Rishi Sunak

Photographer: Hollie Adams / Bloomberg

Photographer: Hollie Adams / Bloomberg

The UK is still in a state of coronavirus crisis, but there is already strong political profiteering on how the country will manage the balloon debt it has run up to fight the pandemic.

With the country still fresh from almost a decade of austerity, there is little desire for spending cuts to reduce deficits on a course to reach 400 billion pounds ($ 547 billion) this year. That will focus on possible tax increases as Treasury Chancellor Rishi Sunak prepares to put out plans in his budget on March 3 to begin re-establishing public finances. innovation.

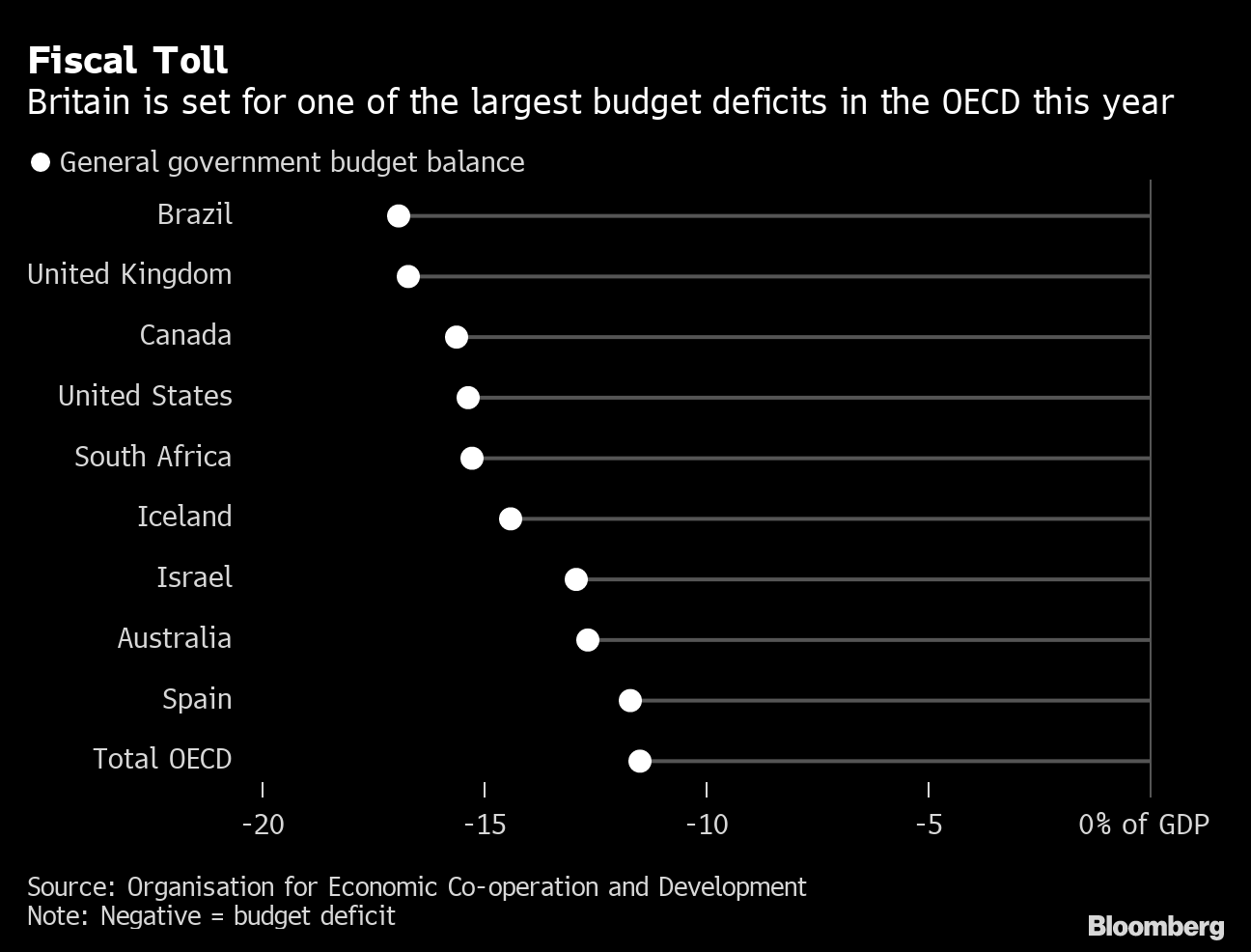

Fiscal Tax

Britain is ready for one of the biggest budget deficits in the OECD this year

Source: Organization for Economic Co-operation and Development

While most economists agree that now is not the time for fiscal austerity, the UK media has been plagued with speculation that the government will try to pass their tax, which would be usually almost 800 billion pounds. That is prompted by Sunak ‘s assertion, again on Friday, that it will repair the country’ s public finances over time.

