It has become harder for Wall Street to watch U.S. Treasury yields climb without feeling a bit queasy.

After all, the Federal Reserve made cheap and plentiful credit a key part of their pandemic response, and as a result major U.S. agencies borrowed the highest debt last year, at ultralow rates, to strengthen their balance sheets during the crisis.

Low rates also helped kick-start $ 4.3 trillion worth of U.S. residential home loans in 2020, with refinancing for the year hitting a high of $ 2.8 trillion, as homeowners looked to breach of their mortgage payments, according to a new one. Black Knight’s Report.

And with COVID-19 vaccines accelerating under Biden administration, it may come as no surprise that borrowing costs both in corporate debt and in American housing markets have gotten a little more expensive this year due to the yield of Finance is longer marching higher.

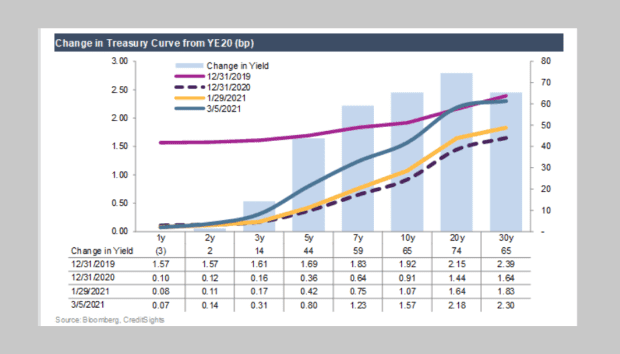

This CreditSights card shows the result of TMUBMUSD30Y’s 30-year Treasury,

about 65 basis points so far this year has risen to around 2.3%. That almost matches the level from December 31, 2019, or before the first COVID-19 cases were detected in the US

Treasury yields are climbing.

CreditSights, Bloomberg

Yield on 10-year Financial Note TMUBMUSD10Y,

about 68 basis points were higher so far Monday, nearly 1.594%, according to Dow Jones Market Data.

But that is still below the 1.92% pre-pandemic level of 10-year yields, apparently meaning the benchmark bond has more room to rise, according to a CreditSights team led by senior analyst Erin Lyons.

Rising government bond yields have already been reflected in the scrapping of 30-year fixed rate mortgages, which hit last week an average of 3.02%, a rate not seen since July.

Read: Mortgage rates rise above 3% – how high can they go before they intimidate home buyers?

Companies have also been in a hurry to borrow in the corporate bond market to get ahead of potentially higher rates, with U.S. ICE BofA Corporate Index yield rising to around 2.2 % at the last survey, from a recent low of 1.79% in January.

Bank of America Corp.. BAC,

they borrowed $ 5.5 billion in the investment-grade corporate bond market on Monday, with the longest 30-year debt slice yielding around 3.48%, according to someone familiar with the contracts.

But climbing bond yields have also been driving circulation in stocks, which has helped with the removal of the Nasdaq Composite Index COMP,

in Monday’s correctional range, as explained by a fall of at least 10%, but less than 20%, from the recent high.

Dow Jones industrial average DJIA,

Monday ended about 300 points higher, but shy of 32,000, as investors measured the potential impact of a $ 1.9 trillion aggressive stimulus package from Congress on consumer spending habits – and inflation – as the revival accumulates steam.

So how high can Treasury results go? “Given the bond market inflation rate of 2.25% (i.e., the 10-year equilibrium rate), there is still plenty of room for yields to climb,” wrote James Paulsen, chief investment strategy at The Leuthold Group, in a note Monday.

“Our 10-year yield is still expected to break 2% this year, but who knows? ”

Analysts point out that much will depend on whether the Fed comes to shift course on its easy-to-monetary monetary policies to deal with persistent and persistent inflation beyond its targets, and possibly by raising criterion levels above the normal 0% -to-0.25% level. sooner than expected, or by reducing the $ 120 billion-per-month bond purchase program, which could drain liquidity from financial markets.

“I think the Fed is likely to work if the 10-year U.S. Treasury yield rises rapidly from here and creates chaotic markets,” wrote Kristina Hooper, chief executive Invesco’s global market strategy, in a note Monday.

But Hooper also doesn’t expect inflation to become “troublesome,” which is due to the severity of the labor market as a result of the pandemic, as well as long-term structural forces, leading to including technological innovations, which keep pressure down on inflation.

Read next: Is housing a joy? This is what the K-shaped rebound means for real buildings