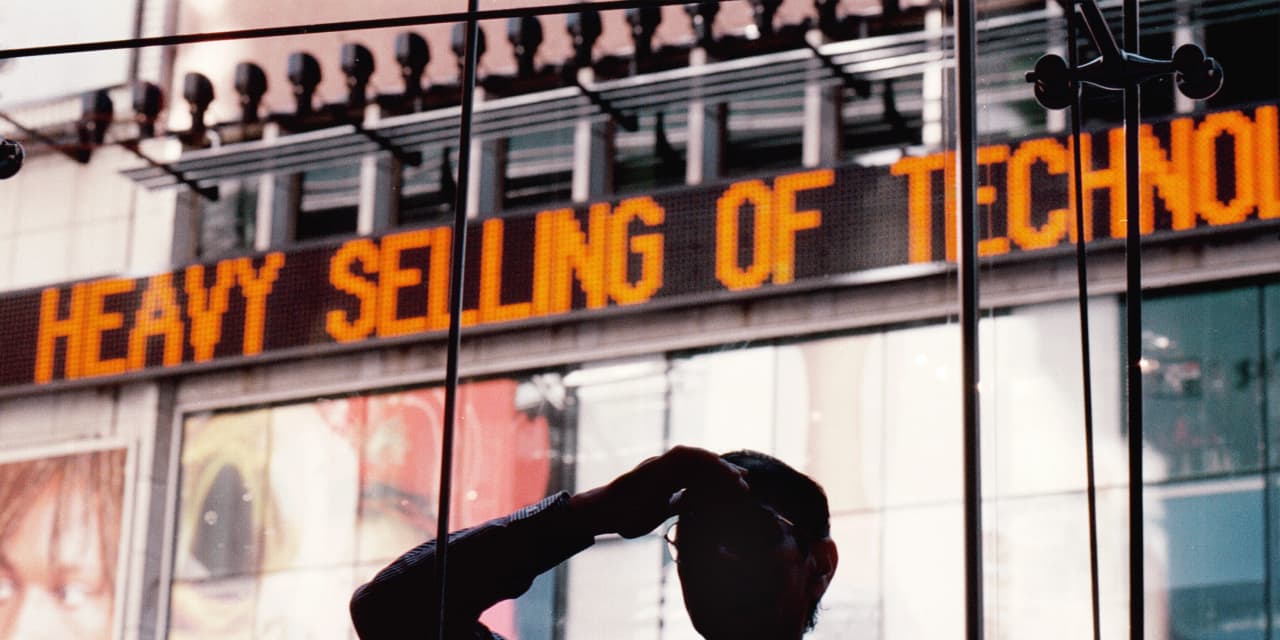

The Nasdaq Index on Thursday was down nearly 10% from its recent high, a trend commonly described as a market correction, reflecting a reversal from full-time highs for tech stocks as yields bands rising.

The Nasdaq Composite COMP, full of technology,

down 8.5% Thursday morning after seeing a Feb. 12 peak at 14,095.47.

The last time the Nasdaq Composite fell into a correction, described as a recent fall from a peak of at least 10% but no more than 20%, was in early September last year.

On Wednesday the index saw the sharpest two-day slide since Sept. 8.

The downturn in the Nasdaq reflects an increase in government debt yields a criterion that may have looked the tech-heavy as attractive compared to fixed-income investments and other segments of the stock market that as well as the economy has begun to recover from the COVID pandemic. Tech stocks are particularly sensitive to rising bond yields as their value is largely dependent on future earnings growth which is deepened when bond yields go up.

Investors pledge further fiscal stimulus from Congress will boost economic recovery in the U.S. but also push up inflation and force the Federal Reserve to raise interest rates faster than they would like. – a complete environment that is not attractive to technical stocks.