The US Federal Reserve is locked in a high display with markets.

This week, chairman Jay Powell won suggestions for recognizing a rapidly shining economic outlook and the opportunity to push higher in inflation, while reaffirming his commitment to interest rates. keep it at future rock levels.

But this calm outlook for inflation is heading into the price of U.S. long-term government bonds, sending shocks over global markets. Despite Powell’s manipulative approach to rising yields, compared to his eurozone counterparts, investors continue to question how far the Fed can let this run.

“It’s not the level of return that matters, but how it interacts with risky assets,” said Gene Tannuzzo, head of global revenues at Columbia Threadneedle Investments. “If yields are moving up at a pace that is causing the stock market to fall and credit spreads to widen, then [Powell] I will be more worried. ”

In just the past week, yields on the benchmark 10-year pound jumped as high as 1.75 percent, after trading around 1.6 percent just days earlier. Since the beginning of the year, long-standing treasures, maturing in 10 years or more, have fallen nearly 15 percent on a total return basis, according to the Bloomberg Barclays index . If these losses continue, the first quarter of this year will mark the worst of the early 1970s.

The recession marks a major resurgence among economists of inflation and growth forecasts, and suspicions that the Fed will have to force the first increase in interest rates.

The European Central Bank has pushed back against rising yields on its turf, fearing a detrimental rise in lending costs for companies and individuals at a financially viable level. In contrast, the Fed chair has stopped any resentment, despite the fierceness of the movement at times, quite different from the March 2020 program when policymakers were present. the regular communication with banks and other market participants about chaotic market trends.

The speed of the sell-off, which has begun to pour into equity and credit markets, has reassured investors. In February, yields broke even some of the best forecasts for the year, after an auction from the Treasury Department got little start on choppy trading.

Powell again rejected the recent gyrations in the $ 21tn market for U.S. government debt on Wednesday, reiterating that financial position over several meters was still “very reasonable” and that the central bank would only be concerned about “disorderly” movements that threaten to weaken the economic recovery. To drive the point home, he suggested that there was no intention to change the $ 120bn monthly bond purchase program.

“The market could push them to change their behavior but for now [Fed policymakers] have made it clear that they do not want to be directly involved in influencing the yield curve, ”said Rish Bhandari, senior portfolio manager at Capstone hedge fund.

Mike Collins, senior portfolio manager at PGIM Fixed Income, warned, yet another sharp rise in Treasury yields could confirm their stance, however.

“Financial conditions remain very stable, but if rates rise another year [0.5 to 1 percentage point], that could delay things, ”he said. The backlash in equity and credit markets could also be harsh enough to encourage verbal intervention from the Fed, or even a move toward the Fed buying longer-term debt.

As the economic picture grows as summer approaches make the situation even thinner for the Fed.

Economists have already witnessed a rise in consumer prices this year as the economy reopens – a rise that Fed officials say will be temporary. But the central bank’s support for inflation is higher, with their recent commitment to allow inflation to run hot to make up for past moments of removing its 2 percent target, coupled with the scale of the recently signed fiscal stimulus package into law.

“Markets have become very concerned that the Fed will make a policy mistake on higher inflation,” said Saira Malik, head of global equity at Nuveen. “The market can cope with rising productivity, but it needs to be orderly and driven by stronger growth and not going up because the economy is overheating.”

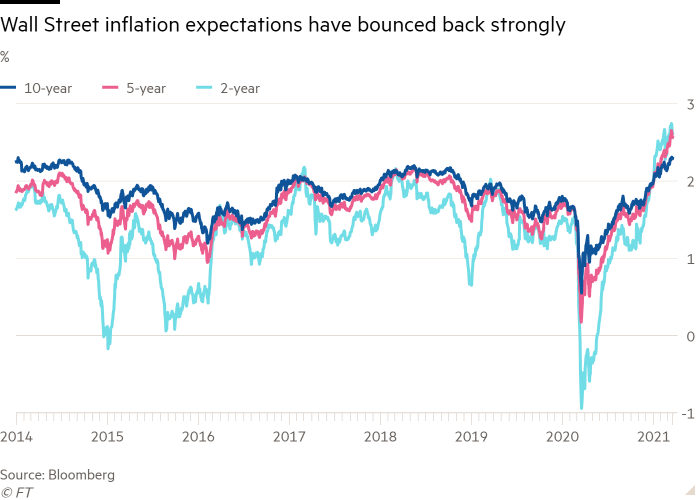

Brian Rose, chief economist at UBS Global Wealth Management, said he was closely monitoring inflation in the long run for any sign that inflationary pressures could become unstable. Five-year balance rates, which come from U.S. inflation-protected government securities, are now hovering around 2.6 percent, just shy of the highest level since 2008. The 10-year rate is slightly higher lower at 2.3 percent.

“If they are too successful and inflation is expected to threaten to anchor, it will be an issue and it would be much more difficult for the Fed to maintain a very loose policy,” he said. On Wednesday, the dot plot of policymaker interest rate forecasts meant the central bank would keep interest rates close to zero until at least 2024, despite the sharp update in the forecasts its growth.

“There is nothing at the moment that tells us we are entering a new inflation regime that will do that. . . tighten the Fed, ”said Diana Amoa, revenue care manager based at JPMorgan Asset Management. That said, there is a lot more uncertainty about that. “