Image of NBA Top Shot digital collection by Cathy Hackl.

Cathy Hackl

In the spring of 2019, a much-needed piece of land was put on the market.

Estate 331, nicknamed “The Secret of Satoshis Tea Garden,” is centered in a busy, expensive place called “Genesis Plaza.” But it’s also expansive – its owner had diligently bought 64 parcels of land that are, together, a perfect square.

There are plenty of other perks to a shoe. For example, while busy roads run along every edge of the square, taking in high traffic from nearby areas, roads do not pass through. And, by law, the more compact a single landlord has, the higher they are allowed to pick up, so 64 together gives access to some unprecedented potential.

Of course, there is one other important thing to say about Estate 331: it is not a property asset as you might think. You can’t drive there or walk there, there is no dirt or grass. It’s just computer code – a virtual realm in a digital world that you can only visit on a computer.

Sadly as that may be, Estate 331 is nonetheless a valuable asset. On March 24, 2019, it sold for just over $ 80,000.

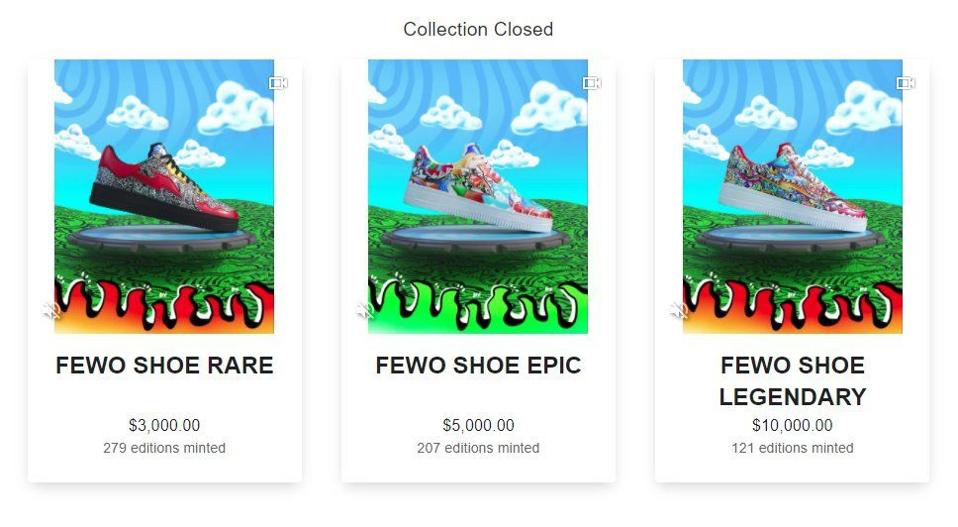

Fast forward to 2021 and a piece of land on Axie Infinity’s gaming platform and virtual properties has just sold for $ 1.5 Million, breaking pre-records. This trend is not expected to continue with significant land sales like The Sandbox’s recent Public Sale Wave 2, selling out in less than a minute. The fashion world is also noticing with the latest example of New snew Fewocius x RTFKT collaboration reduction that generated $ 3 million. All three sneaker editions sold out at $ 3,000, $ 5,000 and $ 10,000 rates.

All three editions of the Fewocious x Rtfkt sneaker sold out at $ 3,000, $ 5,000 and $ 10,000 rates.

Benoit Pagotto / RTFKT

Non-fungal symptoms 101

Buildings in Decentraland are just one example of a growing asset class, known as “non-fungible tokens,” or “NFTs” for short.

NFTs are blockchain-based assets, different from other blockchain-based assets – such as, say, cryptocurrencies – in that they cannot be replaced or exchanged for similar products. Where one Bitcoin can be exchanged for another Bitcoin, or an equivalent amount in Ether, or Bitcoin Cash, every piece of land in Decentraland is unique. Like real land, there are some clods in the middle of the globe, some closer to roads, some bigger and some smaller. Other examples of NFTs are artwork, in-game specials for video games, and web domains.

So that’s what NFT is all about, but non-fungibility alone hardly explains how a plot of virtual land in a virtual universe can run for tens of thousands of dollars. No, to understand that wonder we have to go even deeper. We need to understand what will value anything.

How NFTs get value

Some time ago immemorial items were traded between two parties depending on who needed what. If a goat herd had many goats but they did not have enough furniture, they might be trading goats for some furniture, or some furniture still to be built. The goat valued hunger, the furniture to the smallest furniture. Therefore, items had value accordingly shortage and feum, or solar is demand.

Over time, our perceptions of value have expanded. Mainstream economists generally adopt a “thematic theory of value” or STV, as opposed to a “labor theory of value” which, ironically, was supported by both Adam Smith and Karl. Marx, though they were in various forms.) According to STV, a service or service is not valuable in itself and, rather, depending on how important it is to a consumer. A sleek, elegant dining room table will cost more than a simple Ikea table, unless the consumer has a more expensive taste.

