Photographer: Soichiro Koriyama / Bloomberg

Photographer: Soichiro Koriyama / Bloomberg

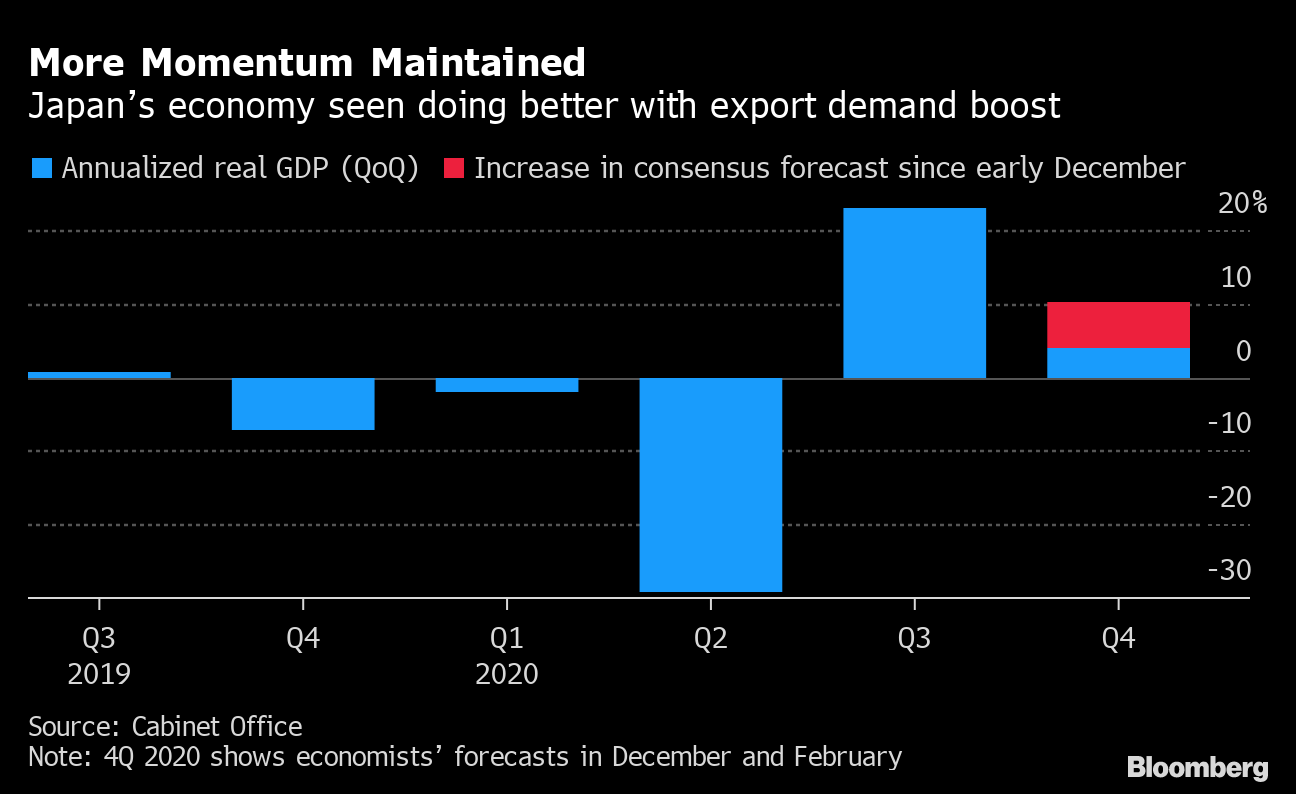

Japan ‘s economy could emerge from a devastating state of crisis this quarter on a less precarious basis growth at the end of last year was as strong as economists estimate.

The latest consensus is for an annual expansion of 10.1% in the last three months of 2020, more than double the export volume forecast in early December, driven by exports and a smaller-than-expected blow to consumer spending. Total domestic product figures are expected Monday.

While the world’s third-largest economy is undergoing further pressure this quarter under renewed emergency guidelines, a stronger presentation at the end of 2020 would suggest that, when growth eventually returns, the recovery could be stronger than originally expected.

More Momentum maintained

Japan’s economy is seen to be doing better with rising export demand

Source: Cabinet Office

There are already signs of sustainability. Government spending, Bank of Japan loan support and corporate culture and workers who have traditionally put work security ahead of high wages have helped keep unemployment at just 2.9%. Bankruptcy has fallen at least 20% from a year earlier in recent months.

That suggests that Japan is avoiding some of the depth scarring affects other countries where businesses have failed and jobs have been lost leaving economies less prepared to kick back.

What Bloomberg Economics says:

“Japan’s GDP growth appears to have slowed in the fourth quarter after a sharp reversal in the third caused by the building of virus protection measures. Nevertheless, the expansion appears to have remained in the double digit figures and appears to have been broad, with the main components excluding investments contributing to growth. ”

–Yuki Masujima, senior economist. For a full preview, click here

Elsewhere, the World Trade Organization is ready to finally get it new leader and central banks in Turkey, Indonesia and across Africa are setting rates.

Click here for what happened last week and below is our coverage of the future of the global economy.

