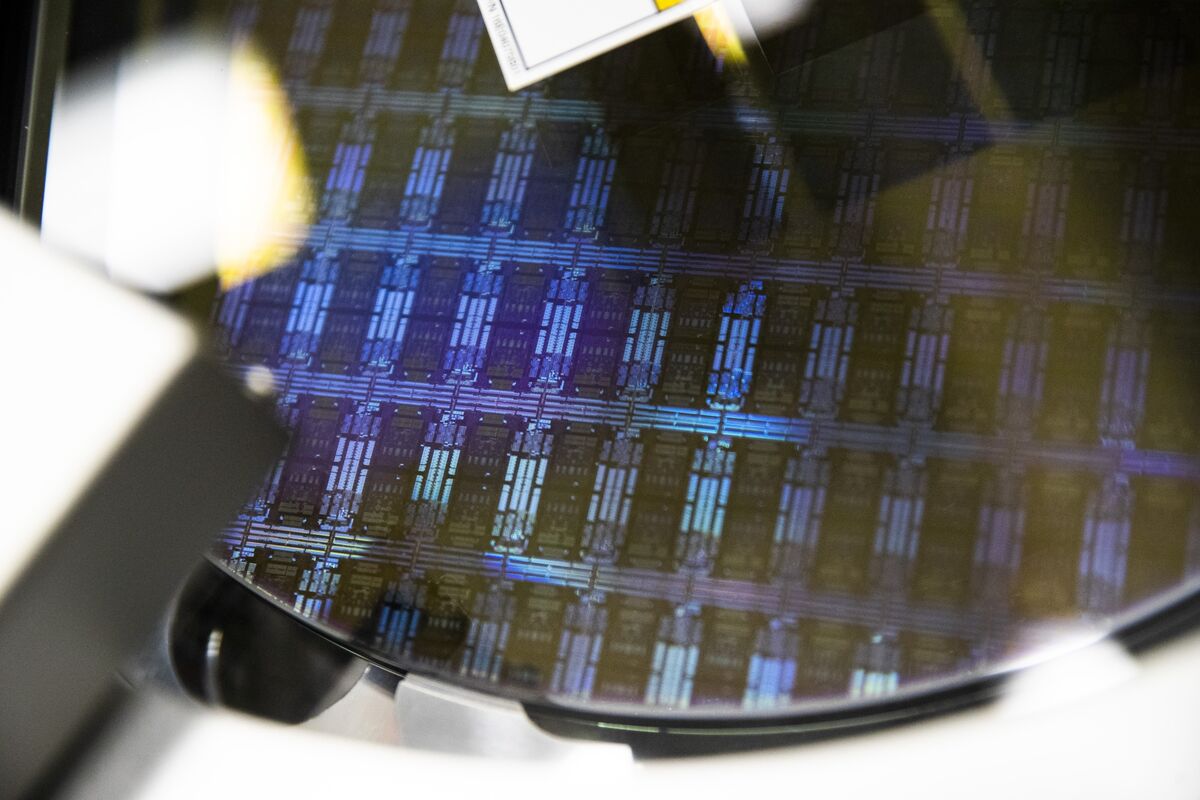

Photographer: Adam Glanzman / Bloomberg

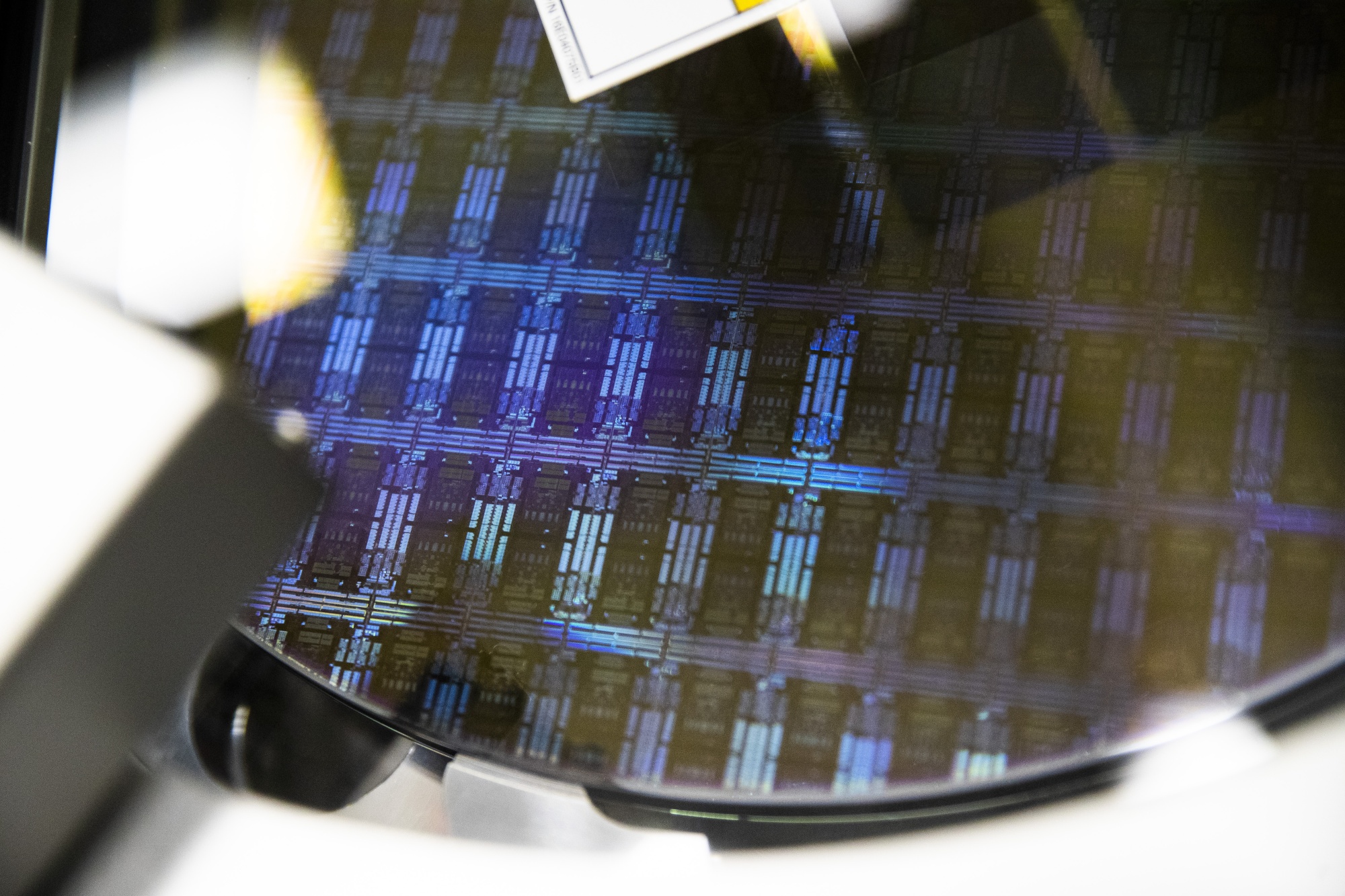

Photographer: Adam Glanzman / Bloomberg

Global semiconductor shortages have been reducing the supply of everyday devices from smartphones to game consoles to technology-dependent cars. With companies warning that the issue could last into the second half, the outcome threatens to put pressure on share prices for months to come.

Since breaking news that November Apple Inc. against a shortage of chips for its latest iPhone, warnings about the impact have been coming in thick and fast. Truckmaker Volvo Group and electric vehicle company Nio Inc. into last week a long list of automated producers that have idled collection lines.

Lack of chips is caused by strong demand for tech gear, largely due to the pandemic, and winter weather in Texas and a a fire in Japan has added to the problem. It has been a resource for such companies Applied Products Inc. and Lam Research Corp. which makes the semiconductor manufacturers equipment increase output.

Read: The World Is Short From Computer Chips. Here’s why

Here’s a look at the companies most involved in the ongoing global chip shortage, and how their stocks have been affected:

