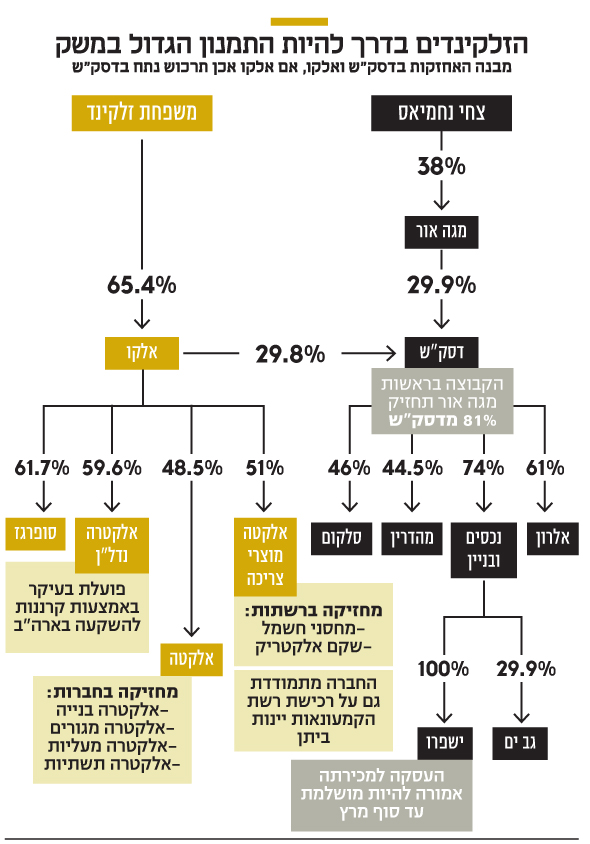

Under the nose of the Centralization Committee grows a monster. Brothers Mikey and Danny Zalkind, who have a strong business appetite, ship, using Elco Holdings Under their control (65.4%), arms to almost every possible sector in the economy.

Read more in Calcalist

In fact, Elco’s recent expansion moves are reminiscent of IDB in the days when it was controlled by Nochi Dankner and was the largest concern in the economy.

Yesterday, Elco announced that it is expected to invest NIS 400 million in the purchase of 29.8% of DSK shares, thus joining the group of investors led by Mega Or Controlled by Tzachi Nachmias (38%). And so, to a large extent, the Zalkinds will replace Rami Levy, who was supposed to purchase a similar share, but was stopped by the Ministry of Communications, which does not approve of the double holding that will be created for him in the cellular field. Rami Levy operates in the field through Rami Levy Communications, while DSKS It controls Cellcom (46%).

If the deal goes through, Elco will become a significant shareholder in a company that itself controls a variety of companies (see chart). Beyond Cellcom, which is the largest cellular company in Israel, DSK holds control of the investment company in Biotechnology Elron (61%), the plantations and real estate company Mehadrin (44.5%), the investment house Epsilon (69%) and the real estate company Properties and Building (74% ), Which holds a significant share (29.9%) in the Gav-Yam real estate company.

Will the Ministry of Communications approve?

Elco is already a significant real corporation today, and it dominates huge companies in the economy. It controls Electra (49%), the largest infrastructure and construction company in Israel, traded at a market value of NIS 6.5 billion. Electra is itself a multi-armed octopus. It is involved in the construction of roads, tunnels, transportation infrastructure, ports, residential buildings, commerce, air conditioning systems and elevators, with some of its operations being overseas. In addition, Elco controls Electra Real Estate (64%), which operates through investment funds mainly in real estate. Yields real estate in the US, focusing on housing clusters.

Elco also controls Electra Consumer Products (51%), which owns the electricity storage chain and the Shekem Electric chain, and imports a variety of well-known electrical brands, including that of the German giant Bosch. Elco also has energy activity through Supergas (61.7%), which it issued last year on the stock exchange, after purchasing it from Azrieli for NIS 770 million.

Supergas, which is traded at a value of about NIS 1.1 billion, markets gas to private and institutional entities, and initiates and establishes electricity operating facilities using gas. In addition, Elco has an activity in the field of cinema, through the Globus Max cinema chain, which it acquired fromForeclosure.

