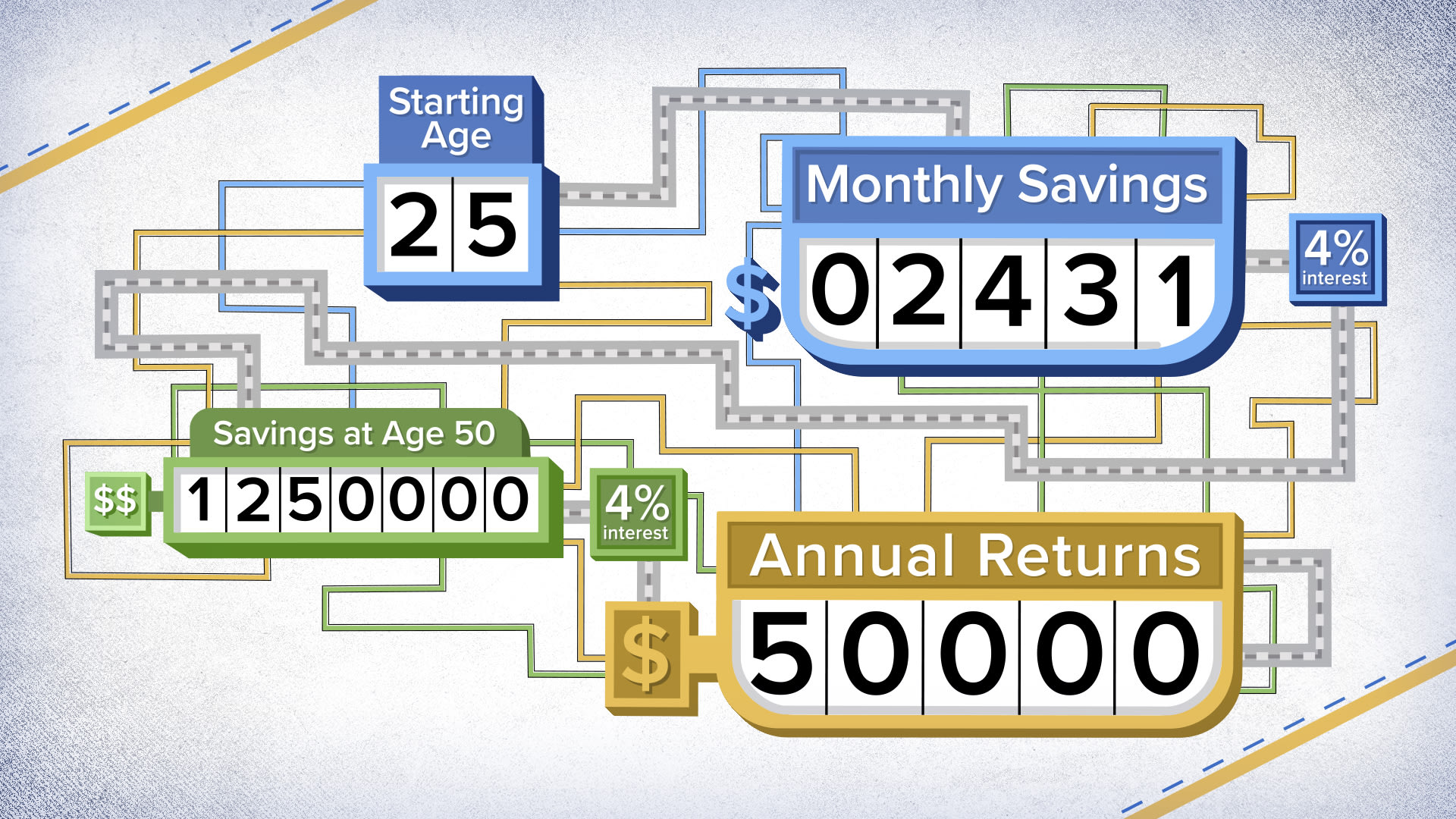

Fortunately, CNBC put the numbers down, and we can tell you what you need to save to get $ 50,000 of passive income each year when you retire.

First, some basic rules. The numbers assume that you will retire at 50, that you no longer have money in savings and plan to divert a significant portion of your income to your goal. to reach.

For investment, we accept an annual return of 4% when you save. We do not take into account inflation, taxes or any additional income you receive from Social Security and your 401 (k).

In retirement, we use the “4% rule,” which is a general principle that states that you can withdraw 4% of your portfolio each year.

It is important to note that with the recent market volatility, there is a risk that you will need to reduce your spending percentage in the future.

Check out this video for a complete breakdown of the numbers.

More from Investing in you:

As Walmart and other big companies try to hire more teenage employees

Americans are more in debt than ever before and experts say ‘money laundering’ may be to blame

How much money do you need to retire? Start with $ 1.7 million

Disclosure: NBCUniversal and Comcast Ventures are investors Dearcan.