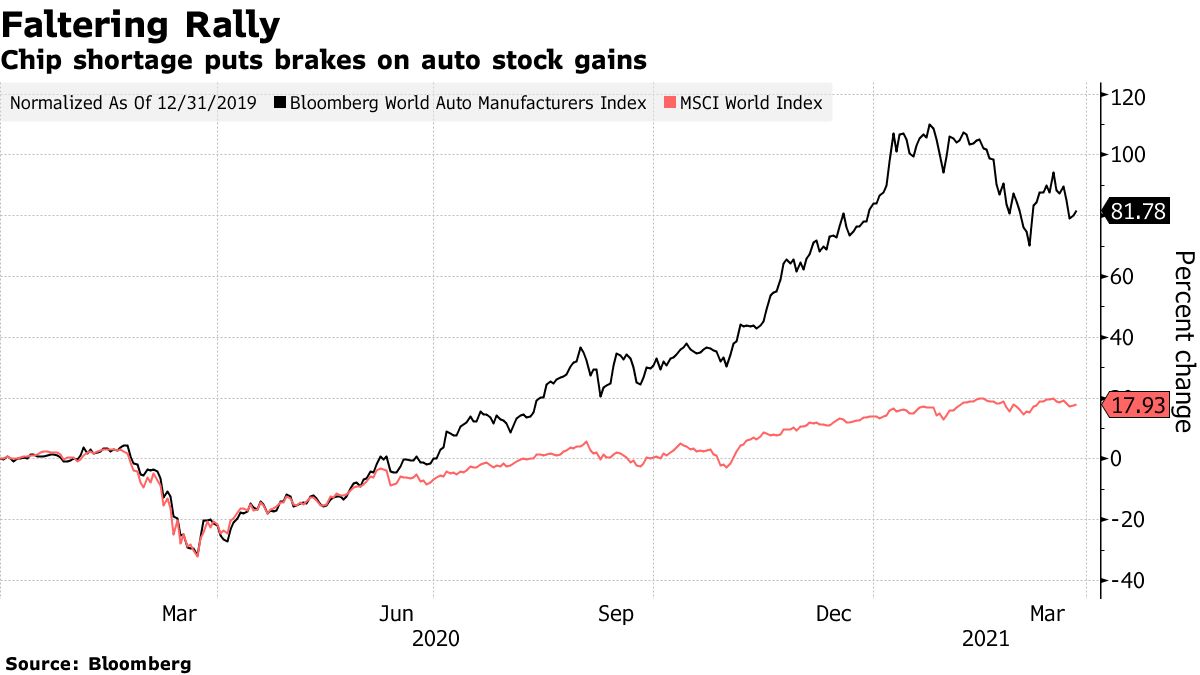

Automakers

Automated stocks have arrived moving back from their pandemic bottoms. Now both chip shortages and concerns about a resurgence of the coronavirus pandemic have pulled Bloomberg ‘s index of global manufacturers down 14% from the Jan chart. 25 high.

Volvo Group fell 7% on Tuesday after saying it needs to production stopped due to lack of semiconductors, while Nio in China slipped 4.8% on Friday when it said it will stop production at factory in Anhui province.

A. March 19 fire at a Japanese factory operated by Renesas Electronics Corp., one of the largest manufacturers of car chips, hit the industry hard. It brought in a fall of 6.7% Corp. General Motors shares over three days last week. In Japan, sections of Toyota Motor Corp., his wife’s six-year high on March 18, fell 6.1% in the four sessions that followed.

“The automotive sector appears to have suffered the highest level of disruption, with more and more OEMs either slowing production or closing temporary manufacturing plants,” said Thomas Fitzgerald, asset manager at EdenTree Investment Management Ltd., referring to original equipment manufacturers. .

Geely Automobile Holdings Ltd has slipped. in China 19% over three days last week after reporting disappointing earnings. Daiwa Securities cited the chip shortage in depreciating stocks and cutting estimates for this year and next. China deals with offline chip supply matters for himself.

LOW, Chip shortages can drive rally hitting market: taking stock

Smartphones, consumer electronics

Beyond the car industry, it is more difficult to reduce the impact of the stock market on companies that rely on semiconductors. Shares of Apple, for example, in November did not respond to the impact of the shortage, and are up more than 5% since then. Smartphone manufacturer Xiaomi Corp. fell. down 4.4% Thursday after warning of a shortage of parts slow growth over the next few seasons.

One positive aspect of the chip shortage: With strong demand for consumer electronics, it empowers companies to raise prices and deliver higher costs, said Neil Campling, an analyst at Mirabaud Securities. “Share prices have not been particularly negative in the news, and I think that’s because the important part is that you see a barrier in demand for that product, ”He said.

Lenovo Group Ltd said in August that a Profit margins from the chip shortage hit, and in November he said he could not fill every messenger order due to a lack of parts. However, demand for the company’s laptops is going up significantly due to purchases by people working at home, and the stock has doubled since August.

Sony Corp. said. last month they may not be able to save a new application game tokens in 2021 due to production bottles. The stock fell at a 21-year high in February, although it has declined 8.2% since then.

While Samsung Electronics Co. furnace business. which makes chips for other companies benefiting from the favorable equation for supply demand, the South Korean company has its own line of injured consumer products. Samsung this month warning of problems, including the cancellation of the launch of its new Galaxy Note, one of their best smartphone models.

Manufacturers of networking equipment have also been feeling the pinch. Analysts at BHO Oddo DigiTimes report that lead times for network chip delivery are extending as far as 50 weeks, suggesting that chip shortages have also reached the network segment and are likely to it will survive early next year.