All these holdings are already turning Elco, which seven years ago was still a company in a severe crisis, into a significant real corporation. The company’s balance sheet in the first nine months of 2020 amounted to NIS 12 billion, and revenues amounted to NIS 8 billion. It is expected that by the end of the year, revenues will reach a threshold of more than NIS 10 billion. The group’s net profit in the first nine months of 2020 was about half a billion shekels.

Due to the fact that Elco is a significant non-financial corporation, it will be required to obtain the approval of the Centralization Committee in order to acquire the share in question in DCS. The committee may create difficulties in the transaction, especially with regard to granting permission to control Cellcom through DSC. Anyone who owns more than 10% of a cellular company must obtain a control permit. It is the Ministry of Communications that gives the permit, but it should receive an opinion from the Centralization Committee before making a decision. The Centralization Committee will examine all of Elco’s assets when it comes to submitting the recommendation.

Until last year, Elco held cellular operations through Electra Consumer, which owned Golan Telecom. Electra should have sold Golan Telecom to Cellcom for NIS 600 million, so if Elco does buy the DSK shares, the company will largely make its way back to it.

Elco’s choice to acquire 29.8% of DSKS is not coincidental. It is a share similar to the one that Mega Or will acquire (29.9%), which won the tender to purchase 81% of DSKS, after IDB bondholders preferred the group led by it over The face of the outgoing controlling shareholder, Eduardo Elstein, the choice of this number is intended to deal with the law of centralization, which prohibits pyramids of more than two public strata.

In the case of Mega Or and Elco, if they are considered controlling shareholders of DSKS, this means the creation of a pyramid that is contrary to the law of centralization. The number was taken from Elstein himself, who due to the law of centralism sold shares owned by property and building, until he remained with a 29.9% share. Thus claiming to have fallen out of control of the company and therefore a floor in the pyramid was erased.

The Centralization Committee will be required to decide whether Mega Or and Elco, who together hold 60% of DSK’s shares, have the ability to direct and control the company’s business – which would create an illegal pyramid of more than three layers. Elco hopes a 29.8% holding will not be considered For control and will not add cash in the pyramid.

Even if the Centralization Committee decides that the two do not control DCS, Elco will have a stake in the corporation’s conduct, and it is hard to believe that it will act as a financial investor only. It would not be unreasonable to have plans for some of DCS’s, led by Cellcom (see box). That is, the starting point of Zalkind and Nachmias challenges the law of centralization in any case.

Those who expressed joy at Zalkind entering the picture are IDB bondholders who feared that Nachmias is a serial regret and is already on his way to regret the deal, after Shalev left the picture, as he has already withdrawn from big deals, such as the acquisition of Ishparo and Arena Group. “Elco has reduced the level of concern, even if it does not provide the security and certainty needed for holders, as a strong partner is not only an advantage but also a disadvantage. As mentioned, the regulator may outwit difficulties due to Elco’s great power and delay the deal.” For NIS 1.14 billion.

Also pavilion wines on target

At the same time as DSK, Elco is conducting contacts through Electra Consumer, contacts for the acquisition of the Bitan Wines retail chain, the second largest in Israel in the number of branches – 148. Such an acquisition will increase Electra Consumer’s retail power. Elco is also conducting contacts to bring the Saban Elban retail chain to Israel.

Elco’s real goal: gaining control of Cellcom

Unlike many others who have turned a blind eye to DSKS, the interest of the Zelkind family in the company is not in its real estate business, but in the cellular company Cellcom. Elco, which is controlled by the Zelkinds, parted ways with its cellular business when it sold Golan Telecom (which was owned by its subsidiary Electra Consumer Products) to Cellcom itself, for NIS 650 million. Now, if the deal is completed, they will get a handle on Cellcom’s investment with an investment of NIS 400 million and a value of about NIS 1.4 billion to the parent company.

Unlike Zalkinds, Tzachi Nachmias, the controlling owner of Mega Or, which leads the group of buyers of DSKS, is interested in the real estate business, and he is also interested in selling Cellcom. The Zelkinds are helping him form a group of buyers, and in the future, apparently, a distribution will be made. Elco will stay with Cellcom, and Nachmias will stay with the real estate. How? The lawyers will work overtime and find out how the loot can be divided. The Zalkind family has already hired the services of a choice lawyer in the field of communications. Either way, making such a division would require a lot of approvals. In them of the general meetings of the various companies.