Photographer: Erin Scott / Bloomberg

Photographer: Erin Scott / Bloomberg

U.S. data is all over the spot this week after Friday’s jobs report surfaced fall in wage rates for the first time since April, highlighting how infectious diseases are taking a greater toll on parts of the world’s largest economy.

Rising fuel costs to inflation caused a bit stronger, but still under control, last month, while a relapsing coronavirus was holding back sales, economists are projecting to show a pair of U.S. reports.

The government’s consumer price index is receiving more scrutiny as investors and economists debate whether the acceleration of inflation is possible in the coming months. Extremely easy money policy, trillions of dollars in fiscal relief that could keep expanding below Biden’s administration is coming in, and higher material costs provide a basis for higher price pressures.

Federal Reserve Chairman Jerome Powell, speaking on Thursday, appears optimistic about further pandemic support raising hopes for the economy later this year. Officers have identified interest rates stay near zero through at least 2023 and have vowed to continue buying bonds at a rate of $ 120 billion per month to see “another major step forward” towards their employment and inflation targets.

Just how long that will take is not spelled out, although a few policymakers, including Chicago Fed President Charles Evans and Raphael Bostic at Atlanta, said last week that they could support reduce the pace of buying before the end of the year if the economy kicks back strong enough. However, Fed Vice Chairman Richard Clarida said Friday that he does not expect the central bank to start cutting down on asset purchases in 2021.

A government report is expected to appear at the end of the week higher levels of Covid-19 infections continued to dominate retail sales. Economist project third direct decline in purchases at dealers other than motor vehicle dealers.

What Bloomberg Economics Says …

“Economic slack in general and labor slack in particular will hamper any sustained upturn in price pressures. This will provide the Fed with a truly long runway before officials need to give due consideration to accommodation reductions. “

–Carl Riccadonna, Andrew Husby and Eliza Winger

For more, read Bloomberg Economics Full Ahead Week for the US

Elsewhere in the world economy, Chinese data appear to show the recovery extended to the end of the year, with central banks in South Korea, Poland and Peru setting levels.

Click here for what happened last week and below is our coverage of the future of the global economy.

Europe, Middle East, Africa

Germany will publish its first reading for 2020 GDP on Thursday, with analysts predicting that Europe’s largest economy contracted by 5.2%, the highest number since the 2009 financial crisis. that was also the first official indication from a Group of any seven countries of their growth performance in the fourth quarter. Further hard data from across the eurozone includes a November reading for industry output in the region.

Christine Lagarde’s first public appearance of the year may give investors an idea of the implications for monetary policy, with the president of the European Central Bank taking part in Monday’s events and Wednesday. Selection of officers’ Consideration will be given at their final decision to publish on December 10 on Thursday, when the foundation will begin a quiet period before next week’s upcoming meeting.

In the UK, GDP data for November will provide an initial picture of the economic damage done by a a renewed lock was installed that month to keep the coronavirus at bay. Economists are forecasting a sharp fall of 4.8%, the first shortening in seven months.

Adam Marshall, chief executive of the British Chambers of Commerce, talks about the challenges facing UK businesses amid a third of the Covid-19 lockout.

Poland and Serbia are the only two central banks in the region set to make monetary decisions this week. Economists predict that both institutions will maintain standards.

Israel is expected to report December data showing the ninth straight month of consumer price declines, highlighting the Bank of Israel’s struggle to curb the value of the sekel. Saudi Arabia and Turkey are reporting unemployment figures.

Asia

Consumer prices in China are expected to be flat-lined in December as modeled factory deregulation and exports continue to power the country’s recovery, Monday and Thursday data are set to showing.

India’s consumer price index figures due on Tuesday are expected to show inflation shifting back to within the Reserve Bank of India’s target range of 2% to 6% .

South Korean jobs data released Wednesday offers the latest picture of a labor market showing a gap between a slow recovery in the service sector and a worsening fall in factories. Later in the week Bank of Korea is expected to hold a policy. Governor Lee Ju-Yeol, who has expressed concern about the uneven nature of the revival, will comment on the decision.

Bank of Japan Governor Haruhiko Kuroda will speak on Thursday in his first recorded appearance since the start of a renewed emergency situation in Tokyo.

Latin America

Since the outbreak of the pandemic last year, only two countries in the region have grown year on year in industrial output – Brazil and Chile. Data is expected to be released on Monday that Mexico does not yet exist.