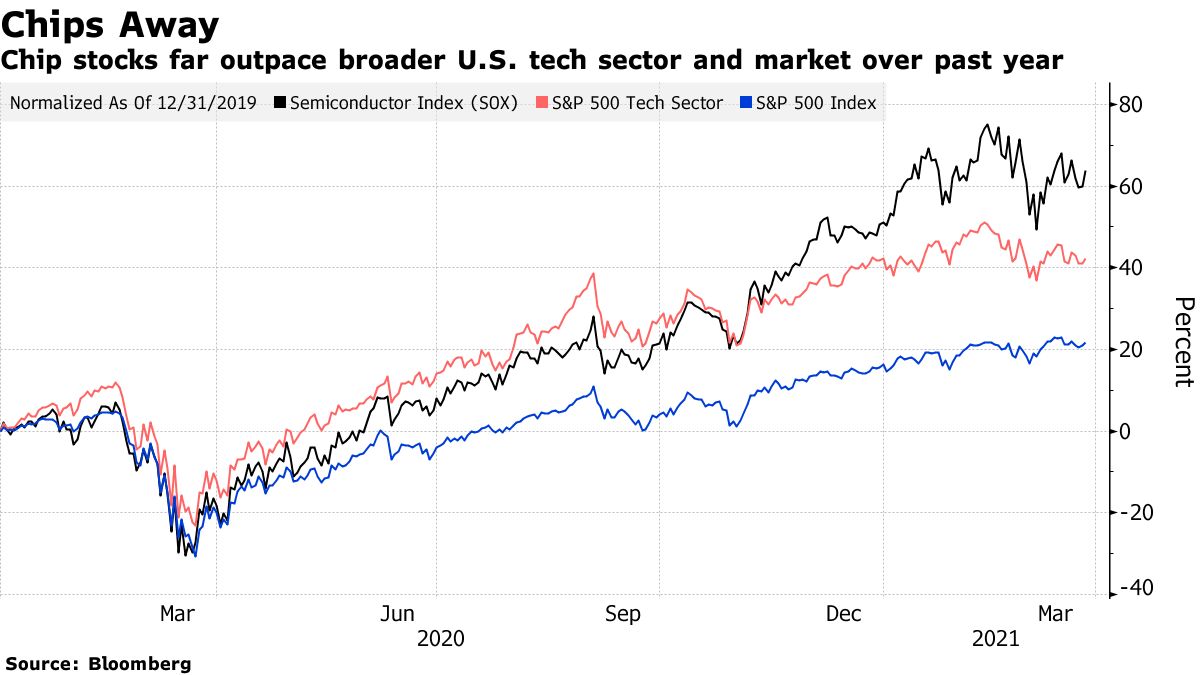

Chipmakers

While manufacturers have struggled, the flip side of the semiconductor shortage is that the companies that supply these semiconductors could boost their business. Most semiconductor companies should report strong results for the first quarter and provide good guidance for the second, said Janardan Menon, an analyst at Liberum Capital Ltd.

“This is good news for the semiconductor vendor,” Menon Liberum said by phone. “This kind of tightness – capacity utilization, rising prices, very strong demand – surprisingly means that their results are very strong. ”

However, Menon warned that share prices may not follow, as the market is now concerned that the peak of the semiconductor circuit is approaching.

European auto chip supplier Infineon Technologies AG is up 12% for the year STMicroelectronics NV has gained just 5.6%. In the USA, Texas Instruments Inc. up 15%, though NXP NV and Semiconductors Tha ON Semiconductor Corp. performed better, up 25% and 24% respectively, compared to an 11% increase at the Philadelphia Semiconductor Index.

There are also broader winners from the shortages in the semiconductor industry, with chip furnaces as the leader Taiwan Semiconductor Manufacturing Co. running near full capacity to try to keep up with the rise in demand. TSMC shares are down 12% from their highest record Jan. 21 but still up 11% on the year.

Manufacturers of semicircular equipment

The manufacturers of equipment used to make semiconductors are benefiting from the supply crushing while chip makers are shredding to enable their factories and governments concerned about national security threats are looking at measures to encourage them local production. The combination has created a consumption environment that some analysts say it will benefit the industry for years.

Applied Materials, the largest equipment maker, has seen its shares double in the last six months, and Lam Research has gained 77% over the same period, nearly double the return for Philadelphia semiconductor index. ASML Holding NV is up 74%.

TSMC promised as much as $ 28 billion in capital expenditure in 2021, up from $ 17 billion the previous year, while Intel Corp. published a plan on March 23 to pour billions of dollars into production facilities.

– Supported by Esha Dey