“As soon as our economy begins to recover, we should be looking to get public finances back to a more sustainable footing,” he said. data shows that a loan has come again.

Here’s a look at the tax levers that Sunak can and cannot pull, if it decides it needs to start taking action.

Holy Cattle

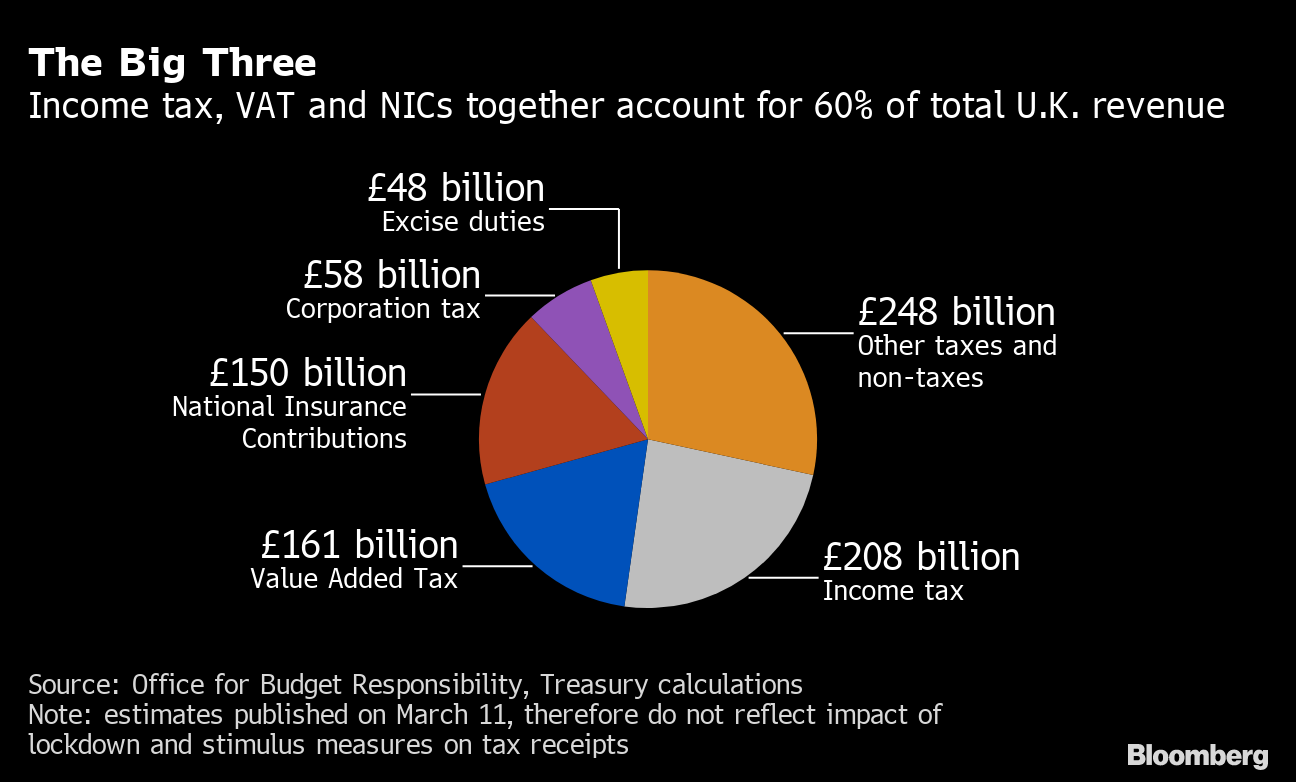

A key problem for Sunak is that the 2019 Conservative manifesto rejects an increase in the three largest taxes in the UK – income tax, National Insurance and Value Added Tax. Between them they raise over 500 billion pounds in a typical year. VAT adoption in particular will be reduced by the crisis, and government measures to deal with it.

