The support of institutional entities in the cryptocurrency market is growing. In recent days, two major players have entered the market to great acclaim: MasterCard, which has announced that it is preparing to start supporting these currencies in its network, and car maker Tesla, which has announced that it has invested in Bitcoin and is also expected to eventually receive currency payments.

Read more in Calcalist

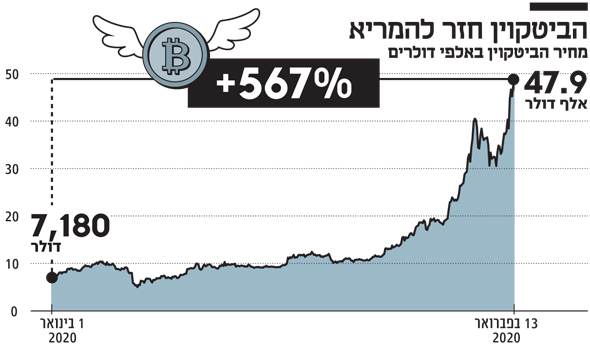

It is not clear exactly when Tesla purchased the coins, but since the announcement, the price of bitcoin has jumped from $ 35,000 to about $ 48,000 in just one day. This gives Tesla, ostensibly, a profit of about half a billion dollars on the investment. By comparison, by 2020 Tesla is expected to post its first annual net profit of about $ 700 million. Tesla explained the investment in Bitcoin: “It will provide us with more flexibility to further diversify and maximize the returns on our cash.”

MasterCard also explains that the move is intended to generate profit from public sentiment. “No matter what you think about cryptocurrencies – from outright fanatics to utter skeptics – the fact is that these digital assets are becoming an important part of the payments world,” said Raj DeModern, vice president of digital assets at MasterCard. According to him, the company recognizes the growing popularity of the crypto market through the payment movements in their system. “We’re here to enable customers, merchants and businesses to deliver digital value – traditional or crypto – however they want. It should be your choice, it’s your money.”

Suddenly everyone wants to

MasterCard and Tesla are really not the first giant companies to want to join the celebration by investing in currencies. Among other things, PayPal announced last October that it was launching a service for Bitcoin, Bitcoin Cash, Ether and Bitcoin to its 346 million users. At the same time, Visa has launched a digital currency debit card in partnership with the Coinbase cryptocurrency trading platform. Shortly before, Square, another digital payments giant that has been processing payments via Bitcoin since 2014, announced that it had first acquired $ 50 million worth of bitcoin because the currency has “potential to be more usable in the future”, being an “economic empowerment tool that provides tools to participate in a global monetary system” , According to the company.

If this seems like a sudden explosion of interest around cryptocurrencies, it is important to mention that this is a development that has been brewing for years. MasterCard, Visa, PayPal and various commercial banks have been working in recent years to develop and support payment systems for cryptocurrencies. Some of the major players in the field entered it with the intention of not only participating in the market but leading it.

Regulators, seeing the growing interest, were reluctant to take seriously an issue that for many years symbolized only a subversive attempt to challenge their authority. In October, the bank issued arrangements Clearing International (BIS) together with seven central banks – including the US Federal Reserve, the Bank of England and the European Central Bank – a report detailing the central requirements for a central bank of digital assets. At the same time, several large central banks are examining their own currency issues. With a string of private-sector companies creating its own national currency, the “digital yuan”, which in the wildest dreams of the Chinese government will replace the hegemony of the US dollar, as in Sweden, where the central bank is collaborating with Accenture to develop an electronic krona “.

Not all jumps are gold

These moves promote what appears to be a normalization of cryptocurrencies, but at the same time generate reactions againstRepoA, which illustrate how deep the controversy is. For example, after Tesla’s announcement, a “Mad Money” presenter and manager explained hedge fund Former Jim Kramer, who is “almost irresponsible” for not owning Bitcoin. “Every treasurer should go to the boards and tell them they need to put a small portion of the cash in Bitcoin.”

Economist Nuriel Rubini mocked Kramer in response, reminding him that he failed to spot the subprime bubble in 2008. “Because the basic value of Bitcoin is zero and its value will be negative if carbon tax is imposed on it due to its polluting production, I predict the current bubble will eventually end in another explosion,” Robinie wrote in a response article in the Financial Times last week. Robinie, known for his pessimistic predictions and aversion to the currency, did not stop there. “Bitcoin is dangerous and volatile and does not belong in the portfolios of serious institutional investors. Most of the currency’s supporters are suckers who are manipulated by an army of associates and snake oil sales representatives.” Robinie warns and warns – many of her partners – of the financial stability of the market in case Bitcoin becomes commonplace in the balance sheets of other institutional entities.

When Tesla bought Bitcoin, it reportedly used 8% of its cash reserve. Companies like Square or MicroStrategy, the Canadian software company that has become primarily a Bitcoin investor, have in recent months invested parts of their cash flow in Bitcoin and have seen the stock price skyrocket. But the crypto market is notorious for its volatility. In March 2020 alone, the price of bitcoin fell below $ 4,000.

This combination of intense volatility, recent wild rises and the strong desire of big players to take part in the celebration has led two prominent regulators – European Central Bank President Christine Lagard and US Treasury Secretary Janet Yellen – to call for significant regulation of bitcoin. The two fear not only the increasing use of cryptocurrencies as tools formoney laundering, But from long-term effects on the financial stability of these assets while they rest on the balance sheet of listed companies.

“This is a matter that needs to be agreed on at the global level … Global cooperation, multilateral action is absolutely necessary, whether at the initiative of the G7, from there to the G20 and then a general deployment,” Lagard said in January. “We really need to look at ways we can reduce the use of cryptocurrencies,” Yellen said over the weekend.

According to Robinie, Bitcoin is “no currencies … no unit of account … no scalable means of payment … no stable value pool … and no assets … Tesla’s Musk Elon and MicroStrategy’s Michael Sailor are betting on Bitcoin. It’s not Say you have to. “