Stocks are expected to enter the new year at the highest level when the first day of trading for 2021 in Asia begins on Monday. Bitcoin rally continued unabated.

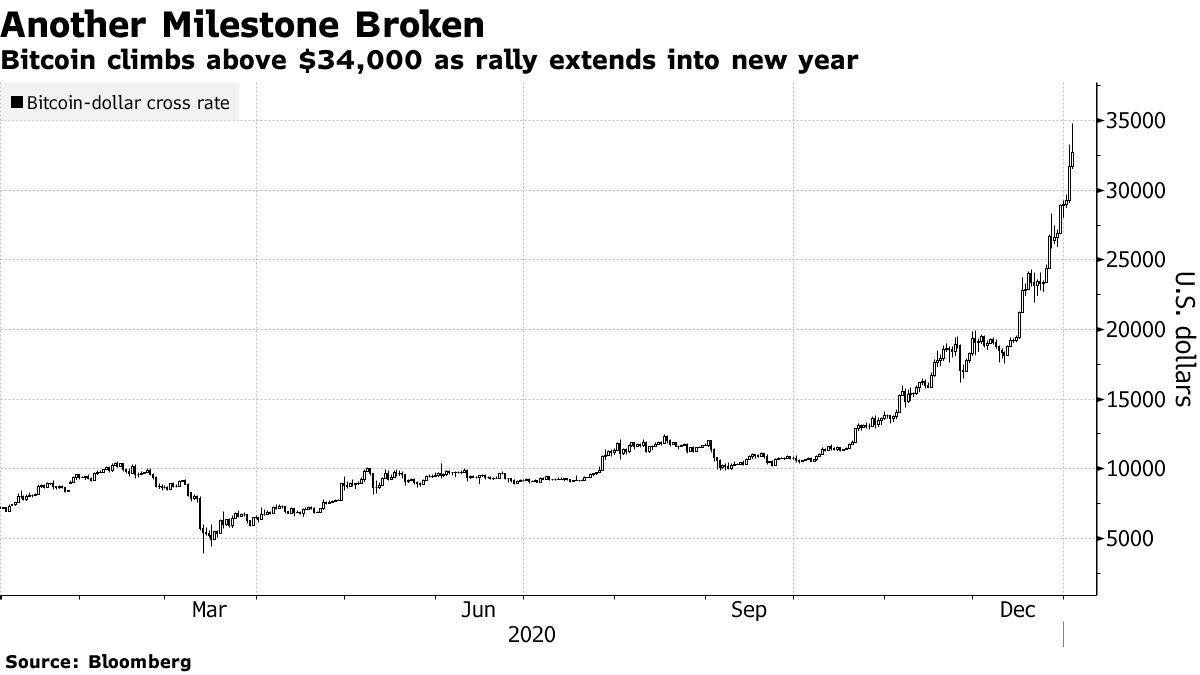

The S&P 500 Index and the Dow Jones industrial averages closed at record highs on Dec. 31. Most markets worldwide closed on Jan. 1. Bitcoin raised $ 34,000 Sunday just weeks after passing another major milestone. The mixed dollar opened against its G-10 counterparts as trading began in Sydney. The pound has plummeted as the UK opposes tighter locking to halt the coronavirus march.

Focus will be on Chinese stocks as Chinese oil majors could be the next line for selling in the U.S. after the New York Stock Exchange said last week that it would divert the three largest telecom companies in an Asian country. The CSI Index closed China’s 300 benchmark five-year high last week.

Allowances start the new year at wealthy valuations amid expected broad-based vaccine spreads in 2021, central bank support and government support regulating economic growth and boosting corporate profits. The global MSCI stock index finished at a record high of 14% last year.

At the same time, the frenzy in cryptocurrencies is not showing signs of slowing down. Bitcoin advanced about 50% in December for its biggest monthly jump since May 2019.

OPEC warned of threats to the oil market from the pandemic, a day before the group and its friends met to discuss further increases in output.

As for coronavirus, U.S. vaccine distribution is gaining momentum after a slow onset and could be on the way within a week or so, said Anthony Fauci, the country’s leading infectious disease expert. New York cases slowed a day after the state passed a total of 1 million infections. UK Prime Minister Boris Johnson has said stricter locking measures are needed in England, including school closures, as cases of the new virus strain continue to rise.

What will you be watching this week:

- OPEC + federation energy ministers will hold their monthly meaningful gathering on Monday to decide whether to add as much as 500,000 barrels to the production.

- China Caixin manufacturing PMI to come Monday.

- In the U.S. Tuesday, the state of Georgia holds a rehearsal election for two U.S. Senate seats that will decide control of the chamber.

- The U.S. Congress will meet to count election votes and announce who will win the 2020 Presidential election on Wednesday.

- FOMC minutes out Wednesday.

- The U.S. unemployment report for December is due Friday.

The main market trends are:

Stockings

- The S&P 500 Index rose 0.6% on Thursday.

- The futures of the Nikkei 225, earlier, have not changed much.

- Australian S&P / ASX 200 index times fell 1.2% earlier.

- Hong Kong Hang Seng Index futures fell 0.2% earlier.

Money

- The yen was at 103.19 per dollar.

- The offshore yuan rose 0.1% to 6.4962 per dollar.

- The Bloomberg Dollar Index rose 0.1% Thursday.

- The euro rose 0.2% to $ 1.2240.

- The British pound slipped 0.1% to $ 1.3662.

Bannan

- Yield on 10-year Finance fell one basis point to 0.91%.

Goods

- West Texas Intermediate crude remained unchanged at $ 48.52 a barrel.

- Gold was at $ 1,898.67 an ounce.