A high stock market is reminding nervous investors of the 2000 dot-com bubble burst, but they might be better off studying a more recent history, analysts said.

It is important to remember that “the current Fed policy, overall interest rates, yield curve, credit movements and cash availability are in a very different position than in 1999-2000,” Tony wrote. Dwyer, chief marketing strategy at Canaccord Genuity, in its Note Monday.

In addition, high valuations – measures of stock price relative to other measures such as earnings – are measured against a pool of profit last year rather than building on higher earnings, as was the case. in 2000, he said.

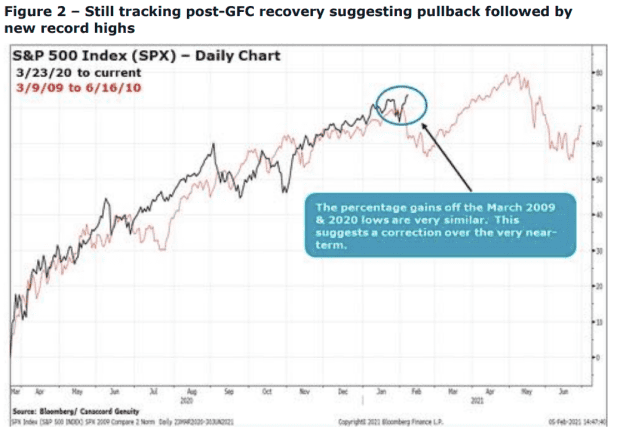

Dwyer said 2021 instead could play out more like the post-emergency situation seen in 2010, which would pave the way to a “hard year” for the market, but with a lump sum as a result of “several first-half corrections” coupled with tightening in price-to-earnings ratios that are likely to result from a historic increase in earnings per share rather than something heavier.

Dwyer built as the S&P 500 SPX,

a move where a March 23 pandemic has reversed the March 2009 index low (see chart below).

Genuity Canaccord

Through closing February 2 – 218 days after March 23 low – the S&P 500 went up 71%. In the 218 days after the March 9, 2009 low, the index rose 70%, according to Dow Jones Market Data.

At this stage of the playbook after 2009, the S&P 500 resumed. This time, the S&P 500 has continued to march higher, recording record-back endings on Thursday and Friday and rose 0.4% in early Monday afternoon trading.

After the end of January wobble tied to the trading frenzy around GameStop Corp. GME,

stocks have enjoyed a widespread rally in February. Dow Jones industrial average DJIA,

it went up around 150 points, or 0.5%, on Monday, on the way to the top of its list near Jan. 20.

DataTrek Research co-founder Nicholas Colas, who has been a regular feature of the 2009 “playbook” from the bottom in March, noted last week that a “textbook relationship” ”Was a 2010 withdrawal, with the S&P 500 falling 8.2% over 13 trading days. The index gained over the next 30 trading days, ending in March 2010 at new highs, he said.

Colas said the prospect was “not as big as a trade call as an example of what will happen as we delve deeper into cyclical recovery. ”

He noted that the 2020 chart has gone from the 2009 route several times and may continue to do so in 2021, but said with so many viewers looking to pull back, the playbook provide guidance “on what to expect and where to buy. ”

At the same time, Dwyer marked another echo of 2010. He noted that, since the start of the employment season, according to Refinitiv data, quarter-over-year earnings have increased 11.9 percentage points (from -10.3% to + 1.6%), the fifth largest improvement on a chart dating back to the third quarter of 2002 and matched directly by the 2009-10 recovery.

Read: The S&P 500 is on track for phenomenal employment growth