The US and Canada

Investors in the U.S. keep track of the latest data on retail sales, business productivity and jobless claims on a weekly basis. Signs of positive upward movement in the economy have boosted traders ’expectations for inflation and sparked a debate about how much more support is needed. The minutes of the last Federal Reserve interest rate setting committee are also minuted payable Wednesday.

In Congress, Covid-19 $ 1.9 trillion to President Joe Biden a relief package will move to the next stage this week, with the Household Budget Committee dragging all the parts into one bill. A vote in the chamber is expected next week.

In Canada, markets will target inflation data on Wednesday.

Europe, Middle East, Africa

The impact of slow vaccinations on the eurozone this year will be one element that an investor could focus on when examining the European Central Bank account of their last policy meeting, which is to be released Thursday. Following the decision on January 21, President Christine Lagarde had to admit that the economy is threatening a double-dip recession.

In the UK, key data is due for inflation, which is likely to show the rate of annual price increases slowing to 0.5% in anticipation of what is likely to be a significant acceleration such as which the year goes on. Bank of England forecasts indicate that mark will rise above 2% next year.

Central bank rate decisions this week

In Africa, four interest rate decisions will keep investors busy. With Uganda’s inflation declining and the economy expected to bounce back in 2021, the central bank is likely to keep its benchmark for Monday’s fourth straight meeting. Two days later, Namibia’s central bank may remain unchanged.

Also on Wednesday, there is an outside chance that Zambia ‘s central bank could walk in a bid to stimulate the kwacha and tackle inflation at a rate above 20%. At the same time Rwandan policymakers may see room for a further slowdown on Friday with inflation slowing.

In Turkey, Central Bank Governor Naci Agbal is seen holding for a second meeting, after cumulative walkers raised the benchmark rate by 675 basis points to 17% last year.

Asia

Consumption numbers from China will be closely monitored during the Lunar New Year holidays, with most expecting a significant reduction from normal levels as travel is not discouraged as factory leaders keep freight at work.

Indonesia’s central bank meets Thursday and could cut interest rates to improve according to early respondents in Bloomberg studies.

