The neighborhood grocery store, which has won obituaries in recent years, has received a shot of encouragement in the past year sponsored by Corona. Many still imagine it with an elderly laborer, with a pencil behind his ear and fingers slamming into the calculator, but the grocery store has been perfected and managed to draw the residents of the neighborhoods back to it.

5 View the gallery

Neighborhood grocery

(Photo: Uriel Cohen)

“In Corona, the sales volume of containers increased by 15%, more than the growth of the food industry, which is estimated at 10%,” claims Eli Satuy, chairman of the Containers Forum. According to data collected by Panel View, a company that specializes in online surveys, Mansky Ben Shahar, about 60% of consumers in the Jewish sector increased their household expenses in grocery stores and neighborhood stores. According to CEO Tamir Ben Shahar, about one-fifth (21%) of respondents increased their household expenditure on grocery by about 25%, 14% increased At about 50%, 5% doubled their spending and 2% even more than doubled.

5 View the gallery

“The Corona did us only good, it is a pity that it happened in these circumstances,” admits Yaron Moshe (50) from Ashdod, who four years ago left the world of car accessories and opened a minimarket in the city with his wife. “It’s hard work. Me, my wife and the kids (14, 16, 22), who join in the afternoon, work very hard,” he says, but there are results: “There are new customers, the cycles have grown, we have expanded, we added another store and opened a vegetable department. When the supermarkets underestimated customers, dried them while waiting for deliveries and jumped prices, we delivered products within half an hour of ordering, with no shipping fees and minimum purchase, and we continue with good service because that is our secret of existence. Free deliveries, cold drinks, warm attitude. Outside with coffee and pastries. ”

Have not opened a website?

Moshe: “Most of the customers took our phones, and I also opened a neighborhood WhatsApp group and an app to make it more convenient. Orders in the group are responsible for 15% of the turnover.”

5 View the gallery

Yaron Moshe from Ashdod, owner of a minimarket: “When the supermarkets underestimated customers, dried them while waiting for deliveries and jumped prices, we delivered products within half an hour of ordering.”

(Photo: Gadi Kabalo)

“During the closure, we reached as far as Herzliya,” says Lev Bengiev, 45, who operates a grocery store in Ramat Gan with his brother Igor, 42. “There was an increase in work, people were afraid to go into the big writers. Customers called, sent invitations on our personal WhatsApp. We expanded the territory by word of mouth. We gave personal treatment, we learned what customers want. We are 19 years in place. Now we see quite a few new people coming to Corona. Stay with us. “

5 View the gallery

Lev Nagabe from Ramat Gan, owner of a grocery store: “It is very difficult to handle the competition. When we opened there was one supermarket in the area, today there are five and almost every building opens a grocery store or an explosion.”

(Photo: Abigail Uzi)

“It should be said to the credit of the container owners that they made a switch in their head and knew how to take advantage of their opportunity to leverage the business,” compliments Roi Freibach, CEO of Shufersal Business, which has become a dominant wholesale supplier to the small food store world. Online, get there fast, invest in customers, and take advantage of them. After all, no one knows better than the grocery store owner which cheese you like and how to cut your chicken breast. “Freibach estimates that today there are about 10,000 small food businesses, containers, mini-markets and explosives operating under the umbrella of the” grocery “(a neighborhood food business that does not belong to the chain). For a long time now, not only kernels and ice cream have been sold.

As early as June 2019, Tamir Ben-Shahar predicted the revival of containers, following the findings of a survey he initiated, according to which the growing public is an important resource from money. He estimated that this would be reflected in an increase in two time-saving channels in the food market: the online and the convenience market. “The frequency of shopping that will increase and the attempt to save time will lead to a tendency to buy food products in the convenience stores in the neighborhood, even at the cost of an increase in expenses,” he stated at the time, noting that the corona has accelerated the process. The survey shows that the main reasons for preferring the grocery store are proximity to home (52%) and a small purchase (40%).

