Powell’s push did not strike his price.

The idea that the Federal Reserve will take action if the stock market suffers too much pain has been put first put on a Greenspan push, after former chairman Alan Greenspan, and renamed by all directors continuation of the US central bank.

But what level of pain is always a question, and so far, Federal Reserve Chairman Jerome Powell is not shaking. That is the clear conclusion that can be reached from Thursday ‘s interview with Powell, in which Nick Timiraos was again asked by The Wall Street Journal about the rise in bond yields and made no suggestion that the central bank should action against him. “You know, it was a famous thing and it caught my attention,” Powell said, using a language similar to the language used by Gov. Lael Brainard Tuesday. “But again, we are looking at a wide range of financial situations, and that is the key. There are many things. ”

Powell is still dovish with any conventional metric. The Fed will not reduce the rate of bond purchases any time soon, he said. “I think there is a judgment feature in the guidelines for buying thinner assets. But I have also said that, long before any decision to consider the purchase of an asset, we will be communicating our sense of progress towards further progress towards our assets. goals. So we’re not looking to surprise people with that, ”he said. Regarding walking rates, Powell said it would take “some time” to get there and emphasized what has been in job creation data rather than robust consumption data.

ING strategists say upside risks in U.S. output will dominate the next Fed meeting, which ends March 17, “leaving both risk funds and a vulnerable short dollar situation. ” Next week’s 10- and 30-year Treasury ropes are “just the tenancies in which risks of overheating U.S. prices can be pricey.”

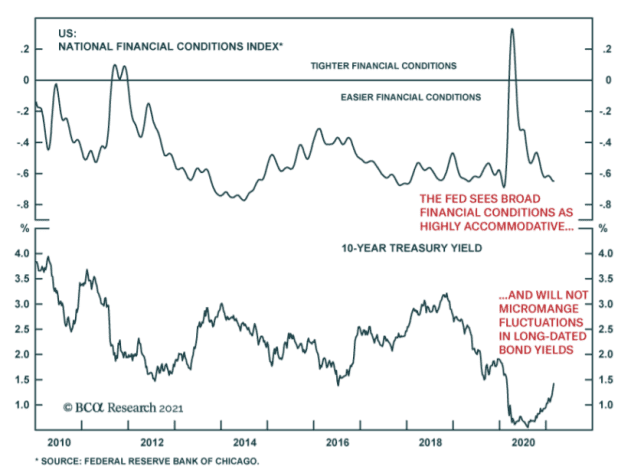

Strategists at BCA Research led by Mathieu Savary say the takeaway is that the Fed has not tried micromanage changes in bond yields that have been around for a long time. For now, expect more of the same – COMP technology stock,

struggles while value segments, such as BKX finance,

coming forward. “Within the equivalence area, short-term stocks are likely to perform better, resulting in a fatal position in value against appropriate growth, and in cyclical sectors over defensive ones,” they said.

In a note written ahead of Powell’s speech, Goldman Sachs strategists reduced their 10-year Treasury yield forecast at the end of the year to 1.90%, citing “the major fiscal stimulus and accelerated vaccination schedule accelerates turbocharge growth and inflation in the coming months. “

The buzzard

The nonfarm pay report due at 8:30 am East will give another indication of just the rate of progress the economy is making towards the Fed’s goals. Economists estimate that 210,000 new non-farm jobs were added in February, with the unemployment rate remaining at 6.3%.

Costco Wholesale COST, discount

reported worse-than-expected earnings after walking wage. BIG Big Lots Dealer,

they reported stronger-than-expected earnings on-line revenue growth.

GPS Gap Clothing Dealer,

predicts sales growth in the mid to high teens this year, which was slightly ahead of analyst estimates.

The markets

US stock futures ES00,

NQ00,

waves ahead of the jobs report.

Yield on 10-year TMUBMUSD10Y Finance Department,

which closed Thursday at a new 52-week high, at 1.54%. The DXY dollar,

it rose to a three-month high.

The records

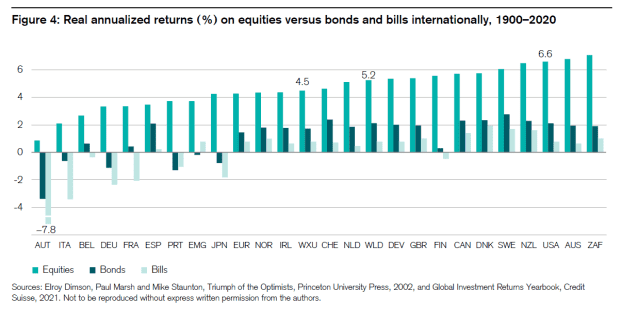

In the long run, stocks outperform bonds, which outperform bills. That is the conclusion from looking at inflation-adjusted outcomes in 21 countries and five regions. “This overall pattern, of equities that outperform bonds and bonds striking bills, is what we would expect over the long term, as bonds are more risky than bonds, while bonds more risky than money, ”financial historians Elroy Dimson, Paul Marsh and Mike Staunton said in a credit investment yield year book Credit Suisse. That is the good news.

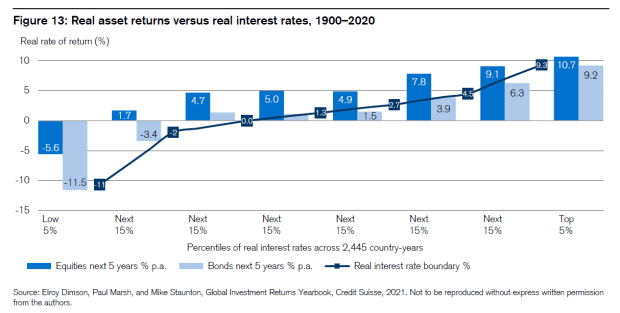

The bad news is, they have designed results against flat rates over 2,445 years, and the current low levels mean that good results are unlikely in the future. “There is a clear relationship between the current real interest rate and the actual outcomes for both equities and bonds,” they said.

Randomly read

A bill making its way through the Kentucky General Assembly would remove the power of the governor to appoint a deputy who will not serve a full term – leading to speculation that the Minority Leader of the -Senie Mitch McConnell left early.

Start building small injectable robots to attack tumors.

Need to Know starts early and will be updated until the opening bell, but sign up here to have it delivered once to your email inbox. The email draft will be sent out at around 7:30 am East.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning preparatory meeting for investors, including a special report from Barron and MarketWatch writers.