Investors are complaining about Treasury yields and questioning when rate hikes could start spurring a stock market rally, even though they were not yet worried enough Tuesday to block key slots. measure from taking another round of full-time peaks.

So when does yield pain, which makes it harder to justify extended equity valuations, start to make a difference? With the result on TMUBMUSD10Y 10-year Finance note,

moving back above 1.2%, a challenge of the 1.5% area, which is equal to the share yield on the S&P 500 SPX,

soon to be in store, Sean Darby, Jefferies’ head of global strategy, wrote in a note Tuesday.

That event “probably coincides with the first test for the valuation of the higher PE stocks and the relative performance of the S&P 500 against more valuable indices like the Nasdaq-100,” he wrote. ‘refers to the P / E, or price-to-earnings ratio, a common measure of stock market valuations.

Historically, low Finance rates have been seen justifying high valuations for equities, as investors have little choice but to look to stocks for yield. While Treasury yields remain low, the higher move could threaten equities with the longest valuations, strategists have warned. Bond yields and prices move in other directions.

But Darby conducts a more in-depth analysis, arguing that financial markets appear to have undergone a “regime change” as investors accept the Federal Reserve’s average inflation target setting, which could be seen. The central bank allows inflation to exceed its target and the economy to run hot before moving to tighten policy.

That regulatory shift amid expectations of abundant liquidity may be reflected by the continued rally in waste corporate bonds, or high yields. These results have fallen sharply, even trading under Treasurys on the basis of inflation change for the first time in history, he noted.

At the same time, although the U.S. dollar, although seeing a moderate kick-off starting 2021, has yet to make a definite turn after its 2020 slippage, analysts said. A weaker dollar is generally seen as favorable for stocks by helping to keep the global financial position stable.

“In reality, the worst case scenario for investors would be equity selling [Treasurys] with expanding credit distribution and a strong dollar, ”said Darby. “So far, higher bond yields have failed to reverse the decline in green – real interest rates remain negative. ”

So what should stock market investors expect?

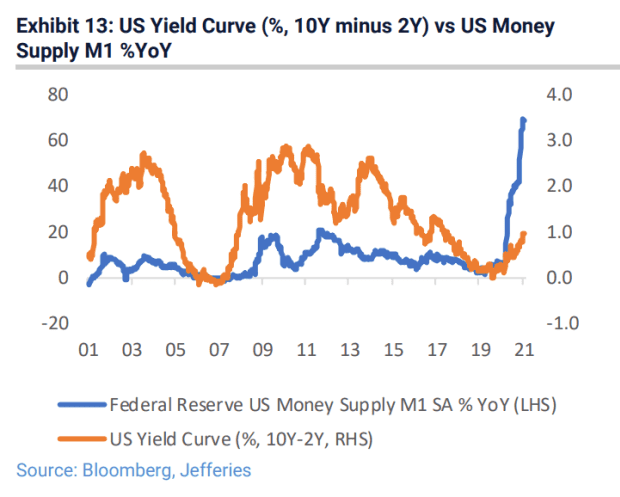

First, “a much higher yield,” he said, noting that the three Jefferies indicators have led the 10-year yield – the 10-year vs. 2-year U.S. yield curve against inflation expectations; the yield curve vs US M1 cash supply; and the yield curve vs the copper / gold ratio – they are all marked directly, especially the relationship between silver supply and the yield curve (see chart below).

Jefferies

Jefferies expects the 10-year yield to hit 2% by the end of the year, Darby noted.

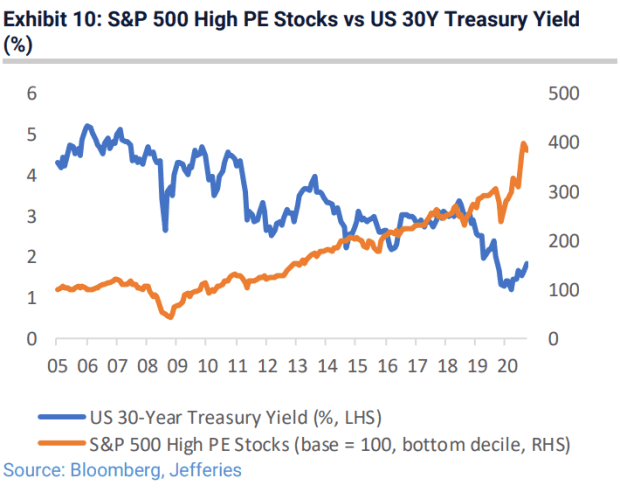

Second, stocks saw a high price-to-earnings ratio in the S&P 500 sharp overall yield as a result of the 30-year TMUBMUSD30Y Treasury,

falling, Darby said (see chart below), noting that the same was true for the tech – based Nasdaq-100 NDX,

Jefferies

“These are the ones most aware of higher long-term rates than the U.S.,” he said, noting that allowances are a long-term asset.

The 30-year yield rose nearly 7 basis points Tuesday at 2.082%, while the 10-year yield rose 7.7 basis points to 1.285%. Dow Jones industrial average DJIA,

it went up around 68 points, or 0.2%, in choppy trading, picking up on a record last Friday nearby when investors returned from a three-day holiday weekend. The S&P 500 was slightly lower, and the Nasdaq Composite COMP,

off about 0.4%.