After the first volatile week of 2021, the second week of the year is likely to start in a slightly more relaxed fashion.

Nevertheless, markets are once again keeping a close eye on U.S. politics, after House Speaker Nancy Pelosi said the House would continue with legislation to impress President Donald Trump unless the 25th Amendment is called.

All three major U.S. stock indexes closed at the highest levels on Friday, despite a report showing the first monthly job loss since April among COVID-19 cases. Instead investors focused on President Joe Biden’s pledge for more financial support for Americans, at a weekend in which Democrats won both Senate-run elections, shifting balance power in Congress. U.S. stock times marked a lower early Monday, suggesting a slight move back from the highs in the opening.

However, in the call of the day, Credit Suisse strategists said the exile was likely to continue, raising the target for global stocks and the S&P 500 SPX,

Investment bank analysts, led by Andrew Garthwaite, raised the MSCI World Ex-US year-end target from 362 to 375, yielding a potential return of 12.3% of this. They said it was in line with the bank’s U.S. strategies, which raised the S&P 500 year-end target to 4,200.

They said that three key components – the push-loss ratio, the bull-bear ratio and risk appetite – were slightly expanded but “not at retail signals.”

“Bullish sentiment is high but at these levels markets are still rising two-thirds of the time over the next month and we believe there is no bullish sentiment in a sales or institutional setting – in fact speculative fares are net on average lower S&P, ”they said.

The only concern of the strategists was that 80% of stocks are currently above their 200-day moving average, which would typically see markets fall two-thirds of the time. time over the next month. However, they said: “But in the very early cycle, as we are, this is not a short-term sell-off.

“We believe the Democratic clean sweep and the spread of the vaccine underpin this year’s 5% global GDP growth. ”

Beyond the short term, there were a number of strategic reasons for staying positive, they said, including “ultraloose” policy and a further U.S. fiscal surge of nearly 2% of total domestic output. They have also seen a bond-to-equality reversal, as institutions begin to realize that bonds are increasingly less diversified, with no risk of return. Excess liquidity was also consistent with other feedback and employment reviews were supportive, analysts said.

Finally, there was the potential for “cash flow pressures,” with accelerated corporate purchases of stock and return to retail purchases, while pension funds would not – with low contribution weights in Europe and neutral pressures in the US. – the vendors.

The card

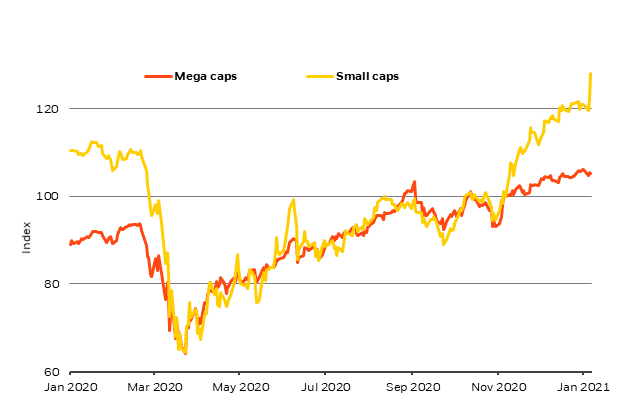

This chart from BlackRock shows the performance of U.S. megacap stocks and small-cap stocks over the past year. Megaacap stocks are represented by the S&P 100 Index, and small-cap stocks by the S&P 600. Performance is set back at 100 on November 6 – the last trading day before news organizations announced that Biden has won US presidential election and drug company Pfizer PFE,

and German partner BioNTech BNTX,

they announced initial efficacy data for their COVID-19 vaccine candidate.

Source: BlackRock Investment Institute, with data from Refinitiv

The markets

US stock futures YM00,

ES00,

NQ00,

marked lower ahead of Monday ‘s opening, after closing at new highs on Friday. European stocks also fell in early trading, as investors assessed compliance with COVID-19 issues and tight locks across the continent. TMUBMUSD10Y bond yield,

he raised concerns that the Federal Reserve will have less interest in maintaining the level of their purchases.

The buzzard

The price of bitcoin pulled back sharply on Sunday and again on Monday, after a bullish start to 2021. Bitcoin BTCUSD,

it eventually dropped 8% to $ 34,740, according to prices quoted by CoinDesk, from nearly $ 41,000 on Sunday.

TWTR on Twitter,

stocks fell nearly 7% in pre-sale trading after the social media company’s decision to permanently cancel Trump’s account.

Former California Republican governor Arnold Schwarzenegger compared last week’s events at the Capitol with Nazi Germany, blaming the violence at the president’s feet, in a tweet that went viral Sunday .

AS Marriott International,

A series of hotels said it would stop political donations for those who voted against the election certificate. The Blue Cross Blue Shield health insurance federation and commercial property company Bancshares also said they would suspend donations.

Signature Aviation SIG private-jet company,

rose 9% to 443 pence after accepting a $ 4.63 billion offer from Global Infrastructure Partners valuing the company at 405 pence per share. Private equity groups Rival Carlyle Investment Group and Blackstone have also expressed interest.

Randomly read

Robot used for locking couple marriage proposal.

‘Do not look disheveled.’ Anger over Seoul city council for pregnant women.

Need to Know starts early and updates it until the opening bell, however register here to deliver once to your inbox. The email draft will be sent out at around 7:30 am East.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including a special statement from Barron and MarketWatch writers.