Photographer: Samuel Corum / Bloomberg

Photographer: Samuel Corum / Bloomberg

Jerome Powell has a target that is greater than inflation worries near the bond market term.

Perhaps in his most advanced press conference since he took over the management of the central bank three years ago, the chairman of the Federal Reserve issued three urgent messages for investors who have been issuing bond yields higher on bet inflation that would eventually force his Fed to tighten monetary policy faster than it has ever shown.

Read More: Powell maintains dhovish line as signaling rates with rates through 2023

Powell’s messages? It does not rely heavily on rising output, control of monetary policy communications stays with it and is willing to run the economy hot to help it overcome Covid-19.

Market rebuff

When asked directly at his press conference on Wednesday whether he was concerned about the increase in Treasury yield, Powell commented on financial conditions and said they were “very pleased.” ”

It was a clear signal that he was not going to be bothered by the emotional movements about the risk of inflation worrying investors. Powell has a specific strategy to revive the economy and does not think this will be easy after decades of low inflation.

Therefore, he wants to see data and does not believe that the inertia of inflation – where today ‘s price changes look very similar to yesterday – is about to change.

“The fundamental change in our framework is that we are not going to implement prediction-based pre-emption for the most part and we are waiting to see data,” Powell said. “I think it will take time for people to accept that and embrace that new practice, and the only way we can build faith in that is by doing it.”

Tantrums will get the attention, though.

“I would be concerned with chaotic market conditions or continuing financial pressures that are threatening the achievement of our objectives,” he said.

Seizing the signal

Powell again played Fed’s quarterly summary of Economic Forecasts.

“The SEP is not a committee preview. It’s not something we sit around and debate and debate and approve, ”he said, noting that the dot plot of interest rate projections that each The Fed’s 18 policy makers “intend to be a pledge or even a prediction of when the committee will operate.”

The projections reflect a policy response, should other views from individual officials come out as expected.

But a three-year rate hike is expected, as seven Fed officials put it, “very uncertain,” Powell said dryly. fa-near, adding that little was known about predicting the recovery of the economy from a pandemic.

All of these comments deliberately lowered the policy signal of the dots. They also raised a question: If guidance about the final tension time does not reside in the dot plot, where is it?

Powell made it clear that he lives with him.

In a tense dance, the first step will be to reduce the $ 120 billion monthly asset purchase that the Federal Open Market Committee has entered into “further progress” in employment and inflation.

Powell said that that will be a judgment, or in other words, a committee consensus that Powell himself is responsible for creating. “Until we give you a signal, you can accept that we are not there yet,” he said.

The second term?

Undertaking the message gives Powell an essential quality, like Alan Greenspan, at a time when Fed communication is crucial for financial markets, and as a debate builds on whether he gets a second term when his current term as chairman expires in February.

President Joe Biden has not yet said whether he is open to holding on or picking up someone else.

“Powell wants to be reinstated and the Democrats have kept the door open,” said Derek Tang, an economist at LH Meyer / Monetary Policy Analytics in Washington. “If the Democrats tried to get a favorable policy out of Powell, they have kept playing but have done nothing to convince him. It is a very possible work compromise. ”