The Big Three

Income tax, VAT and NICs together make up 60% of total UK income

Source: Office for Budget Responsibility, Treasury calculations

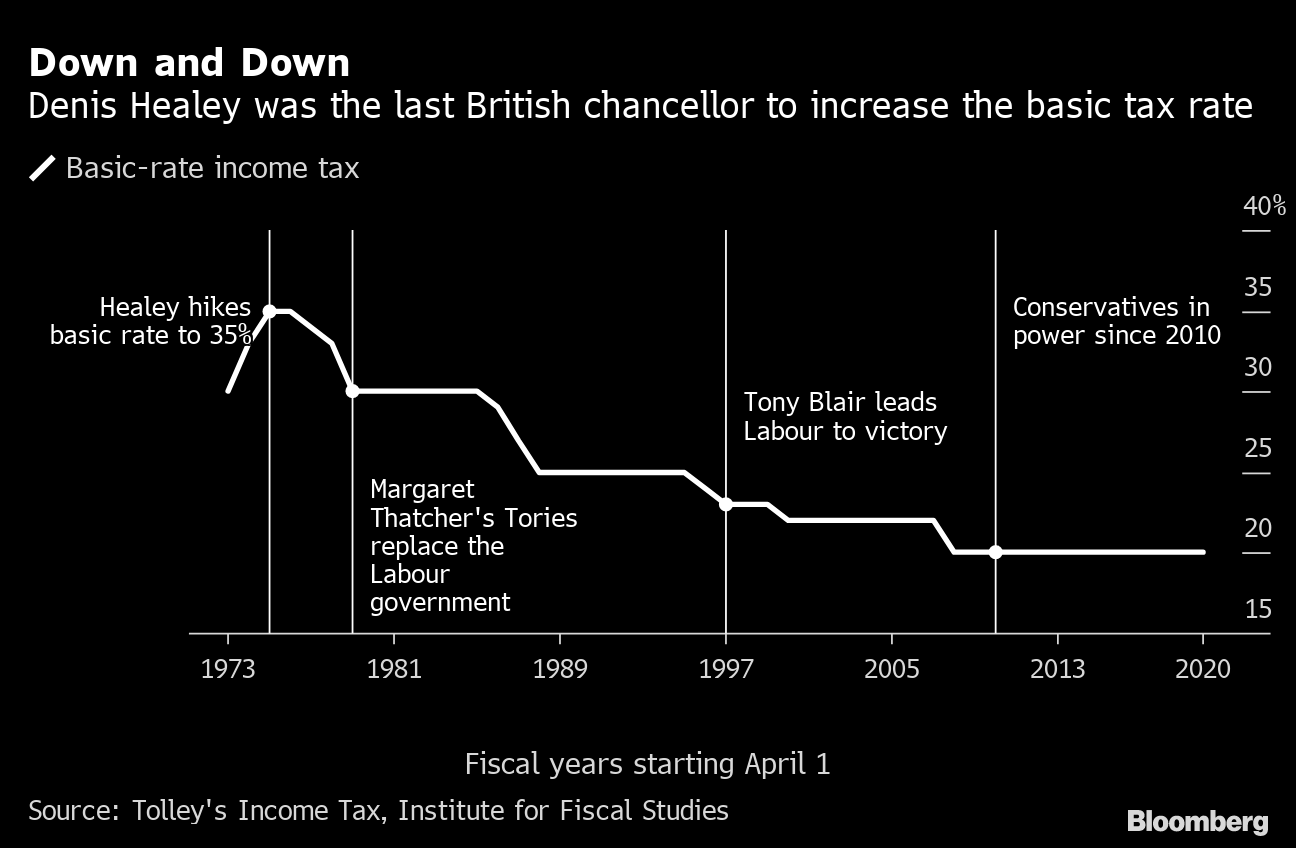

While an increase in any of these taxes could generate significant additional income, it can be very frustrating and even risk hurting spending once the treatment has begun. No Chancellor has raised the basic income tax rate from Denis Healey of Labor in the 1970s.

Down and Down

Denis Healey was the last chancellor in Britain to raise the basic tax rate

Source: Tolley Income Tax, Institute of Fiscal Studies

That left the government looking for alternatives. A Treasury spokesman said the department would not comment on profiteering about tax changes.

