India is expected to oppose its first test of a bid for a more risky type of bank bond since the regulator introduced restriction on mutual fund investments in such securities.

One of the largest regional lenders in the country, Banca Maharashtra, is seeking bids Monday for rupee-denominated Stage 2 notes in sales that will be closely watched to gauge demand from each other’s currencies, the largest buyer of those debts.

The Securities & Exchange Board of India this month published the rules of a limiting mutual cash holdings of additional Stage 1 and Level 2 notes to 5% of net assets for a single issuer, effective April 1. The regulator also asked fund managers to start valuing notes AT1 as 100-year securities, including the sale of these debts. Sin an evaluation step can be relaxed, people familiar with the matter said last week.

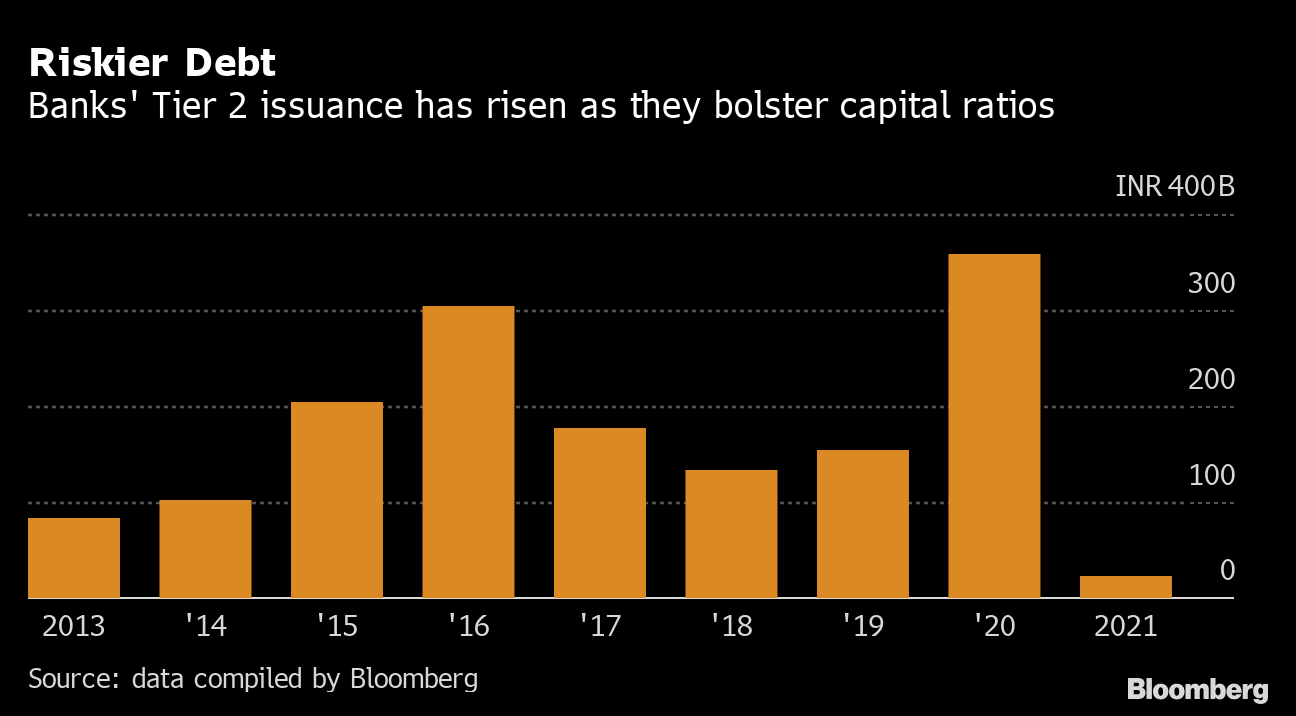

More risky debt

Banks ’Level 2 issuance has gone up as they strengthen capital ratios

Source: data compiled by Bloomberg

Concerns have been raised about more risky bank bonds, which can be written in urgency. Lenders in India are plagued by one of the worst bad debt pills in the world and need to incentivize capital buffers by expecting more souvenir loans as will the coronavirus battery industries.