The latest fears in crypto are changing the way we buy and sell things in the digital realm.

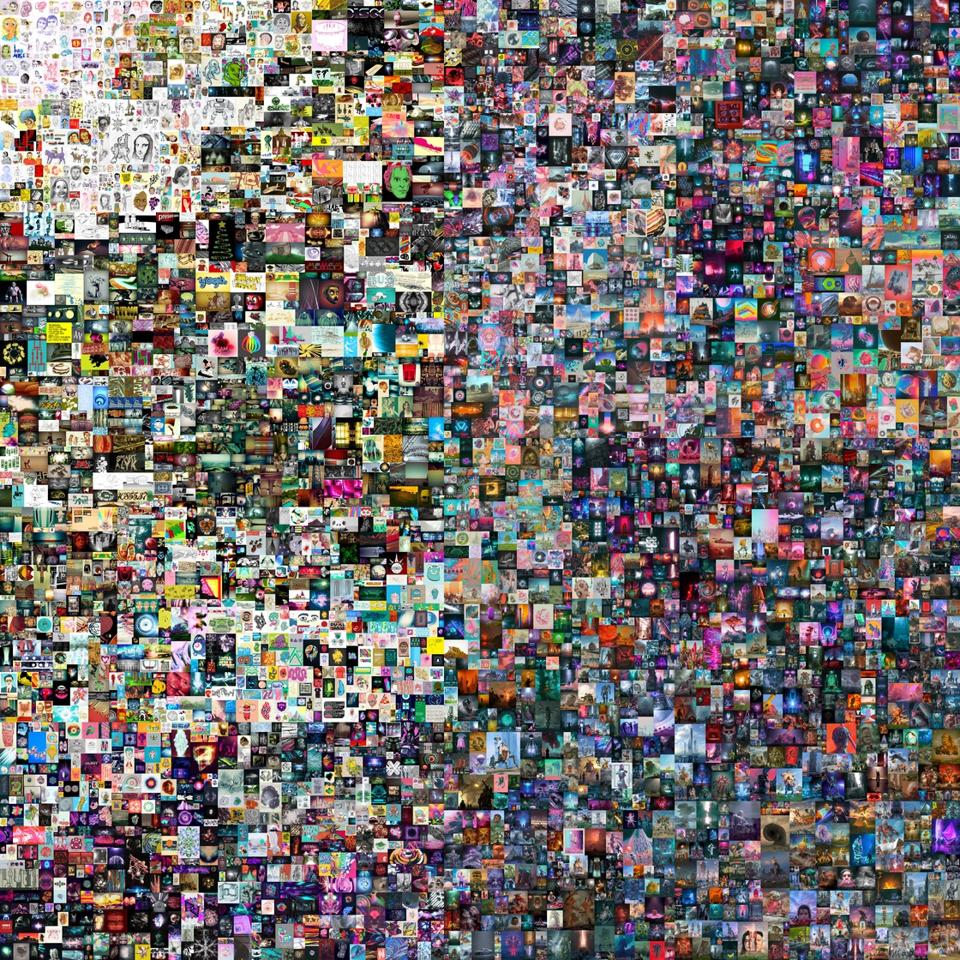

A.a herd of cartoon cats with googly eyes. Video of a high-flying Lebron squash. Digital image made up of 5,000 smaller images soon to go on sale at Christie’s auction house.

All of these have recently been turned into non-fungible tokens, or NFTs, a new way of buying and selling digital and other arts and media. These cryptoassets represent the latest increase based on blockchain: Three years ago, the entire NFT market was worth no more than $ 42 million. By the end of 2020, it had grown 705% to $ 338 million in value, according to the latest estimate from Nonfungible.com, which monitors the NFT market.

While estimates for the current market size are not available, it has certainly grown even larger. Just think of the face value of tokens sold in the first two months of the year: During February, nearly 150,000 of those tokens were sold for about $ 310 million – almost the bulk of the amount sold in 2020 as a whole.

“This is the future – the future of the kingdom,” said actor William Shatner, on a Zoom call from his home in the San Fernando Valley. Last July, the 89-year-old Shatner sold souvenirs from his life and career as virtual trading cards on the Wax blockchain. Five dollars was good for a five-card pack. Twenty-five dollars got you a pack of 25 cards, a collection that included candid photos from his Star Trek days… and a 68-year dental x-ray. They sold out in nine minutes. One of the rarest cards – a Shatner header from the 2000s – was recently resold for $ 6,800. “It’s amazing the rarity of things on the internet.”

What is NFT?

Simply put, NFT is an entry for blockchain, the only digital mass distribution technology that is the basis for cryptocurrencies like Bitcoin. But unlike most Bitcoin – which is fungible, meaning that one coin is different from another and equal in value – tokens on these blockchains are non-fungible. That means they’re unique, so they can represent one-of-a-kind things, like the rare William Shatner headshot or even the title on a piece of property.