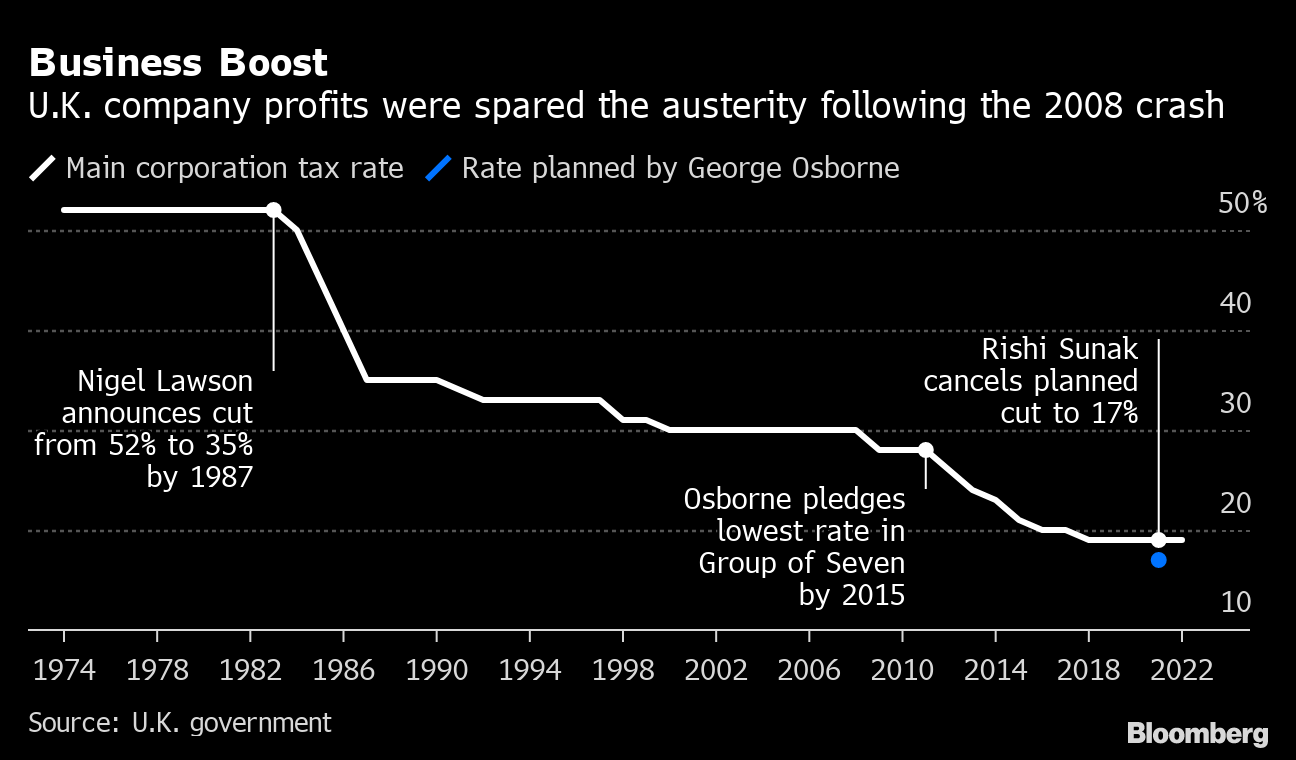

Corporation Tax

The Times reported last week that Sunak may be levying a tax on businesses first because it sees it as the fairest way to raise large sums. Corporation tax currently generates around 60 billion pounds annually.

The key rate has fallen from 28% in 2010 to 19% now. Although each increase would make a percentage point raise more than 3 billion pounds, any move would prioritize the government’s priority to make the UK an attractive place for post-Brexit business.

Business incentives

The profits of UK companies were saved so hard after the 2008 crash

Source: UK Government

Property Tax

Another idea raised by the Times was a homeownership tax. That would replace local authority taxes that filled nearly 40 billion pounds, based on 1990s valuations, and a stamp duty, which will cut home purchases.

Stamp duty filled more than 12 billion pounds for the Treasury in the last fiscal year, but acceptance appears to have been greatly reduced by the government’s decision to release the first 500,000 pounds of business.

Combining the two taxes would be neutral in the heart of Tory, which tends to have higher house prices, which could mean relatively large increases for the south east of England without raise a lot of money, according to Torsten Bell, chief executive of the Resolution Foundation. However, such a popular move in northern areas could be crucial to the impact of the 2019 Conservative election.

Fuel duty

The Sun announced last week that a 5-penny ($ 0.07) increase in fuel duty is being considered – another move that is likely to disregard Tory’s back members. The the tax has been frozen at 57.95 pence for a decade.

