Bitcoin prices have been scaling new heights recently, and tighter supply core dynamics and increased demand have underpinned that climb, according to a report compiled by London-based Copper.co .

Copper has argued that the recent price climb is due to a gradual rise in demand for BTCUSD bitcoins,

and the growing shortage of assets with a maximum supply of 21 million, which is expected to be hit by 2140. The researcher also said that the majority of interest in new bitcoins coming from North America, and the US in particular.

Approximately 18.625 million bitcoins were created, or digitally mined according to cryptocurrency enthusiasts, according to CoinMarketCap.com, but a good chunk of that was lost, the folks at Copper wrote.

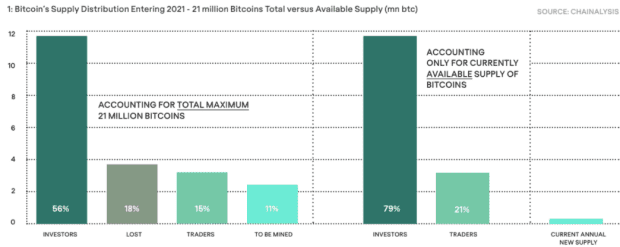

According to their estimates, 56% of bitcoins are owned by investors, 18% are lost, 15% are held by so-called traders and the rest have not yet been mined (see chart attached):

through Copper.co

Copper said that with the majority of investors being long-term owners, representing eight out of 10 holders of the cryptocurrency, a rise in desire for the most popular digital assets in the world may increase. a world of influencing values.

The researchers said bitcoin’s rise above $ 40,000 was already in play even before Tesla Inc. TSLA,

he made an impressive filing with regulators Monday, reporting the $ 1.5 billion investment in bitcoin, and their decision to finally allow buyers to buy its products with bitcoin.

“Data shows that new investors pushed prices much higher in the

the last six months of 2020, to get north of 2 [million] bitcoins, ”Copper researchers wrote in the study.

“So that we can buy bitcoin in such a deep volume, the price has gone up

well above the $ 20,000 mark which helped persuade early investors

sell their cryptocurrency above the previous high, ”they said.

The crypto market relies on a new supply of some 3.2 million bitcoins on exchanges and held by traders, according to the report.

The study also found that investors who have been owners of at least 1,000 bitcoins for about three months increased their holdings in 2020 by 173%.

That increased demand, coupled with that limited supply, helped raise bitcoin values to a total market value of around $ 800 billion, and Copper said North American buyers are the main reason for the demand. supply from Asian miners.

“The price increase is due to demand and liquidity crunch marriage

occurred in early 2020 when flows erupted from exchanges – that is,

bitcoins shifting to self-care – greatly increased, ”the company’s study found.

Copper also made an interesting discovery, noting that nearly a third of bitcoin trading volume occurs in the period when the New York Stock Exchange is open and investors should aim to trade in Dow Jones industrial average DJIA,

and S&P 500 SPX index,

So much trading in bitcoin takes place at stock market hours, between 9:30 am and 4pm East, which probably explains why S&P 500 movements are seen at times so tied to bitcoin prices, wrote Copper.