Individual investors are back in love with the stock market, but a new passion for options is making some veterans weird.

“What we’ve seen focuses on short-term, out-of-the-box call options because those payouts are like the lottery,” said Garrett DeSimone, head of quantitative analysis at OptionMetrics, options database and provider analysis for institutional investors and academic researchers.

Those bets have been paying off in incredible fashion, in some cases. But it also evokes memories of the rise of dot-com in the 1990s, when a rise in day trading contributed to inflation a huge market bubble.

A call option is a financial instrument that entitles the custodian, but not the obligation, to purchase the underlying security at a fixed price, known as the strike price, before a specific date. By buying long “out of the money” calls, which have a strike price well above the normal stock level, investors are promising that a rise in the price of the stock will give them a healthy return.

That activity has escalated, in some cases, as options investors gather on Reddit’s Wall Street Bets forum and elsewhere to brag about winners, to coalition about losses and, to special, persuading each other to pile up into a special stock and keep the fort when suffering obstacles.

Stop playing

That’s the kind of collective action that has been called the main driver of a 300% rally with shares of a videogame vendor Corp GameStop

GME,

from the end of last month. The GameStop rally confirmed a surprise in which small investors have bought attacks from companies severely shortened by hedge funds and other large investors, forcing them to go out and accelerate price increases while they scratch out their price-sharing bets. fell.

GameStop finished at another high on Monday, with the S&P 500 SPX,

and Nasdaq Composite COMP,

the pair closed at records like the Dow Jones industrial average DJIA,

land lost for third straight session.

Read: Reddit moderator drags Wall Street ‘fat cats’ as GameStop wild ride continues

That’s a new wrinkle compared to the dot-com past or even the past.

The ability of individual investors to shorten shares significantly represents “a new side of the market that did not exist five years ago and must be respected,” said Mike Zigmont, head of trade and research at Harvest Volatility Management, in interview.

Dumb money?

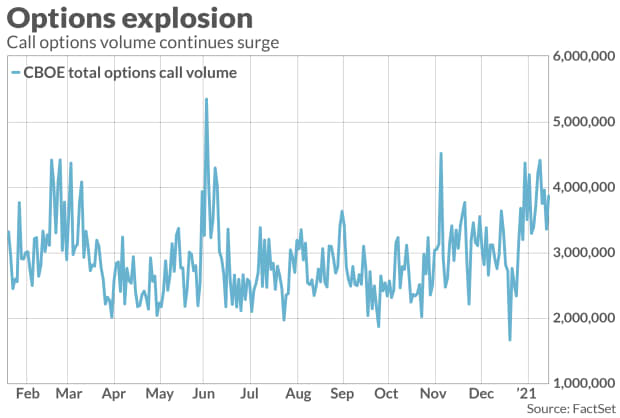

Call volumes have been going up since last year, and have surpassed volumes for push options, which entitles the custodian, but not the obligation, to sell the underlying security at a price established, since May, analysts noted at Deutsche Bank, in its Note Monday.

Average numbers of daily calls over the past three months have reached new heights, with the majority of the increase driven by “very small” contract volumes, said analysts, who show buy reic.

And don’t call it “dumb money.”

Deutsche Bank analysts said the volume of calls was “largely dependent on heightened equity multiples” as institutional investors of all struggles have been “running since March. ”

The sharp advantages of thin trading stocks are not just due to short coverage.

Feedback loops

Market makers who sell the call options to individual investors are left short on the market. To restore their positions to neutral, they buy the underlying stock. In general, if stocks continue to rise, market makers need to buy more to maintain their hedge.

An overall surge in online trading has been attributed to a number of factors, including affiliated investors looking for ways to spend their incentive surveys last spring.

Of course, not all retail options investors are looking to push a short cover rally.

“What is often missed in the statement is that retail investors need to manage capital very well,” said JJ Kinahan, chief market strategist at breakrageTD Ameritrade.

For many options trading clients, the instruments instead of tech stocks are expensive, he said. Buying a call will allow the trader to clearly define risk as they are only out for the price they will pay for the option if the stock does not accumulate.

Also, while the rise in call buying has attracted attention, the “main strategy” that most retail options traders focus on is covered calls, said Kinahan – strategy in which an investor sells call options, collecting revenue stream from the prices, while accumulating maintaining the underlying security in an equal amount.

Basic disconnection

While the Reddit phenomenon has raised legal questions about coordinated activity, the biggest concern among some veterans is the disconnect between price action and market fundamentals.

The increase in the number of calls comes with other signs of froth, including low levels of overall short interest and high margin rates, said Tom Martin, senior portfolio manager with Globalt Investments , in an interview.

And when prices move more with blind trade flows than new information, investors with a primary focus face greater challenges, Martin said.

Of course, while the ability of individual investors to effectively “hunt” short sellers is a deception that dot-com-era day traders have not enjoyed, it is another reason for investors. -investor to be concerned that the vast accumulation of equity market is going to be at risk. level, Zigmont said.

Instead, trading in specific stocks has become more about muscle, pitting individual investors against hedge funds and institutional players.

“It strikes me as dangerous, because at some point [individual investors] They are not going to win the battle, ”he said. It’s not hard to imagine a situation where individual investors don’t force a short seller to overtake, eventually running out of buyers and leading to an explosion that could adversely affect it.

“It is unbelievable to buy on its own, but it is also difficult to make a purchase at this time,” Saut Strategy technical analyst Andrew Adams wrote in a note last week.

“It hasn’t happened yet, but I’m really scared of what could happen if it ever starts to make a difference. Reductions and falling prices are not a good combination. ”