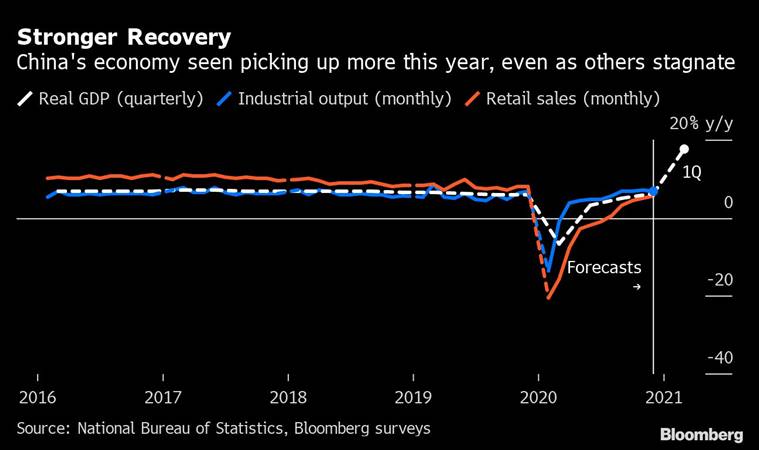

China’s economic uptick is accelerating barely a year after its first coronavirus locks, as its success in controlling Covid-19 allows it to boost its share of global trade and investment.

The world’s second-largest economy is set on Monday to account for a 2.1% increase in gross domestic product in 2020, the only major economy to avoid a downturn, according to a Bloomberg study of economists.

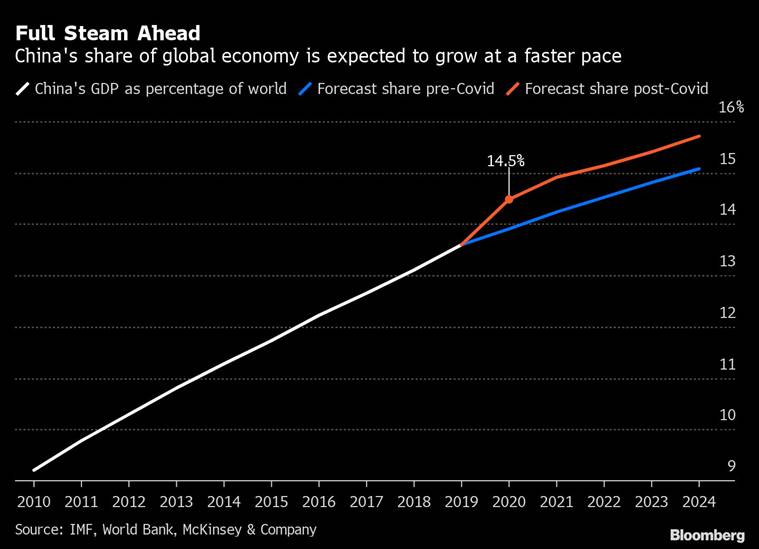

That should ensure that its share of the global economy rose at the fastest pace in this century. Global output fell 4.2% last year, according to the World Bank, pushing China ‘s share off to 14.5% at 2010 dollar prices – two years earlier than expected.

Source: Bloomberg

Source: Bloomberg

And it’s not just a blip that will turn around when other major economies start to recover when vaccines are released. Economists expect China’s GDP to expand 8.2% this year, leading to a surge in global peers including the US.

China is now on track to overtake the U.S. as the largest economy in 2028, said Homi Kharas, deputy director for the global economy and development program at the Brookings Institution, two years faster than it was. respect before.

After opposing President Donald Trump’s trade war, China is deepening economic ties within Asia and Europe and looking at domestic spending to power the next growth phase . President Xi Jinping said this week that “time and situation” on the country’s side in a new year was marked by domestic unrest in the United States.