And because they are unique and stored on the blockchain, they are undoubtedly authentic. That’s especially important when the assets they represent are digital. Because digital files can be copied indefinitely and perfectly, it is difficult to own (or sell) a rare digital image of Captain Kirk. The NTF token solves the puzzles by confirming that one digital file is the “original” one.

Peter Thiel Foundation Fund is an investor in OpenSea, the largest NFT marketplace; a Winklevoss twin, Nifty Gateway has a competitor.

John Lamparski / Getty Images, Stefanie Keenan / Getty Images

When you purchase NFT, you get both a non-volatile asset register and access to the real assets. These funds can be anything. At the moment they are mostly digital artworks or trading cards. Some are genuine products that are only available within the market for sale, and some come in packages in familiar formats such as JPEGs or PDFs. A minority of NFTs are digital records of ownership of a physical, factual object.

When did they start?

Around 2017. Two early popular NFTs were CryptoPunks, digital images of 10,000 cute and human characters in cutesy, 8-bit style animation, and CryptoKitties, a collection of fancifully drawn felines. They were initially provided free of charge. The most valuable CryptoKitties now sell for over $ 100,000, CryptoPunks for over $ 1 million. “I wish I could tell you that we knew how it was going to turn out,” admits Mack Flavelle, one of the co-creators of CryptoKitties. “But it surprised us with anyone.”

CryptoKitties was launched in 2017, giving the NFTs a huge boost. Today more than 260 of the characters trade hands-on weekly, generating over $ 2 million in annual sales.

What is special about the symptoms?

For a buyer, they issue a secure ownership certificate over a digital object, protecting the value of the good. The internet makes it easy to duplicate and create something, and without a unique property register like NFT, the good is useless.

For a retailer, NFTs not only make it possible to sell something today, they make it possible to earn tomorrow as well. Historically, artists have struggled to gain benefits if their work is of great value. NFTs can be coded to allow the original creator to raise money each time the token trades hands-on, typically for between 2.5% to 10% of the sale price. The ability to establish a recurring revenue stream is attractive to any celebrity looking to expand a reputable earning potential. For example, YouTube star Logan sold $ 5 million worth of his own NFT – a carton image of himself stripped as a Pokémon trainer – last weekend.

“NFTs are the single largest renaissance of power control back to the artist’s hands fundamentally since the Renaissance and print media,” says Benjamin Gentilli, an artist based in London. He sold NFT through Christie four months ago for $ 131,250, nearly 10 times the estimated price. “It’s attractive for people who have built their own audience – perhaps on social media – to go and sell work directly to their audience.”

The Beeple collage for sale at Christie’s; the artist has also collaborated with brands such as Nike and Louis Vuitton.

CHRISTIE’S HOME LTD. 2021

Why are NFTs in the news right now?

Combination of factors. Celebrities like Paul are moving forward with the movement, pushing it to public attention. Christie’s festivities do the same, the acclaimed auction house gives the genre a sense of legitimacy. Next week, Christie’s will complete a 14-day online sale of a piece by digital artist Beeple. The initial bid for his work, a virtual collage of photographs from his life was taken over 5,000 consecutive days, $ 100 and since then has surpassed $ 1 million.

Another major player: NBA Top Shot, a site launched last October for virtual, video-based basketball trading cards. The so-called times are sold in five-card packs and then resold in a thriving high school market; the collections are later displayed in publicly visible image pages that act as virtual cup cases.

Some $ 200 million worth of sales have already taken place on Top Shot, more than two-thirds of all transactions coming in within the past week. On Monday, a new record was set when Jesse Schwarz, 31, of Los Angeles, bought Lebron Moment – a piece of hanging, one-handed scrap during the finals of the 2019 West Conference – for $ 208,000. “People at first thought, ‘You just spent $ 200,000. Are you crazy, have you lost? ‘”Remembering Schwarz. He thinks he could turn the Moment for $ 1 million or more. “People’s trust in blockchain has reached mainstream level. This kind of product doesn’t scare people … Eventually everyone will be on board, ”he said with a shrug.

Should you buy one?

Whether you’re buying fine art or Mouton Rothschild 1982 or CryptoKitty, investing in other markets is more risky and less rewarding than money invested in more conventional places, such as equities. A recent study by Citi, for example, found that the Contemporary Art market delivered an annual yield of 7.5% from 1985 to 2018. Stocks, meanwhile, threw nearly a yield of 10%. And while NFTn is currently going up a lot in price, it feels a bit bubbly. The NFT market is largely speculative and the volatile price movements of their cryptocousins may have been observed over the past few years. Bitcoin, for example, goes for around $ 50,000 today. Twelve months ago, it was worth less than a fifth of that.

“There is a lot of risk,” said Nadya Ivanova, a close observer of NFTs at L’Atelier, part of the BNP Paribas investment bank. “The important thing to understand about the NFT market is very new. And we are still going through various rounds that establish what the true value of something is. ”