Latin America

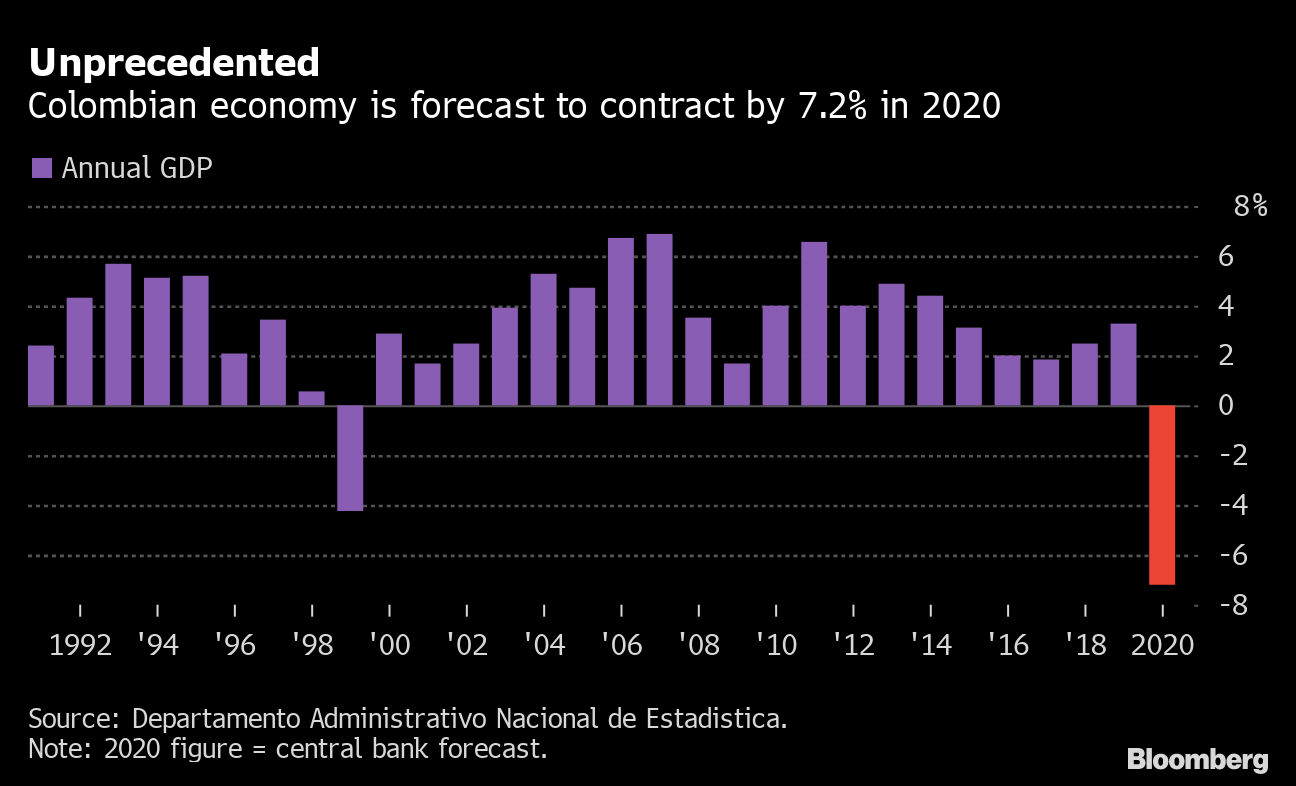

With Brazil and Argentina out in the middle of the week due to the Carnival holiday, the focus will be on two Andean countries. Colombia on Monday will be the second largest Latin American economy to report fourth-quarter yields after Mexico’s full-year reading of -8.3%. The central bank is looking for a 7.2% decline in 2020 – putting its decline around halfway between the -11.5% fall forecast in Peru and -4.5% seen in Brazil.

Unmatched

The Colombian economy is expected to hold 7.2% in 2020

Source: Departamento Administrativo Nacional de Estadistica.

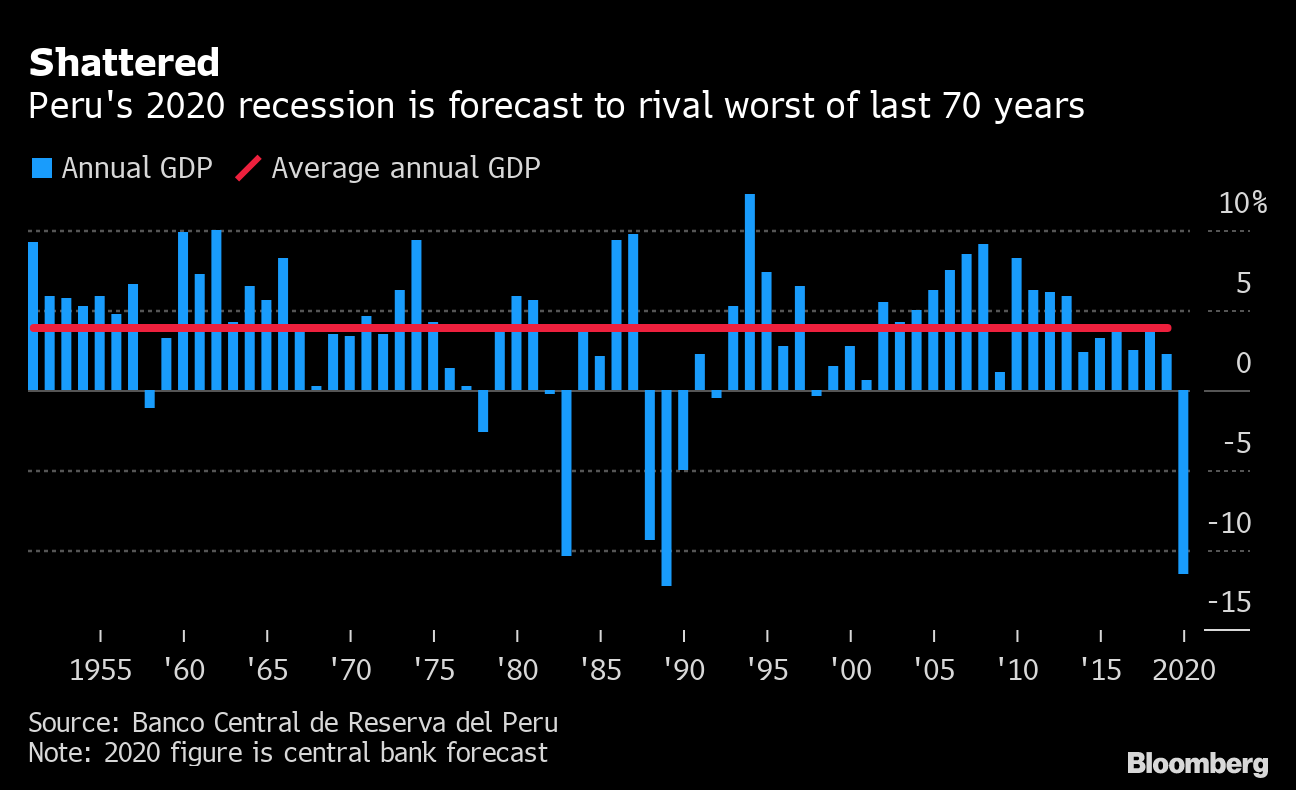

Also closing out 2020 this week is Peru, with reports on output and jobs. The economy is gradually recovering from one of the deepest levels in the world with little movement heading into the end of the year. Look for GDP data in the fourth quarter on Thursday to remain negative, although December economic activity may have slipped to zero.

Breaking

Peru’s 2020 recession in 2020 is expected to be more competitive

Source: Banco Central de Reserva del Peru

A large part of the South American country, including the capital Lima, went into partial lockdown in late January amid the resurgence of the virus, seemingly pushing up unemployment from the 13.8% posted in December.

– Supported by Malcolm Scott, Robert Jameson, Benjamin Harvey, Laura Davison, Peggy Collins, Theophilos Argitis, and Chris Anstey