So what are the causes of the trend change? “Improving the search for sustainability,” says Ben Shahar and immediately explains: “Generation Y and Z look at the world differently, throwing less things in the cart and less things in the trash. Splitting shopping into specialty stores strengthens small stores. More consumers want to buy bread, vegetables “Consumer products, etc. in specialty stores in the neighborhood. Consumers do not want to go to the store in the industrial area, it is convenient for them to buy online or in large discount stores the heavy and large products – soft drinks, toilet paper, diapers – and the rest, interesting and experiential, in the neighborhood store.”

How will the small neighborhood stores deal with the giant chains?

“In service, in excellence, in eye-level management. A store that provides a service at a fair price can succeed. In the network, everyone knows that the service depends on the staff and the branch manager – and it is difficult to reach the level of good grocery.”

5 View the gallery

Tamir Ben Shahar, CEO of the Czemanski Ben Shahar consulting firm

(Photo: Elad Gershgoren)

The attractiveness of the containers and neighborhood stores has risen not only due to the fear of crowds and the need to make quick and functional purchases, and according to Ben Shahar, many of the new buyers are young people who buy small baskets, especially for dinner, especially when many are unemployed.

Consumer behavior in recent years has changed: instead of a large weekly or monthly purchase – a large number of small purchases complement. The smaller baskets and the lack of need to travel far compensate for the high price

“63% of those surveyed (511 are a representative sample of the Jewish population) shop at the grocery store an average of 1.6 times a week, a high figure that indicates that the grocery store is an alternative to about two-thirds of the population,” he says. “The figure reflects the change in consumer behavior in recent years and is now strengthening: instead of a large weekly or monthly purchase – a large number of complementary small purchases. The smaller baskets and the lack of need to travel far compensate for the high price.” In the Arab sector, the containers were and remain dominant even before the corona, mainly because the supply and deployment of the large chains is still sparse.

Evidence of the rising attraction of the neighborhood solution can also be found in businesses from the category that “immigrate” class and interest the big ones. The most extreme example is “Super Yoda”, a small neighborhood minimarket that has become a chain that Paz recently acquired. This week we were informed that Sonol is also involved in the container business, and purchased seven branches in the Tel Aviv and Ramat Gan branches from the “City Market” chain of Lior Kimchizi – which began ten years ago as a neighborhood mini-market on Dizengoff Street. Until the last acquisition, the chain had ten branches that generated NIS 60 million a year.

