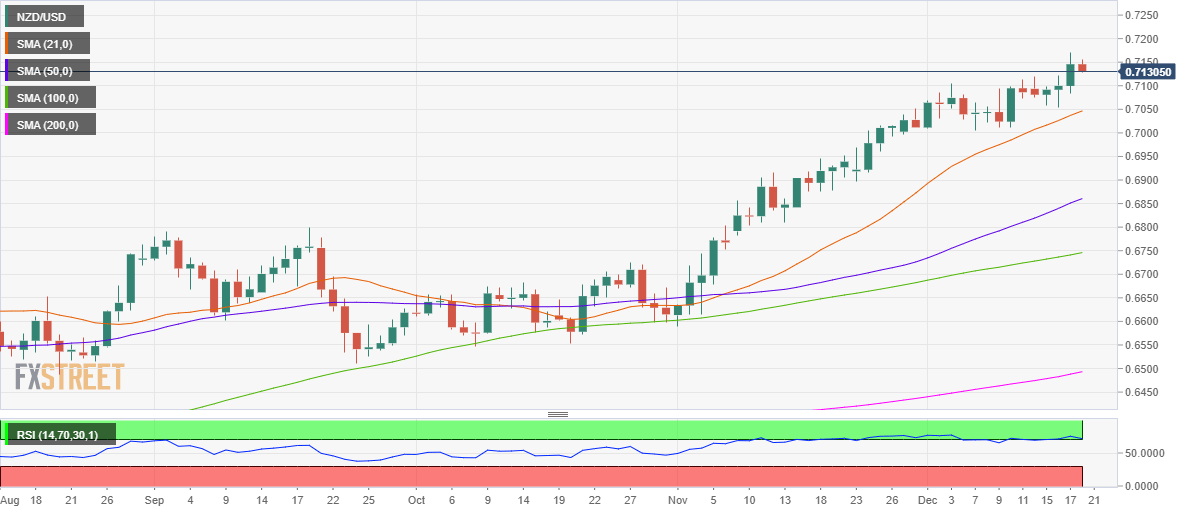

- NZD / USD right from a multi-year high of 0.7172.

- An overbought RSI position on 1D could pull fuel back.

- Focus on U.S. stimulus news and U.S. dollar flows.

NZD / USD will extend its correctional decline from a two-and-a-half-year high of 0.7172, now holding the ground below 0.7150, as the U.S. dollar steps into an impressive kick amid tepid market sentiment.

Markets remain optimistic about a similar U.S. stimulus deal, as they look to take profits off the table, as the last full week of this year draws to a close.

From a near-term technical point of view, the 14-day Relative Strength Index (RSI) is moving within the occupied area suggesting that the price may pull back longer before the start it is elevated.

The immediate support for the bulls is seen at a round figure of 0.7100. The bullish move will hold as long as the price defends the upward 21-day moving average (DMA) at 0.7045.

Above, the bulls need to take the 2020 peaks of 0.7172 to challenge the 0.7200 barrier.

NZD / USD: Daily chart