If its local control of virus control is maintained, the pandemic could help China “strengthen its position in the global economy,” said Ka Zeng, director of Asian studies at the University of Arkansas. U.S. and European companies are likely to focus more on China because of “the country’s potential to be the only major source of growth in the post-pandemic world. ”

The highest jump in China’s global GDP segment was just one of many milestones for its economy last year:

- The US economy was recovering at the fastest pace on record. China’s GDP was at 71.4% of US levels in 2020, according to the International Monetary Fund, up 4.2% from the previous year

- The global trade sector increased exports of pandemic-related exports. Already as the world’s leading exporter, Chinese shipments increased 3.6% in 2020, according to official data. Total global trade accounted for a 5.6% contract, according to estimates from the United Nations trade and development agency UNCTAD

- China apparently regained the title as the world’s leading destination for foreign investment, which it lost to the US in 2015. Foreign investment into China reached more than $ 129.5 billion through November 2020, slightly higher than the previous year. Globally, FDI flows appear to have fallen by 30-40% year-on-year in 2020, according to UNCTAD

- The Global Fortune 500 list of the world’s largest companies by revenue for the first time included more companies based in China, including Hong Kong, than in the US: 124 vs 121

- Full-year box office receipts surpassed the U.S. for the first time

- Sovereign debt was added to the FTSE Russell benchmark index, completing the country’s inclusion in the top three global indices. Foreign investors bought 1.1 trillion yuan ($ 170 billion) of Chinese bonds in 2020

China’s developed role in the post-pandemic world is fueling a crisis of debate among the rest of the world over its engagement with Beijing. While the Trump administration has raised taxes and restricted access to key technologies, other countries have sought closer trade and investment ties.

Fifteen Asian countries including China signed the Regional Comprehensive Economic Partnership agreement in November, voting to reduce trade barriers in the region. In December, the European Union agreed a broad investment deal with China.

“Countries need to deal with a bipolar world rather than a unipolar world,” said Bo Zhuang, China’s chief economist at TS Lombard.

What Bloomberg Economics Says…

“Not only is China’s growth, but also its pattern of growth is important for the global economy. China is still trying to move towards greater confidence in spending for growth. For the rest of the world, China will continue to grow as a consumer in addition to its long-standing producer role. ”

– Chang Shu, Asia’s chief economist

Chinese leaders typically cut economic milestones, such as the economic output surpassing Japan in 2010, for fear of snatching those who are already monitoring its ascent. But Beijing announced this year that it would aim to double GDP from 2020 levels by 2035, a goal that means a march to number one.

However, there is no guarantee that this will happen. China proved pessimists wrong in 2020, but they face major challenges from reducing relations with the U.S. which could limit its access to technology, over-reliance on debt-funded investment, and a population that is grow rapidly.

China’s place as a factory for the world was developed last year as it pumped out face masks, medical equipment and work-from-home gear. While political leaders such as France’s Emmanuel Macron have pledged to do more at home in the wake of the pandemic – reflecting the US astronomy of “separating” from China – there will be no movement. to gradually diversify production due to the high costs involved.

Source: Bloomberg

Source: Bloomberg

Multinational companies have another reason to stick to or even increase their investments in China: A fast-growing consumer market, already dominating the U.S. and western Europe in some regions.

China now makes up a quarter of the world’s middle class, defined as the population spending $ 11 to $ 110 per person per day in 2011 buying power equity terms, stone- mile “would not have been reached for two more years if Covid-19 had not happened it would not have happened,” said Kharas of the Brookings Institution.

Both General Motors Co and Volkswagen AG continued to sell more cars in China than in their domestic markets last year. The Starbucks Corp. expects to open about 600 new stores this year, while Nike Inc. account sales in China of $ 2 billion for the first time in the quarter ended November.

“We have seen wave after wave of pandemics hitting different markets,” Nike Chief Financial Officer Matthew Friend said in an investor call in December. “And in fact, China is the only market where we have seen some sort of path to virus control.”