Bringing the heat

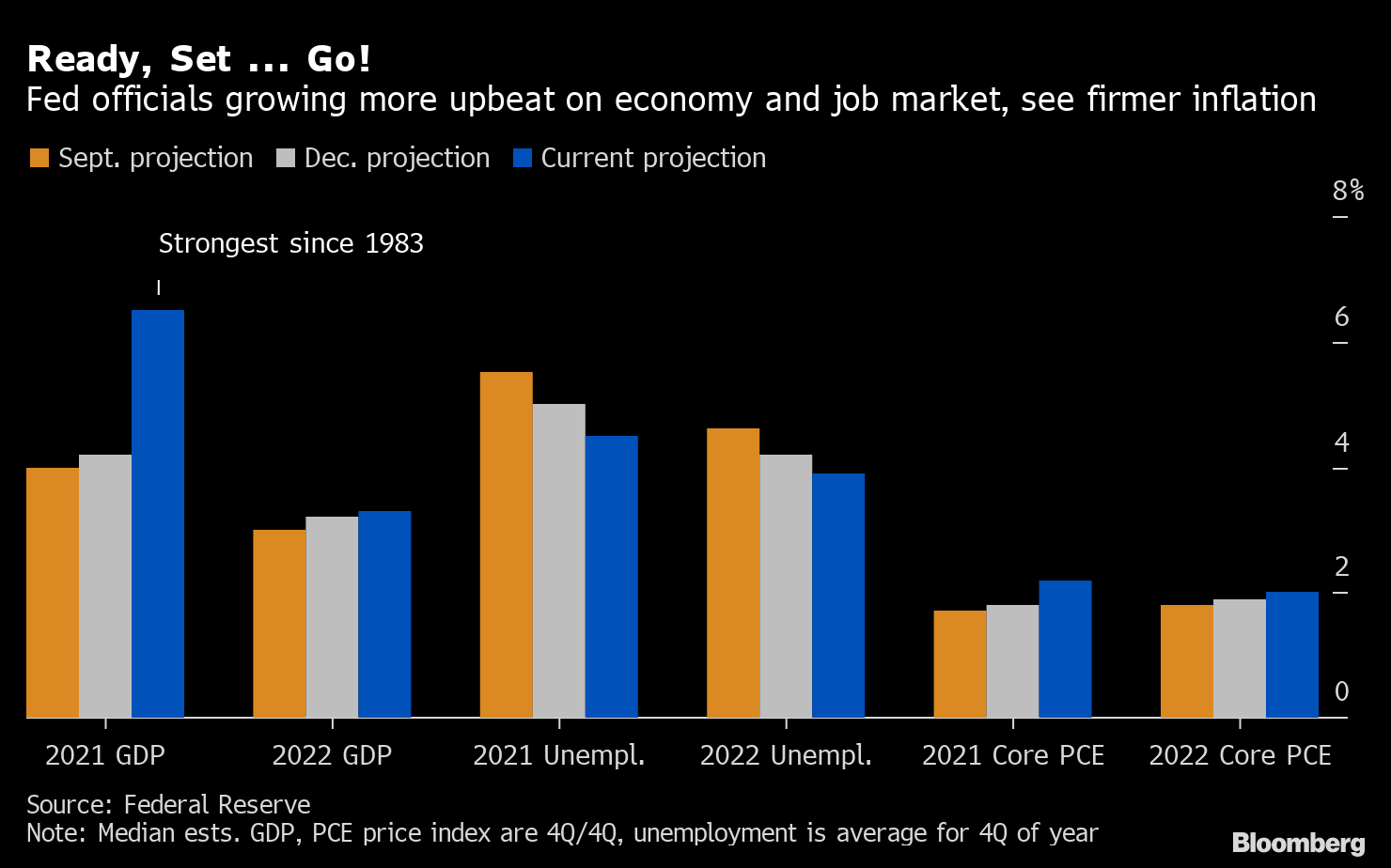

A third message came in the forecasts and how they will deal with unemployment. Taken together, the median combined forecasts showed inflation pushing just over 2% this year but falling closer to the target in 2022 and 2023.

Economic growth is set to continue in 2021 thanks in part to fiscal policy, exceeding 6.5% and remaining above the committee’s equilibrium growth rate of 1.8% for the next two years. Unemployment will fall to 3.5% by the end of 2023, matching the low pre-pandemic rate.

For all that heat, most officials still see little need to raise interest rates.

The story here is that their “broad and inclusive goal” of maximum earnings is not represented by the unemployment rate. Even at 3.5%, they predict there will be a slap in the face to take advantage, perhaps especially in the toughest segments of the labor market such as women of working age and ethnic minorities.

Done, Set … Go!

Feeders are becoming more vulnerable to the economy and labor market, see stronger inflation

Source: Federal Reserve

Powell has been focusing on the devastating impact of a pandemic, and wants the 9.5 million Americans who lost their jobs at the time of Covid-19 to get back to work so quickly. as possible.

Even though the unemployment rate fell last month to 6.2%, it rose to a staggering 9.9% for Black Americans despite the economy recovering strongly.

Powell argues that, with inflation expectations anchored at 2%, the Fed can run the economy hot to overcome better inclusion without suffering a steady rise in prices.

“Unemployment will take a long time to go down,” Powell said, and here it is safe to say that he is thinking about the broader measures of unemployment. “The sooner the better. We would like to see it come sooner rather than later. We would not welcome anything more than that. But in reality, with the numbers, it’s going to take time. ”