Investors in much of the country are waking up to Arctic temperatures and apparent power levels, as a major winter storm falls from the Ohio Valley down to San Antonio.

But it’s warming up on Wall Street, where futures mark President’s Day rally. For that, we can thank signs that U.S. COVID-19 disease rates are falling and a continued push by President Joe Biden’s team to get a $ 1.9 trillion stimulus package through Congress.

“There seems to be the same urgent concern right now around the prospect of high inflation driven by a combination of exposure from COVID, generous incentive packages and rising raw material costs,” said AJ Bell investment director Russ Mold, in a note to clients.

Another thing, keep buying right? Yes call of the day Mohamed El-Erian, Allianz’s chief economic adviser, explains some of the problems with this rally of all things, along with a warning that investors could travel over a “market crash” if they don’t careful.

“Investors are chasing what someone called the ‘reasonable bubble,'” the president of Queen’s College Cambridge University told CNN in an interview. While fully aware that asset prices are high, they anticipate that prices could go even higher thanks to moderately large bank liquidity and the prospect of a fiscal injection, he said. “Basically, investors feel confident riding a huge wave of historical liquidity.”

Inflation is a bog here, even though data says otherwise. “When markets see price levels going up more than the Fed expected, they will be concerned and you have already seen a bond yield on securities with a longer date going up, and as that’s a concern and you’re starting to see it in the market. , ”He said.

Yield on 10-year Finance note TMUBMUSD10Y,

Tuesday’s 4 basis points climbed to nearly 1.25%, a level not seen since March last year, partly due to vaccine optimism.

El-Erian said the Federal Reserve’s response is very important and he believes it will continue to do its thing, becoming even more involved at the cost of segregated asset prices.

What else could stop all rally? “Market crash,” such as one that may have led to a few weeks ago when retail and hedge fund investors were up against short stocks, he said.

“So the first risk in this over-risk becomes reckless risk-taking and you get a market crash. The second risk is the bond market. If you imbalance the link market, you will take away two reasons why people are so fond of stocks. One, this idea is not an alternative – well if a product goes up there is another option, the second one with the low rate, flowers forever, discounted cash flow models signaling purchase purchases for installments, ”he said.

El-Erian will also take pressure into the bitcoin rally and where it sees the risk. It is not an adoption, but “will the official department allow this to continue? But on the private side, he said, more companies are likely to follow in the footsteps of electric car maker Tesla TSLA,

made headlines recently by investing in the cryptocurrency, with plans to adopt it as payment. These companies do not know how to mitigate other risks. It’s part of the overall financial market movement that we are seeing. ”

The markets

ES00 stock futures,

YM00,

NQ00,

climbing, but benefits have not extended to SXXP European equivalents,

An Nikkei 225 NIK,

and HSI Hang Seng index,

both were up more than 1%. The action was large over energy contracts with NGH21 natural gas,

and gasoline futures RBH21,

surging, while US CL.1,

raw slipped back below $ 60. Bitcoin BTCUSD,

going closer to $ 50,000.

Read: Oil ends Friday’s session higher on Middle Eastern tensions, with global prices up more than 5% for the week

The buzzard

Large parts of the U.S. are experiencing sub-freezing temperatures, with facilities ordering blackouts as reserves run low. In addition, the storm is causing several states to delay the release of vaccines.

In terms of positive news on the pandemic, daily U.S. coronavirus cases fell below 100,000 on Friday and remained there on Saturday, although experts remain cautious for fear of spreading changes.

Biden will be in Wisconsin Tuesday, making a public case for his incentive plan.

Empire State’s manufacturing index is ahead of the open market, a day ahead of a major retail update.

The card

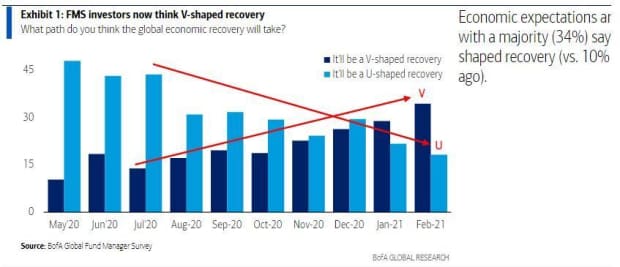

Hopes for overcoming V-shape – a quick and steady kick – are looking up.

Randomly read

Prince Harry and Meghan, Duchess of Sussex, go to Oprah court.

Get your Krispy Kreme Mars donut while supplies last.

Need to Know starts early and updates until the opening bell, but sign up here to have it delivered once to your inbox. The email draft will be sent out at around 7:30 am East.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning preparatory meeting for investors, including a special report from Barron and MarketWatch writers.