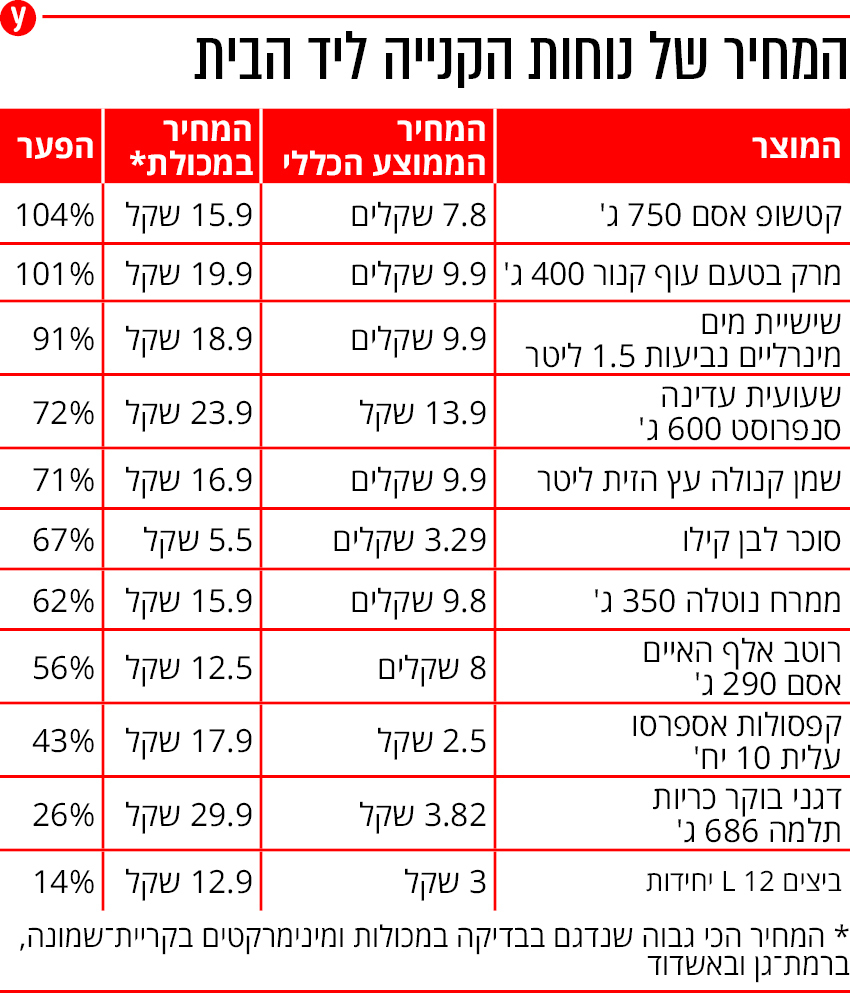

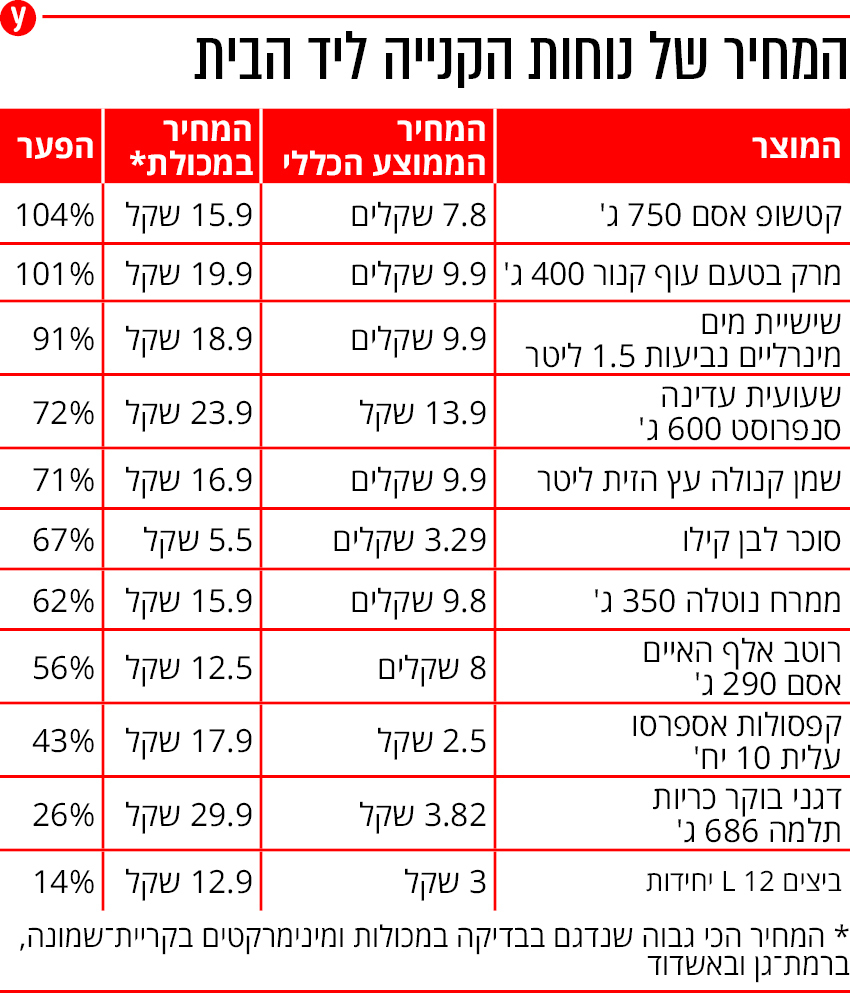

The quality of service in containers should not be underestimated, but a test we conducted sharpens the weak link: prices. We visited containers and mini-markets in Ramat Gan, Ashdod and Kiryat Shmona with a short list of 15 popular products, and compared them to their average prices in five representative discount chains: Rami Levy, Victory, Yochananoff, Shufersal Deal and Half Free. In most cases the containers are tens of percent more expensive (and in two cases more than 100%). In only four cases was the gap less than 20%. Also, in no grocery store we inspected were not all the products in the limited basket. Ben Shahar mentions that the discount stores are also about 20% cheaper than the neighborhood branches of the chains themselves, so that compared to Shufersal Sheli, Mega in the city, Stopmarket in the city, etc., the gaps in front of the containers are lower.