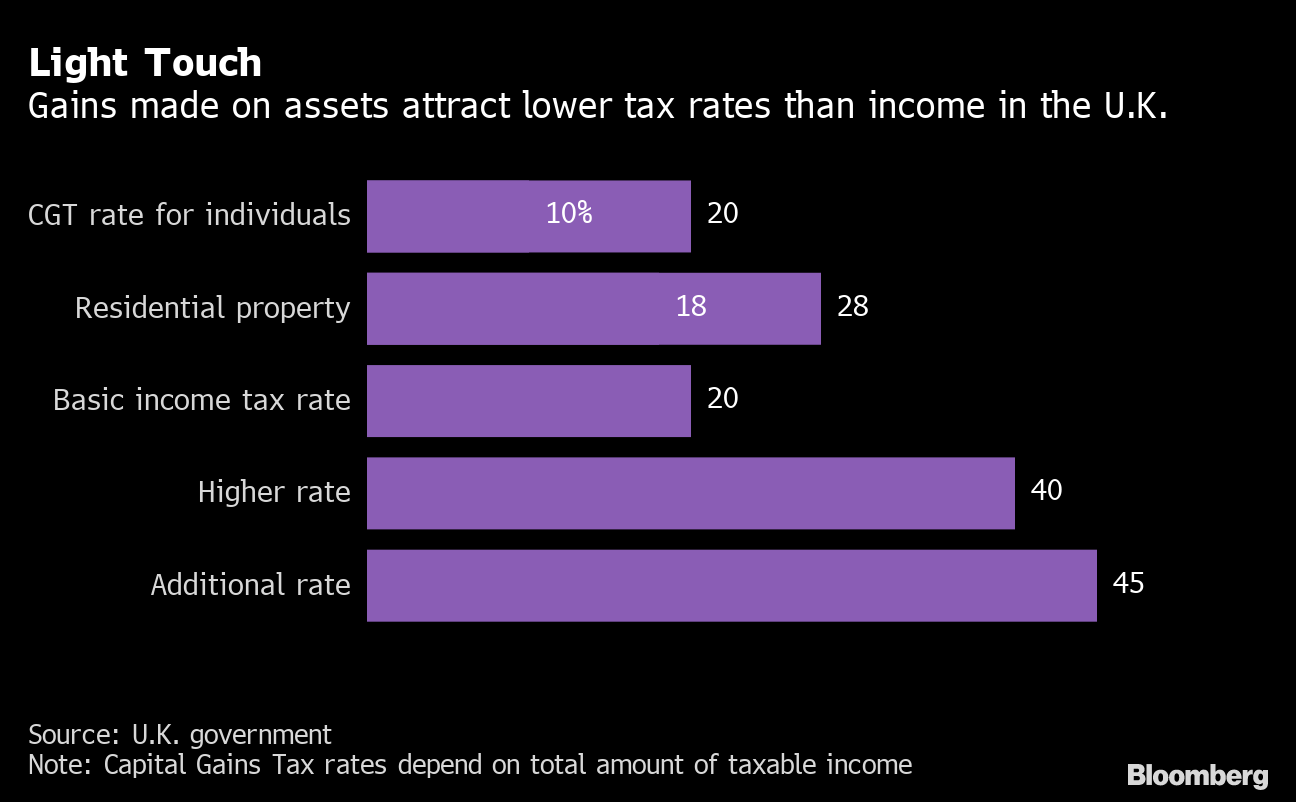

Light rub

Gains on assets attract lower tax rates than UK incomes

Source: UK Government

Capital Gains

The Treasury commissioned a review of Capital Gains Tax last year, which found that the increase could theoretically be more than double the current figure of around £ 10 billion, even if it could as a result of being unprofitable in practice.

Proposals included raising rates raised on the sale of assets such as property and shares to align with income tax. Other proposals included lowering the floor above which the tax is liable, focusing on more stock-based rewards for employees and eliminating relief on the allocation of shares in unlisted companies. .

Wealth Tax

Wealth tax is a more innovative and potentially highly controversial option that may seek to address growing inequality in the UK.

Last year, the independent The Wealth Tax Commission said the UK could raise more than £ 260 billion with a 1% annual cost lasting five years on individual funds over £ 500,000. It would affect about 8 million residents.

Wait and see

Sunak may also decide it is too early to raise taxes, opting to accept a higher debt burden so the UK’s recovery is assured. That tactic was picked up last week by a Treasury minister who suggested that walking could be avoided if the economy went back strong.

