The concern in the last two days following the Bank of Israel’s decision to allow us to expand the share of the prime track in our mortgages from one third to two thirds – excessive and even dangerous. With all due respect to the risk in taking a loan linked toPrime interest, Which is determined by the Bank of Israel’s variable interest rate and is currently at a historic low (1.6%), the expected decline in the index-linked mortgage share is welcome and several times more important.

Read more in Calcalist:

Despite the well-known Israeli affection for dividing the mortgage mix into three tracks – prime, index-linked and fixed non-indexed interest rates – it is important to realize that a mortgage in the CPI-linked track is several times more risky. “Risk diversification” using a triple mix is nothing more than a slogan, similar to someone convincing you to buy an office and a store and not just an apartment, “so as not to put all your eggs in one basket.” In practice, the Bank of Israel’s recent decision to increase the prime component (in practice, competition between banks has so far led to mortgage interest rates that were 0.5% – 0.9% lower than the same prime, which stands at 1.5% above the Bank of Israel interest rate) reduces the average risk of The borrower – and does not raise it. The risk that will increase slightly is that of the lenders, the banks (which may also increase the prime route as a result), but not of the loan takers – the public who will buy an apartment tomorrow or rush to refinance the old mortgage.

The low interest rate is tempting but dangerous

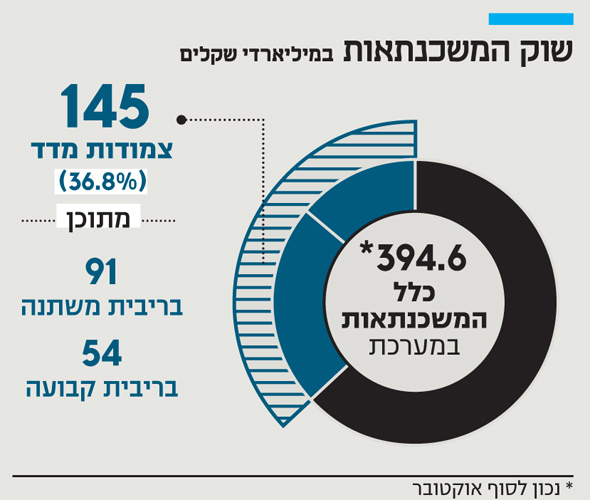

According to data from the Bank of Israel, as of October, the volume of index-linked loans held by Israelis was NIS 145 billion, of which NIS 54 billion was at fixed index-linked interest rates. And another NIS 91 billion at variable interest rates (usually once every 5 years). This is a share of 36.8% of the total mortgages held by Israelis, which stand at NIS 394.6 billion (as of the end of October), while the volume of prime-rate mortgages is around NIS 140 billion.

The temptation to take an index-linked mortgage lies, of course, in the low interest rate offered to us by the bank, compared to the fixed and unlinked mortgage. As of October, the average linked interest rate offered by the banks for a period of five years or more was 2.65%, compared with 4% -3.5% in the fixed and unlinked track. But of course there is no assurance that the index (inflation) will not jump sometime during the loan years.

|

|||

And what is more important: unlike the prime track, where only the interest rate is linked to the variable Bank of Israel interest rate, in the linked track the mortgage fund is also linked to the index. Therefore, even if we run to refinance the loan when inflation jumps (at predetermined exit points or pay a high repayment fee to the bank), we will find that the entire fund jumped along with the index.

Equally important is that the stated policy of the world central banks predicts a low interest rate environment at least in the coming years, which is not necessarily true of the inflation environment (certainly in view of the inflows of funds following the corona crisis). Last August 27, US Federal Reserve Chairman Jerome Powell announced a dramatic change in Fed policy – “focusing on average inflation” rather than short-term inflation, so that it would let inflation run “moderately” even above the target “for some time” The new policy will examine the rise in American wages before raising interest rates – a historic change for the Fed, which has so far examined mainly inflation in its interest rate considerations.

An inflationary world but without a change in interest rates

In fact, among central banks there is a growing internalization that raising interest rates will stop being the immediate response to rising inflation, especially after previous crises revealed that economic improvement (which leads to price increases) does not permeate quickly to all sections of the public.

Bottom line, we may live in the coming years in a world where there is inflation, with no wage increase and no interest rate hikes (until wages improve). Which means that those whose loans are index-linked may come out bald from here and there, at least for now, the choice of the prime route and the “bet” on central bank interest rates seems several times safer.