Closed shops on Oxford Street in London.

Photographer: Jason Alden / Bloomberg

Photographer: Jason Alden / Bloomberg

UK government borrowing came to $ 19.1 billion ($ 26.6 billion) in February, reflecting the cost of supporting the economy through a third lock-in to fight the coronavirus.

The deficit left the budget deficit for the first 11 months of the fiscal year at 278.8 billion pounds, almost six times the amount borrowed in the same period a year earlier, according to figures from the Office for National Statistics. was published on Friday. Net debt rose to 97.5% of GDP, near its highest level since the early 1960s.

The figures confirm the scale of the fiscal repair work facing Rishi Sunak after the deepest economic recession in three centuries. While the Chancellor of the Exchequer ‘s budget on March 3 outlined a sharp rise in taxes from 2023, many economists say more will be needed to fulfill his desire for a balance of costs and revenues from day to day in the medium term.

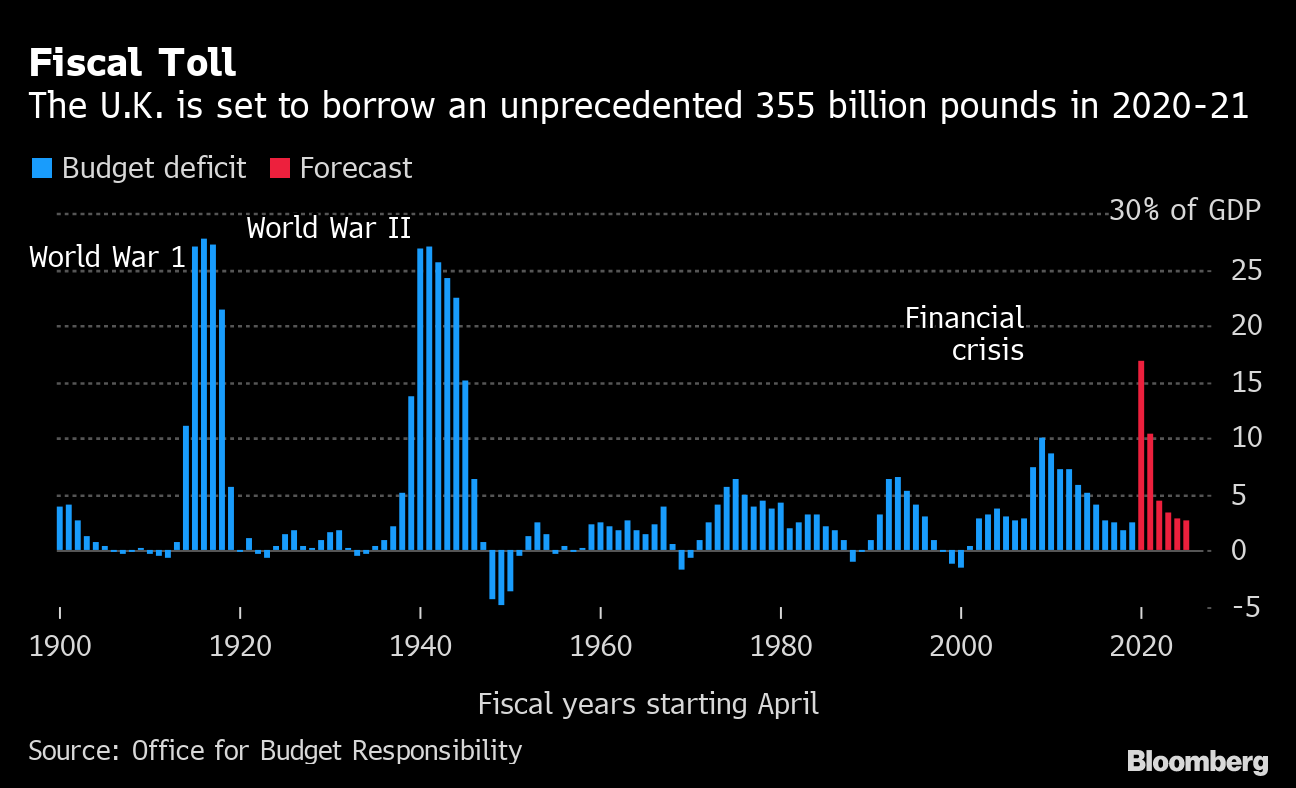

Fiscal Tax

The UK is expected to borrow 355 billion pounds in 2020-21

Source: Office for Budget Responsibility

The cost of seeing businesses and homes through the crisis is now at 344 billion pounds after announcing further relief in the budget. Billions more have been pledged in tax cuts to recover over the next two years.

The The Office for Budget Responsibility forecasts a loan of 355 billion pounds in the current fiscal year, comprising 27.2 billion pounds of writings state – sponsored coronavirus loans that have not yet been incorporated into ONS data.

That equates to 16.9% of GDP – the highest in peacetime history. The deficit in 2021-22 is expected to be as high as it was after the financial crisis at more than 10%.

The current budget, which includes investment, is expected to be in short balance by the middle of the decade, despite the Treasury expecting companies and employees to be hit by the increase. largest taxes since 1993.

Research groups including the Institute of Fiscal Studies say these estimates are based on overly optimistic assumptions about future tax revenue and spending, meaning further pressures will be needed to balance the books.

Sunak Faces Backlash Over Hike Tax Business as UK Budget Surs

“We should be looking at getting public finances back on track once the economy has recovered and at budget I have set out how we will start to do that. reassuring families and businesses, ”Sunak said in a statement following today’s data.

The budget deficit in February was slightly lower than the forecast of 21.4 billion pounds made by economists, and a revision of lending came down in January.

Receipts were helped last month by an influx of income taxes after the government extended the deadline for self-assessment sheets for the 2019-20 tax year to Feb. 28 from Jan. 31. Self-assessment receipts jumped 26% on the year. Capital gains tax revenue also rose, partially offset by a decrease in income from VAT, fuel duty and stamp duty on property purchases.

Expenditure in February was up 25%, driven by 3.8 billion pound pay subsidies for fur workers. The total cost of the furlough program and payroll support for self-employed workers now stands at nearly 77 billion pounds.