The container owners we spoke with, as well as Autumn, Grocery’n until 10 years ago and set up the Containers Forum, are well aware of the weak point. “It is very difficult to deal with the chains, and I am constantly trying to find a solution to buy goods at lower prices,” admits Naguib. He now buys on Shufersal’s wholesale supply channel, which reduces his purchase prices by 15% -25%. Bengayev’s solution is a red sheet fluttering in front of Satuy’s face, who is worried about the big ones entering the market and fears that the power and independence of the little ones will be harmed. He says this is also not a big news: “From conversations I had with container owners, there are marginal benefits in buying cigarettes on credit and there are certain products of the Shufersal private label that are worth buying, but the overall is not particularly impressive.”

At the same time Autumn, the man who recognized the soft underbelly of container prices and the need to provide a solution through concentrated shopping as early as 2015, is trying to organize with the help of the Ministry of Economy, it is not clear what he is doing in the story. From super products, through technological services to end equipment.

The one who actually recognized the potential and had already jumped into the water was, as is well known, Shufersal, which set up Shufersal Business, wholesale sales that are already estimated to roll in hundreds of millions of shekels a year both online and at “Kesh & Kerry” points of sale. Two branches, which are open for wholesale shopping only, operate in Beer Yaakov and Haifa, and in about a year another store will join in the south of the country. Unilever also operates the online shop “Shofo” for containers and mini-markets, whose sales grew by 370% in 2020. Recently, the competition authority also approved importers Diplomat, Guri and Leiman Schlissl to join Bar Distribution and Aikes, and set up a joint venture called “Nile” and compete with Shufersal Business for the pockets of container and minimarket owners – especially in remote localities. Yaron Moshe hopes that the projects will enable better price solutions.

“Until five years ago, the grocery market went down because of the expansion of big chains that went into more and more neighborhood formats, and also because convenience stores at gas stations entered the grocery world instead of settling for ice cream and coffee on the go,” says Freibach, a food company graduate. “The big food producers should not go to the small points of sale, they will supply the state of Tel Aviv, but go to the grocery / consumer in remote seats? They also fear the financial strength of the small business owners. They pulled their hand and sent the container owners to wholesalers and agents, which jumped prices. Of products that were bought second-hand and third-hand and caused the world of containers to become extinct. ”

Today Shufersal offers small retailers 15,000 items including private label products, at prices 10% -15% lower than what they are used to paying. “Most container owners are satisfied with profits of 20% -25%, these are family businesses, based on employees from the family, the grocery store owner, his wife, brother or child. If you give them a good price they will roll it over to the consumer,” says Freibach.

Does organizing the joint purchase of container owners have a chance? According to Ben Shahar, this depends on the size of the procurement expected of them. “If they stay in small numbers they will not get substantial discounts. At the same time, their opportunity is now at its peak – the suppliers inevitably need them in light of the fact that the big players are increasing the share they direct to the private label and reducing the big suppliers’ share.”

Is it time to go to the grocery store? The two industrious groceries have two opposing views. Yaron says unequivocally “definitely” and has advice: “Remember the service first and foremost. Smile at customers, give them a feeling that they are important to you, constantly innovate and bring special things, such as pastry boxes, peeled fruits and vegetables, wine, even flowers. My customers know “That they get fruits and vegetables from Israeli farmers who work hard to grow them, and they want my tomatoes and not cheap Turkish tomatoes, they know we bake the pastries instead.”

Lev, on the other hand, suggests not entering the field: “I would not advise anyone to open a grocery store. It is very difficult to deal with competition. When we came to the area there was one supermarket here, today there are five. Almost every building opens a grocery store, kiosk or crackers that bring grocery products. The personal treatment of customers, but two people work from seven in the morning to one at night. “