Supply and demand are as fundamental as food and water, and STV frees us from the notion that things have intrinsic value – that a dining table, or a plot of dirt, is simply the result of being the way it is, it is worth It ‘s all it should be. Together, these concepts can help us make sense of how NFTs, invisible and insensitive as they may be, can be worth a lot. money. A piece of land in a 3D animated world, or a work of digital art, or an object in the game, may be of no value to some people, but very appealing to some. And more importantly, NFTs are, by their nature, unique and unrepresentative (think: Estate 331). That shifts the long supply-demand curve toward one side.

All of this does not mean that NFTs have to cost tens of thousands of dollars, of course. But that kind of price tag isn’t more remote in place. In fact, compared to other specialized NFTs on the market, it is $ 80,000 pence. As of writing, a digital artwork titled “Everydays: the First 1,000 Days” is auctioned at Christie’s, the highest shy bid of $ 3,000,000.

Every day – The first 5000 days NFT by Beeple auctioned by Christie’s.

Beeple / Christie’s

NFT Confirmation

Now we understand how valuable NFTs can be, but some other issues remain unresolved. For example, a cunning viewer might notice that software tends to be very reproducible. You can’t recreate a plot of dirt, or Matisse, but you can copy a PDF, or free software, onto as many computers as you can. What, then, is the incompatibility of NFTn? What’s stopping anyone from just spouting Decentraland and recreating Estate 331 – little by little – for a second sale? Or, for that matter, what is stopping Decentraland developers from doing the same?

These are important questions for anyone looking to invest in NFTs. If you’re going to drop $ 80,000 or $ 3,000,000 on such, you need a good way to make sure someone can’t come in and steal it, or destroy it.

This is where the blockchain comes in.

Blockchain are lists. Each blockchain records a series of events, or transactions: Alice sent two Bitcoins, Bob sent one Bitcoin, et cetera to Charlie. Since transactions are causally interconnected cryptographically (in a kind of “chain,” hence the name) it is almost impossible, after a number of new transactions have occurred, to replace an old one. For example, Alice cannot cancel her payment to Bob if 300 Daniels, Ericas and Freds have all paid each other in that time. As a breath, you can draw a house of cards: each card stands upright by bending over the others, so you can’t pull one out of the bottom without making a mess.

NFTs are listed on the chain just like cryptocurrencies, so once ownership is transferred it cannot be reversed. As “tokens,” they have a unique ID that differentiates them from other NFTs. And because blockchain is usually open – that is, anyone can see the history of transactions for themselves – it’s easy to see shady contracts and forgeries. In these ways, NFTs are to be regarded as works of historical art: they travel securely between parties, have unique features that distinguish them from copies, and anyone viewing the make those decisions for themselves.

How big will NFTs come from?

Now that we understand how NFTs get value, and how they ensure security, the idea of a $ 80,000 plot of land is worthwhile, or a $ 3,000,000 real work of art, at least possible. What, then, is the future for this strange and fascinating asset class?

While nothing is certain, evidence suggests that NFTs are only becoming more widespread. They’re still pretty new, after all, and weren’t appreciated as much as they were from the beginning.

The big debutante ball moment for NFTs happened just three and a half years ago. Cryptokitties, based in the Ethereum blockchain, was a sort of mix between trading cards and Tamagotchi: Ether investors could pay for digital kittens, each with their own unique combination of attributes (or “cattributes”) such as fur and eye color. The kitties did not do much, but they could grow and produce children who, like their parents, were also the same type.

The thing is: Dapper Labs – the developers of the app – or the Ethereum community didn’t expect how quickly interest in this simple game would accelerate. Within weeks of its release, Cryptokitties experienced so much activity that it almost brought down the entire Ethereum blockchain. The most expensive kitties sell for up to $ 100,000. In one case, a spunky gray kitten sold for nearly $ 150,000.

Cryptokitty = NFT

Cryptokitties

When Cryptokitties hit Ethereum like a tsunami, the blockchain community learned the power of NFTs. But, even three years on, that fact still seems to be erasing the rest of us. Hip investors like Chamath Palihapitiya, Mark Cuban, and Elon Musk have taken over, but most people still disregard NFTs, or just don’t know about them.

This new and digital asset class is driving value and expanding the virtual commodity ecosystem, which is expected to reach $ 400 billion. by 2025. As developed reality, virtual reality, spatial computing and the direct – to – avatar economy hit, NFTs may be one of the ways in which we trade in the metatore. How many $ 80,000 actions, how many $ 3,000,000 auctions do we have to have before we all notice?

Tweet by Gary Vaynerchuck. Used by permission.

Gary Varynerchuck

Gary Vaynerchuck said it would be better, “NFTs will be a gateway to what you value.” Which raises the question, what would you pay this tweet did you sell it through NFT?

This is the first article in the What Brands Need To Know About NFTs series written by Cathy Hackl on Forbes.