The Treasury’s rising yields have boosted sales by the stock market’s high spreads, but they may not be enough to spoil the repurchase of stocks over bonds in 2021, according to one analyst.

U.S. equity investors “have been focusing on the recent rise in 10-year Treasury yields over the past week, which is on its way back to mid-term levels. February 2020, ”Lori Calvasina, head of U.S. equity strategy at RBC Capital Markets, wrote in a note Tuesday. Bond yields and prices have an unstable relationship.

10-year Treasury Product TMUBMUSD10Y,

comes off the biggest rise in six weeks, which is to blame for a slowdown led by technical stocks that had benefited from the home-stay vitality that created the pandemic COVID-19.

Related: Can the bull market in stock survive rising inflation, bond yields? Here is what history says

The relationship was on display at the back of Tuesday as the surge in yields was dragged down after evidence from Federal Reserve Chairman Jerome Powell, allowing key criteria to offset or cut major losses. The tech-heavy Nasdaq Composite COMP,

which has made its way down, having cut losses of nearly 4% to 0.5% as yields declined; the S&P 500 SPX,

He earned an advantage for sculpting a five-day losing streak, while the Dow Jones industrial average DJIA,

eliminate losses greater than 360 points to finish slightly higher.

Meanwhile, Calvasina said by looking at what stocks offer in terms of share yield and earnings relative to bonds, as well as recalling what kind of bond movements have spelled out trouble for equities , giving some reassurance that 2021 is unlikely to turn into a year down, she said.

Separation result

When it comes to quota yield, RBC measured the percentage of companies that still exceed 10-year Treasury yields. While that has fallen to 51.5% from 64% at the start of the year, it is still within range which is generally followed by a 17% gain for the S&P 500 over the next 12 months, he said. i.

Earnings

S&P 500 earnings have also declined, moving to the lower end of the range that has existed since the end of the financial crisis. It is now close to the level seen in 2017-’18, but is still in range followed by average gains of 9.3% with the S&P 500 over the next 12 months, Calvasina said.

“In other words, this analysis recognizes the case for short-term withdrawals in the S&P 500, but that does not necessarily indicate that long-term investors should pursue. the way out, ”she wrote.

Calvasina also made a “significant difference” between 2018, when the trade war was a threat to the U.S. and global economies, and now, when domestic output forecasts are rising rapidly.

Financial yield and stocks

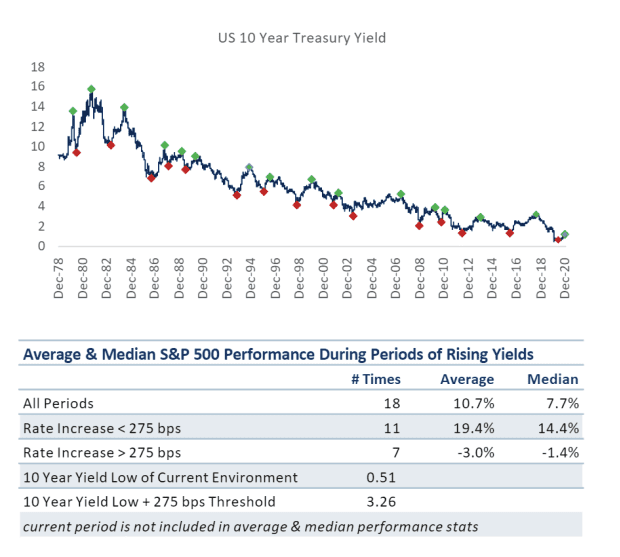

Finally, what about the increase in Treasury yield? After all, many market observers have argued that while yields remain low by historical standards, the magnitude of the increase may be a concern for equities. Calvasina broke the relationship between yield movements and stock market performance in the chart below:

RBC Capital Markets

Calvasina said U.S. shares have tended to struggle when the 10-year yield rises more than 275 basis points, or 2.75 percentage points. Coming off the low of 0.51%, a 275-point move would bring the yield to around 3.26%. The 10-year ended Tuesday at 1.363%.