Photographer: David Gray / Bloomberg

Photographer: David Gray / Bloomberg

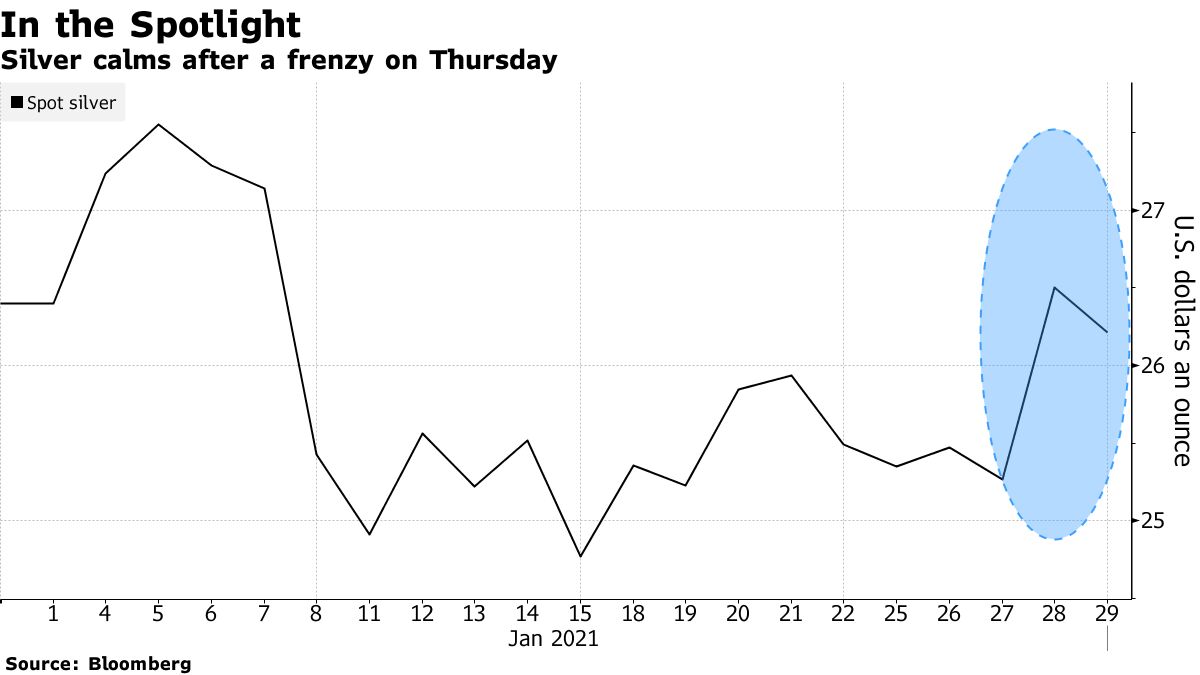

Money frenzy calmed down Friday as investors gauge whether pushing legs with Reddit posters to create a brief push.

The entire market – from mining shares to trading currencies and even the corporate metal – has emerged as one of the latest board targets r / wallstreetbets now famous for fueling a short press in Gamestop Corp. which raised its market value above. Posts encouraged people to join the IShares Money Trust, the largest money-trading fund, one of which described it as “THE JOURNEY TO EXCELLENCE IN THE WORLD” .

“It is true that the combined efforts of those on Reddit forums can have a significant impact on the price of individual stocks, but if you compare the size of the money market as a whole and the market cap Of the individual companies that forums have been targeting recently, we do not see this as the potential to move money significantly in a tight environment, ”said John Feeney, business development manager at Guardian Vaults, based in Sydney.

“Money market cap it’s too big and those on the forums usually want to see quick benefits, so I wouldn’t read into it too much, ”he said.

Spot money was 1% lower at $ 26.2317 an ounce before 9:50 am in Singapore on Friday, making a monthly loss.

There was little gold change, largely saved from Thursday’s trading frenzy, at $ 1,843.51 an ounce. Prices are heading for the biggest decline in January in a decade as the dollar strengthened after the Federal Reserve kept its currency policy unchanged without promising further help.

“Gold has been losing its mojo indefinitely as US stocks start to climb higher and ‘little sister’ money gets approval from traders’ armies Reddit, ”said Edward Moya, senior market analyst at Oanda Corp. “Gold has been in increasing demand as institutional investors focus more efforts on the recent volatility emanating from retail traders trading very scarce stocks and now money. Gold needs to recapture and hold back the $ 1,850 level or bearish momentum could fall sharply below $ 1,800. ”

In other markets, palladium and platinum were stable. Asian stocks followed their higher US peers. The Bloomberg Dollar Index rose 0.1% and is making its first monthly gain since September.

– Supported by Joe Deaux, and Yvonne Yue Li