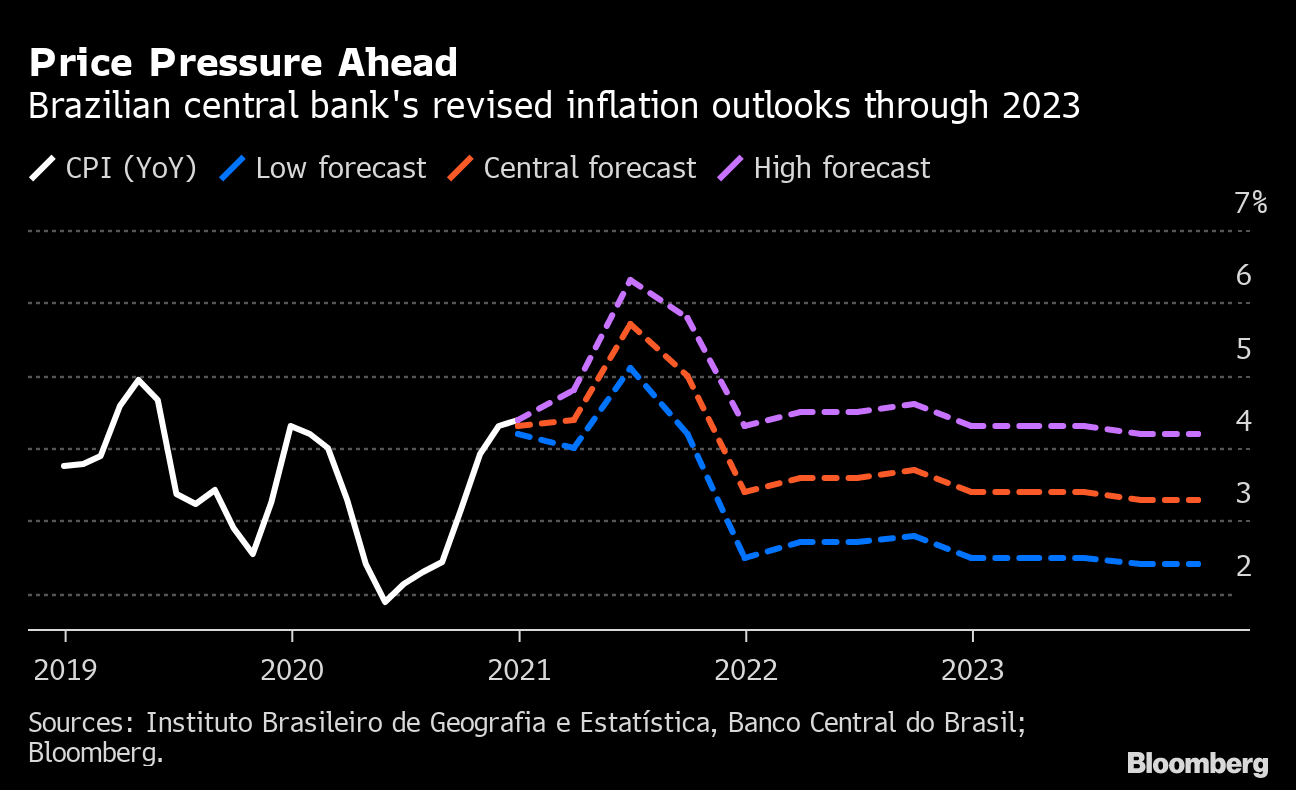

After the 2020 panic, one sign of a world returning to something like normal is that inflation is again significant in Brazil. December figures posted on Tuesday show that the annual rate has risen for the seventh month and is now well above the 3.75% target.

Price pressure ahead

Brazilian central bank revised inflation forecast through 2023

Source: Instituto Brasileiro de Geografia e Estatística, Banco Central do Brasil; Bloomberg.

Consumer price data out Thursday for Argentina will be near lows for the year, but most viewers see it accelerating in 2021.

Later in the day, Peru’s central bank as a whole but certainly will keep its key rate unchanged at a low of 0.25% for the ninth month.

Friday’s report in Brazil shows retail sales expanding a dramatic run, spurred by government cash bills and cheap credit, apparently posting its sixth year-over-year rise.

– Supported by Benjamin Harvey, Robert Jameson, Malcolm Scott, and Michael Winfrey