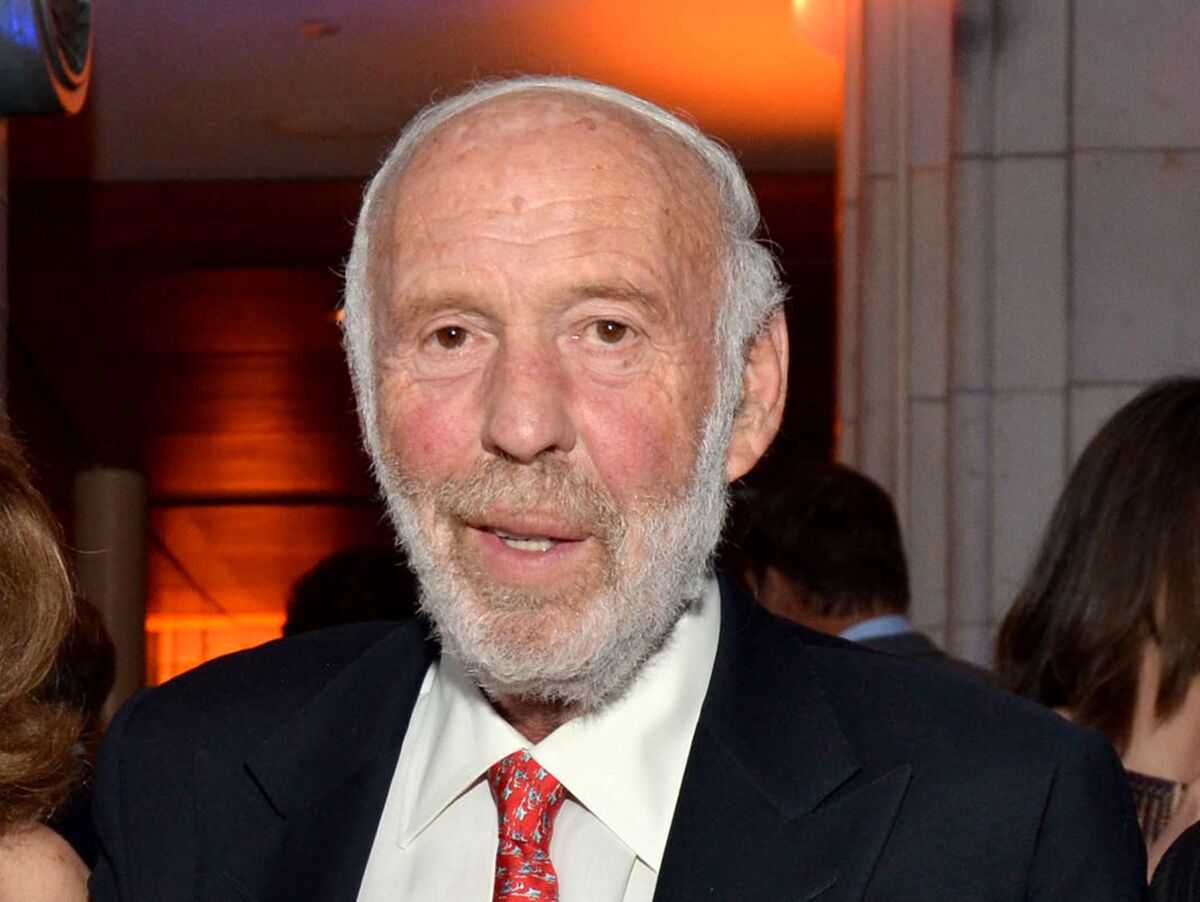

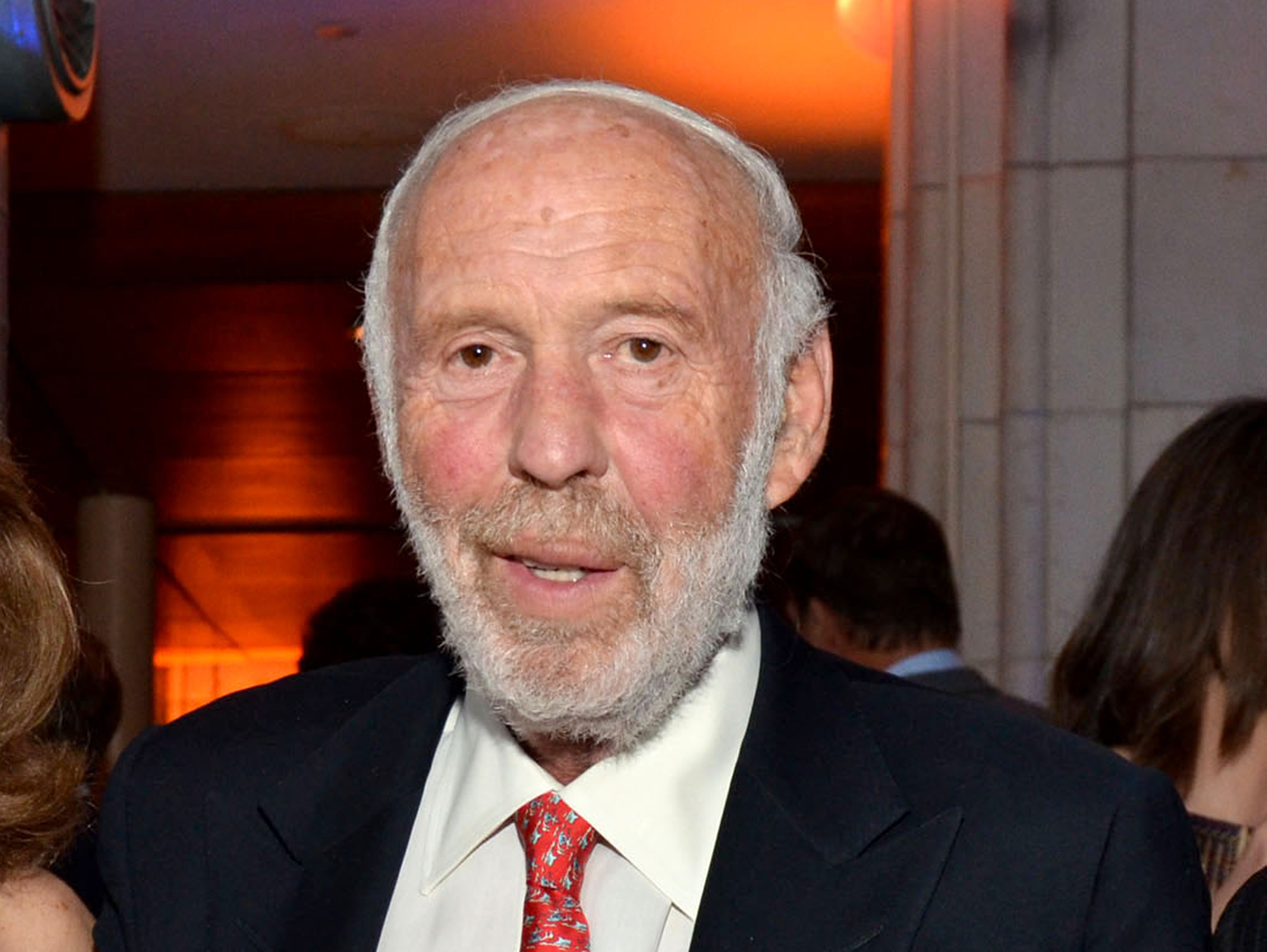

Jim Simons

Photographer: Amanda Gordon / Bloomberg

Photographer: Amanda Gordon / Bloomberg

Renaissance Technologies, the investment giant that delivered just the worst ever returns over its public assets, was hit by at least $ 5 billion in repurchases.

Clients withdrew $ 1.85 billion net over all three hedge funds in December and demanded $ 1.9 billion net return in January, according to investment letters seen by Bloomberg. Investors are set to shoot another $ 1.65 billion this month, the letters show.

These figures could be offset if there is any inflow in February or if investors decide to walk back any of their redemption requests.

Billionaire Jim Simons, an investment pioneer, is approaching a rough year. All three of their public hedge funds suffered a double-digit loss in 2020 as their algorithms were thrown out of whack by market movements the computers had never seen before. At the same time, its assets for staff and intellectuals has risen 76% last year, the Institute Investor said.

Read more: Beat human hedge money Quants per annum ruled by Pandemic

Renaissance Institute Equities fund, the largest outsourced vehicle, lost 19% in 2020, the letters show. That fund got the most out of the solutions. The Alpha Renaissance Institute fund fell 32% and the fund for Institute Global Multiple Opportunities fell 31%.

A spokesman from East Setauket, a New York-based company declined to comment.

Renaissance told reporters in a letter in September that its loss was a result under a hedge at the fall of March and then an excess hedge in the next round from April through June. This was because their trading models were “going too far” for the original problem.

Renaissance once again addressed its sad numbers in a letter in December.

“While recent performance has been staggering and worse than previous performance would have been similar for 2020,” said the company, whose model “expects, in records as far as ours, that some risk return ratios are just as bad as those. we now see that they are not terrible. ” The broad lesson is that “even good investments should be expected to perform tremendously from time to time. ”

Revitalization is the world’s largest quantitative hedge fund. It was founded in 1982 by Simons, who was a breaker for the National Security Agency. Last month, he announced his retirement as chairman of the company, which managed about $ 60 billion at the time. He will remain a member of the board.