Photographer: Doug Mills / The New York Times / Bloomberg

Photographer: Doug Mills / The New York Times / Bloomberg

The U.S. economy is showing some scattered signs of a pick-up from slowing at the end of the year, undermining President Joe Biden’s efforts to move a $ 1.9 trillion stimulus package transport corridor to earn.

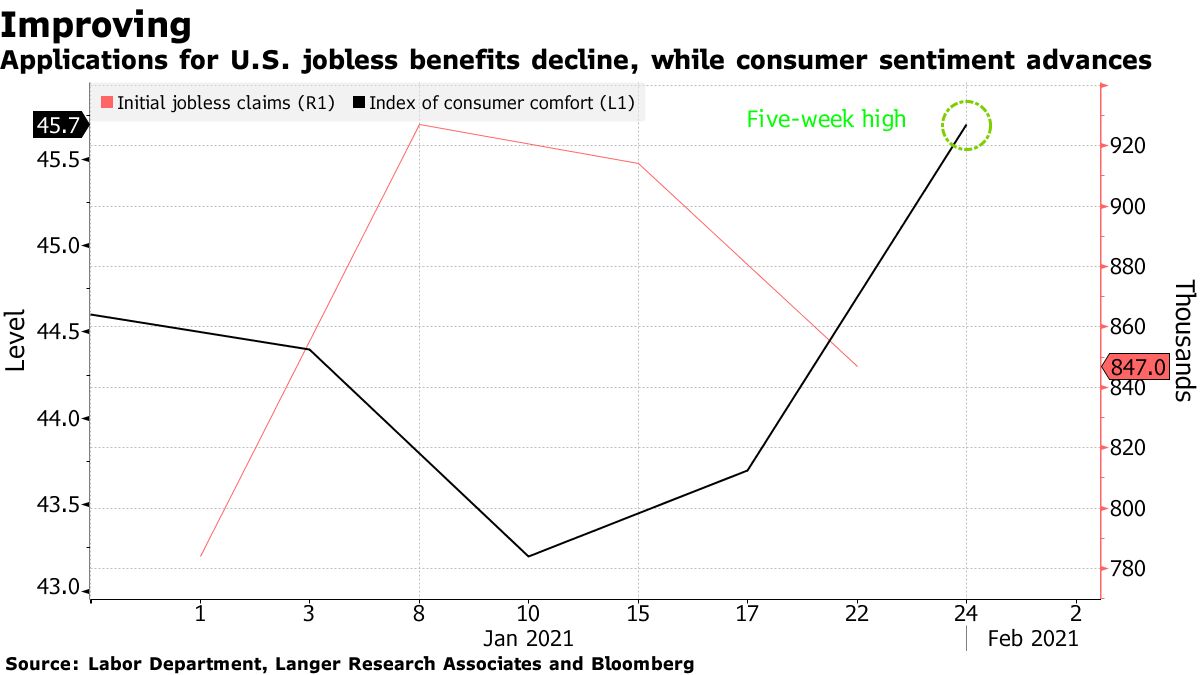

New claims for unemployment benefits have fallen for two straight weeks, and payrolls in January are expected to bounce back from a December awakening in data released Friday. Managers in charge of buying products for U.S. companies said more business last month and home builders said demand remained strong.

Selected high-frequency data, such as weekly consumer confidence readings and restaurant tickets, also point to some strengthening, as eradicated virus infections and industry restrictions are eased.

“We’re seeing continued growth below the surface,” said Gregory Daco, chief U.S. economist at Oxford Economics.

The positive development comes as Biden’s raspberry package goes against some lawmakers who question whether that support is needed in addition to the government’s remaining $ 3 trillion already delivered or promised.

Read More on Stimulus: Biden, Yellen Tell Democrats GOP Plan Too Small

Works Report

The next major economic recovery comes on Friday with the Department of Labor’s release of monthly labor numbers for January. Economists’ estimates for the shift in non-farm payrolls vary widely – from a 250,000 decline to a 400,000 increase.

The median forecast in Bloomberg study calls for a 70,000 gain after the December fall of 140,000. In November, employment increased by 336,000.

Wrightson ICAP LLC chief economist Lou Crandall said the data could be filtered higher by seasonal factors that take into account the usual January lay offs sales staff hired for year – end holidays – an unprecedented development due to the pandemic.

“To the extent that job creation looks stronger it could take away some of the crisis” to come up with a broad stimulus plan instead of a more focused one, said Michelle Meyer, head of the US economy at Bank of America Corp.

However, she warned that the near term of the economy will be determined by the country’s progress in getting the virus under control, especially now that new, more infectious changes have emerged. in the USA

‘Point Inflection’

The economy already appears to be benefiting from the $ 900 billion aid package agreed at the end of December, with credit card and account data compiled by Bank of America showing an increase in freight spending -use.

Jefferies LLC economists Aneta Markowska and Thomas Simons see February as an “inflection point” with growth picking up steam after slowing to an annual rate of 4% in the fourth quarter of 2020 from a pace of 33.4%. height in third place.

