Photographer: Tomohiro Ohsumi / Bloomberg

Photographer: Tomohiro Ohsumi / Bloomberg

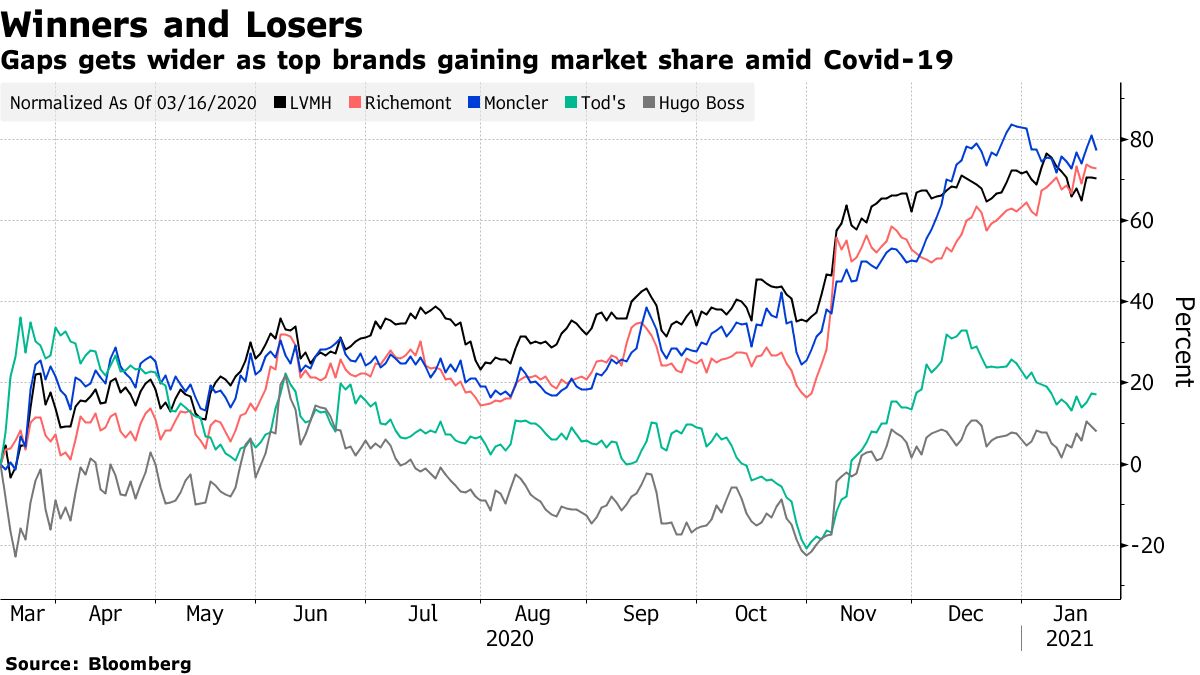

The coronavirus pandemic continues to rise across large parts of the world and China is facing a revival of the revolution, but investors continue to push luxury goods stocks higher, unaffected by near-level valuations.

The combination of strong growth in Chinese consumption and a strong start in an employment season is seen in supporting stocks as LVMH, Hermes International and Kering SA, all of which have reached their highest level in the last two months. The quality of the businesses and their substantial position in the stock market are causing some investors to compare the companies with US technology behemoths.

“We view European luxury companies as the European technology market equivalent of U.S. technology: industries that are unparalleled in global leadership,” said Giles Rothbarth, manager of Blackrock’s European Dynamic Fund. Some companies in the sector with the best prospects remain attractive even after the recent performance of share prices, he said.

Cartier owner Richemont, the first major luxury player to report sales for the last three months of 2020, set the tone Wednesday with that quarterly jewelry revenue. far higher than expected despite refurbished locks and no revival in travel, fueling further gains in the sector.

French consortium LVMH, one of the largest stocks in the Stoxx Europe 600 Index and a bellwether for the industry, is likely to “burn out the lights compared to peers” when it reported results on Tuesday, with strong move at Dior and Louis Vuitton logos, said Swetha Ramachandran, GAM manager Luxury brand equality fund.

While high-end consumers can’t splurge on travel and restaurants with many major economies locked in, they are opting to buy luxury products instead, retaining sales power for the most iconic brands, she said.

“Mega-brands seem unstoppable,” Luca Solca, an analyst at Sanford C. Bernstein & Co., said in an interview. Growth is driven by Chinese buyers buying in their home market at higher prices due to Covid-19 and carving out “what they see as essential as something nice rather than cool. , ”Which helps the major brands, he said.

Companies like LVMH, which only acquired U.S. jewelers Tiffany & Co. is believed to be. as a high-quality asset, generating money that will continue to benefit from long-term structural trends such as China’s middle-class exposure and mixed-brand, best-in-class care that will help reduce risks.

Some analysts see reason for a warning, as Covid-19 restrictions will continue to hurt the region this year and a return to normal could mean consumers would shower out traveling and eating out rather than on the latest handbag.

The stocks are “priced for perfection,” said Francesca DiPasquantonio, a Deutsche Bank AG analyst who recommends you buy only one, Richemont, among the 13 she covers. Valuations have been “unmistakable for risks,” she said.

Analysts at RBC Capital Markets say valuations look “stretched,” with luxury stocks as a group selling for about 40 hours of estimated earnings this year compared to the 10- average. year of 23 hours.

That’s even more valuable than many U.S. tech giants that have been making good stock market trends for the past year. Google Alphabet Inc.’s parent, for example, gets about 27 times the estimated earnings, the price of Apple Inc. at 33 hours and Facebook Inc. selling for 24 hours profit.

Many investors are worthless, saying the industry is benefiting economic recovery in China. Market prices may be in a much stronger reversal in earnings this year than analysts expected, said Cedric Ozazman, chief investment officer at Reyl & Cie in Geneva.

“I’m not afraid of high valuations and I’m still very bullish on the sector,” he said. “The strong desire for luxury names is accelerating in China. ”

Deutsche Bank predicts that luxury companies will report 18% sales growth, on average, this year, which is likely to move back 95% despite a soft start to the year due to Covid-19 , which could affect China’s New Year’s Holidays next month.

A positive employment surprise will be “crucial to maintaining such stock levels but we may see more of that,” driven by rising industry prices, cost cuts and a move to online sales, Solca Bernstein said.