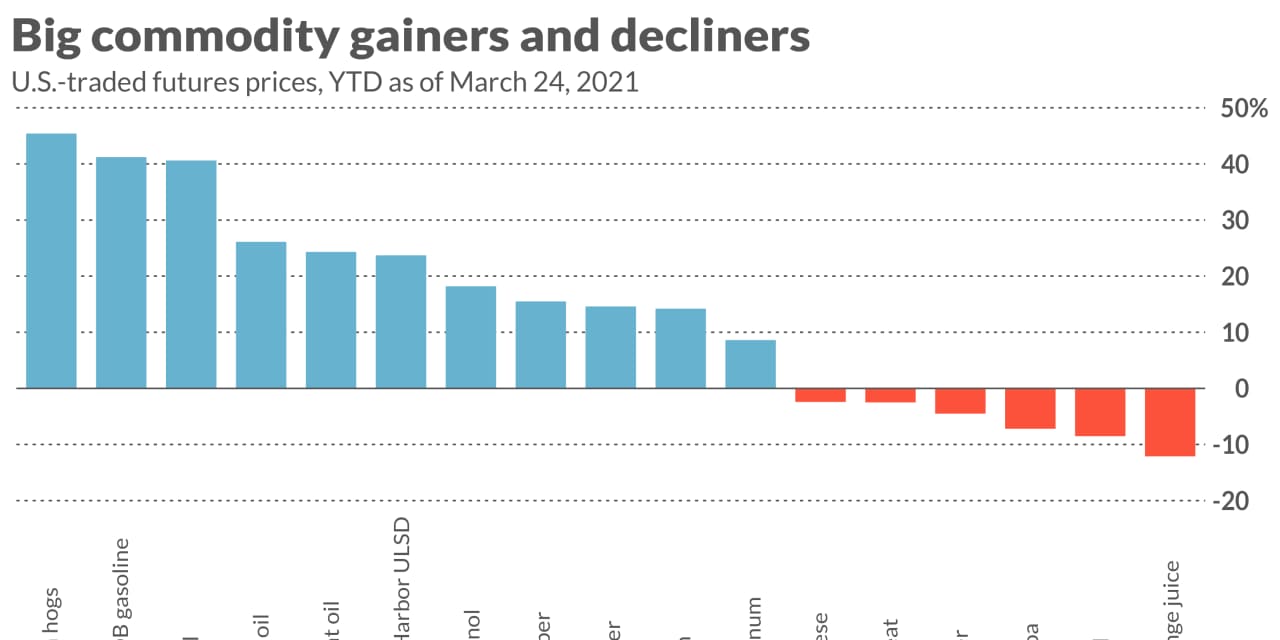

Commodities have been performing well so far this year, with the energy sector standing out and prices of lean hogs and steel rising sharply, as expected overall for a global recovery.

Looking at commodity prices in the coming months, the market is not worried about “the next series of Covid that could be rolled out in Europe,” said Adam Koos, president of the Executive Group Wealth of Libertas. “Price movements support the thesis that the overall economy is set to continue. ”

To date, the SSC GSCI SPGSCI index,

following 24 trade revenue contracts, up about 16% year to date from March 24. The S&P subindex SSC GSCI Energy Index SPGSEN,

trading around 24% higher.

Investors’ optimism about the prospect of better demand from the release of the Covid-19 vaccines raised expectations that lock-in locks would be well-built, and helped fuel rally in activity-dependent products economical, says Fawad Razaqzada, market analyst at ThinkMarkets online breakout.

However, that positive outlook has “put pressure on reserve assets such as gold and silver,” which have also been hurt by rising bond yields.

GCJ21 gold future,

GC00,

based on most active contracts like March 24, trade nearly 9% lower this year, with SIK21 currency,

SI00,

down above 4%.

Razaqzada outlines a “major recovery” of oil to climb from the historic downturn to negative prices for Texas West Intermediate crude back in April 2020, supply constraints with the OPEC + alliance, and a growing demand outlook.

This year, as of March 24, futures for a month for the U.S. West Texas Intermediate crude CLK21 benchmark,

CL.1,

trade around 26% higher, with Brent crude global benchmark BRNK21,

BRN00,

up 24%. Energy products include RBJ21 gasoline futures,

RB00,

they stand, up about 41%.

Despite “how and where we work for our employers,” oil and gasoline, in particular, are signaling higher global demand, and travel is set to recover, Koos says .

Other products with external benefits this year include LHM21 lean hogs,

LH00,

up 45%, and HRNJ21 steel,

up more than 40%, on futures markets.

Rising Chinese demand, following Phase One of the U.S.-China trade treaty, the destruction of Chinese pig herds caused by African Swine Fever, and the skyrocketing U.S. demand for pork behind the market are “miraculous ”For hogs, in terms of exports and trading currencies, says John Payne, a leading futures & options broker with Daniels Trading. Also, seasonally, the best time for pig rallies is into the summer, he says.

At the same time, strength in U.S. Midwest domestic hot coil steel “clearly supports the theory that prices are looking forward,” Koos says. There are likely to be more government-led projects with a focus on infrastructure, and steel will benefit from those projects, he says.

However, the price for the TIOJ21 iron ore rose,

which trades nearly 7% for the year, pales compared to steel increases. Some analysts warn that pollution reduction efforts in China could lead to restrictions on steel production, with demand for iron ore ready to take its first look.

However, with the big gains for commodities so far this year, the asset class may need to take a break here, ”says Koos. That doesn’t mean “forever” lower prices in the long run. “Following such a strong move since the end of 2020, commodities could use time to consolidate and cut down on all sides.”

Koos will see higher commodity prices in the future, while Invesco DB DBC Product Index Management Fund,

agent for commodity investment, breaking above the previous support floor at $ 18. If the DBC trading fund is above that key level, “I would like to be a commodity long, ”he says.