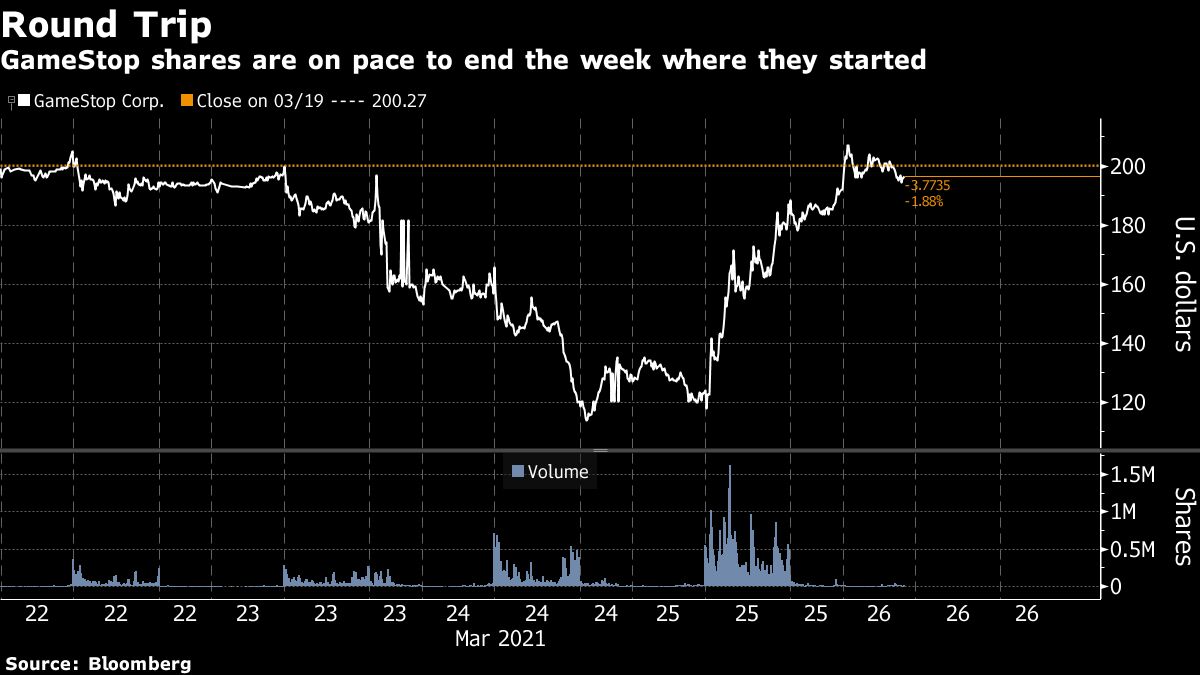

The GameStop Corp. ending the week in which it began, after earnings – related sales fell sharply, with retail investors refusing to relinquish their commitment to the stock.

Investors were quick to get over the 12th consecutive quarter of GameStop slowing sales and a regulatory decision not to raise questions about their employment call Tuesday, despite warnings from most Wall Street analysts. After seeing saves as low as $ 118.62 the stock was trading pre-sale Friday at $ 196, close to its closing level last Friday. That created a swing of $ 6.4 billion in market value from Monday’s intraday high to Wednesday’s bottom.

GameStop shares rose as much as 13% in pre-sale trading on Friday before cutting gains in half at around 8:50 a.m. in New York.

GameStop bulls continue to active investor and board member Ryan Cohen continues to shake. Cohen has grown into a cult-like icon for investors who are building social media platforms like Twitter and Reddit and his quest to turn the retailer into a tech giant has gathered a bunch of followers. gather active trade.

Read more: GameStop Taps Tech Trio to make good on loyalty dreams

Analysts have warned that fundamentals are not important enough for investors and that the company’s overahaul are facing major challenges.

“The turnaround story will be very difficult for GameStop to deliver and right now shares are working as they have already been successful,” said Edward Moya, Oanda’s senior market analyst. “The GameStop stock party is lasting longer than anyone expected, but ultimately they should trade for under- $ 100 shares.”

The overall trading volume during Thursday’s rebound boosted the cumulative activity seen in the three-day fair, meaning investors who were keen to buy the dip and trade on the uptrend were much more likely. more than the sellers who wanted cash out or stock shortly after the return of their earnings. The retail traders who love to speak up their diamond hands cheered as the retailer continued to change its table and bring in veterans. business to help redesign the business.

Read more: GameStop Soars to Erase $ 4 billion Toll mar Meme Roic stocan

Other stocks that have caught retail traders were tougher on Friday morning after losing streaks alongside GameStop. Shreap AMC Entertainment Holdings Inc. 3.4% in early trading while making headphones Koss Corp. fell. 7.9%.

The group of meme stocks has continued with Wall Street analysts covering the companies. GameStop is not recommended by any analysts and has three catch levels and four sales levels – with the average price target meaning a 75% drop. While AMC has no buying, five holds, and four sells a 12-month average rating and target that is nearly 70% lower than Thursday’s close.