Read More: Bloomberg Economics recovers in high-frequency dashboard

Congressional Budget Office said Monday that it is seeing the country ‘s total domestic product recover from coronavirus pandemic much faster than previously thought – even before any further stimulus from the federal government. GDP is expected to expand 4.6% this year – the fastest pace since 1999 – after contracting 3.5% in 2020.

If Biden’s package is approved in full, federal government support for the economy during the pandemic will reach about 25% of annual GDP of nearly $ 21.5 trillion. That compares to the hole around 10% of which the virus entered the economy at its peak of impact.

“Economists say there is room for more support,” said Peter Hooper, global head of economic research for Deutsche Bank. “The argument is the extent to which you want to get over it.”

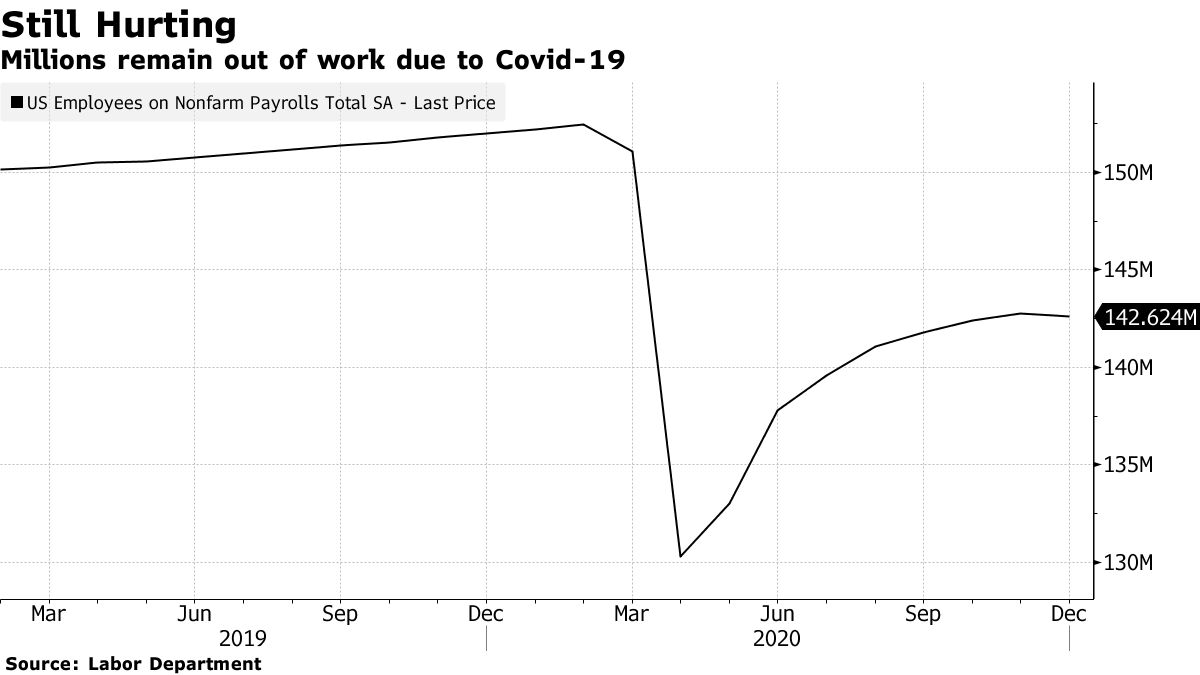

Biden administration officials are highlighting the benefits of going big. They point to the plunder caused by Covid-19 – about 10 million fewer Americans have been employed since the pandemic began a year ago – and argue that it is no longer the time to hold back the government.

“We have a real urge to get involved and work together,” Brian Deese, director of the White House National Economic Council, said in an interview on January 31 on NBC’s “Meet the Press” news show. “A step-by-step approach, where we try to address one element of this and wait to see the rest, is not a recipe for success.”

Proponents of the package also claim that it will help reduce long-term damage to the economy by returning GDP and the labor market back to their pre-existing heights. earlier.

Making the case for a smaller plan, former CBO Director Douglas Holtz-Eakin said the virus is what is holding the economy back, not a lack of money in consumers’ pockets. The personal savings rate was 13.7% in December, more than double the 2000 average.

“If we get another save in the savings rate, what are they going to do with it? Asked Holtz-Eakin, now president of the American Action Forum and an adviser to the late Republican Senator John McCain. “Are they going to go out and buy GameStop?”

After skyrocketing on wholesale purchases and short cover with hedge funds, shares of video game retailer GameStop Corp. came down Tuesday when the purchase came in handy.

Most Wall Street economists promise that Biden will get some, but not all, of the extra cost he seeks. But that will still be enough to build GDP significantly in the coming numbers.

“The economy will be stimulated by a one-pound punch of virus prevention and stimulus support,” Meyer said. It sees GDP rise at 7.5% in the second quarter and 10% in the third behind another $ 1 trillion in stimulus.