“It is therefore not entirely clear that there may be a need for future consolidation, depending on what you are taking for taxes,” Treasury Secretary Jesse Norman told the House of Commons Treasury Committee.

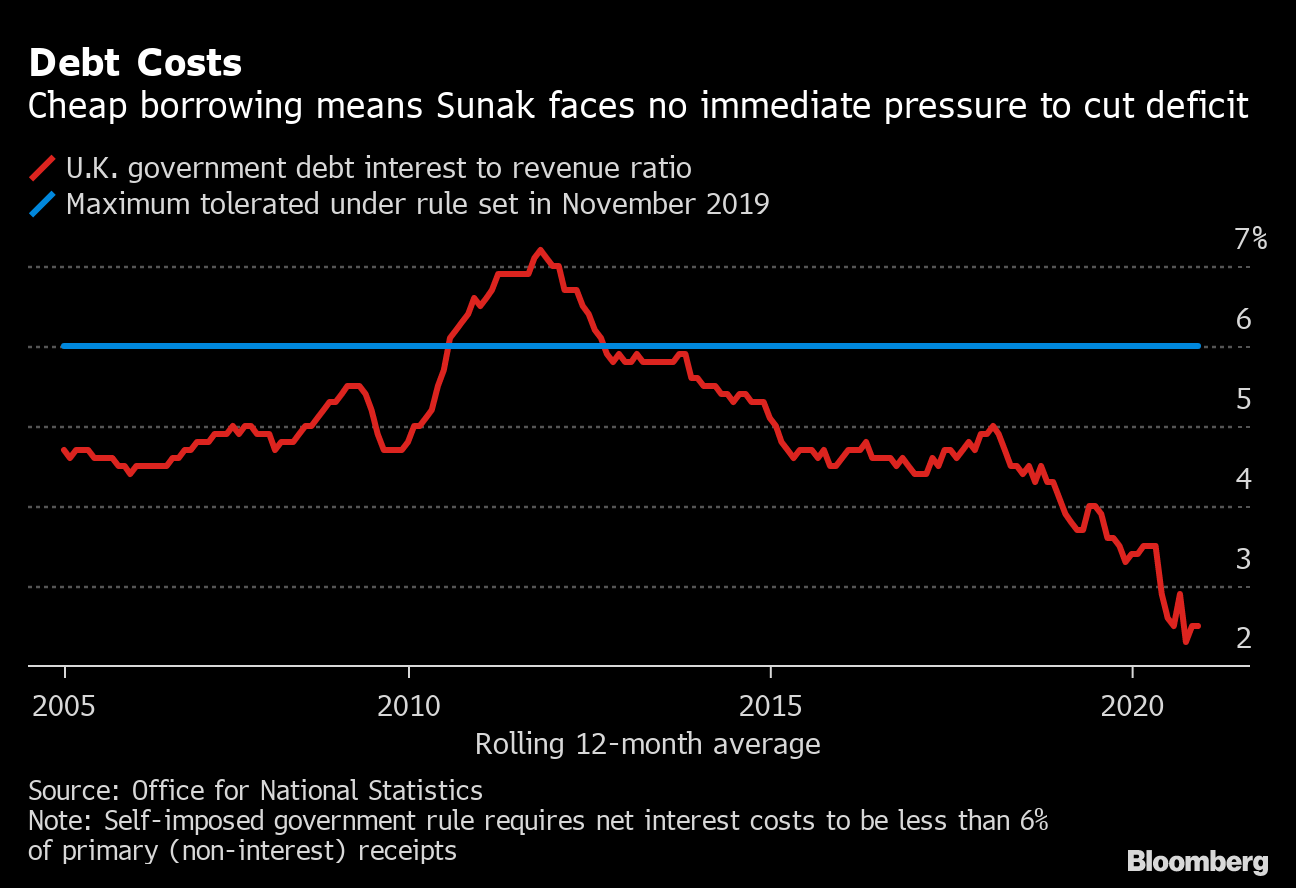

Debt costs

Cheap lending means there will be no immediate pressure on Sunak to cut deficits

Source: Office for National Statistics

That approach, which removes the risk of premature tightening that could reduce growth, could be achieved after the purchase of Bank of England bonds to stimulate the economy to meet the costs of debt servicing. the UK managed below pre-pandemic levels, despite the loan splurge.