Photographer: Andrey Rudakov / Bloomberg

Photographer: Andrey Rudakov / Bloomberg

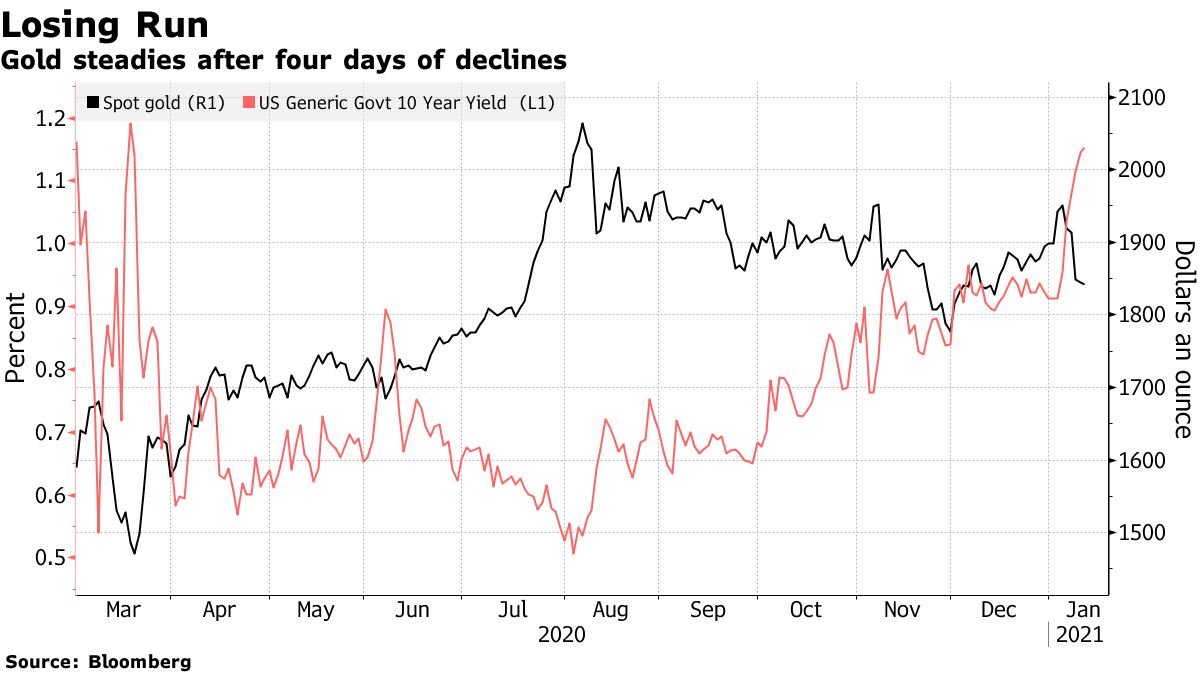

Gold was on the rise after the longest run of a daily decline since November as investors measured the impact of a stronger dollar and a rise in Treasury yields in anticipation of further major stimulus.

A reversal in the U.S. currency from a nearly three-year low, coupled with a 10-year rise in yields, has put pressure on interest-free bullion. President Joe Biden is expected to pick up proposals for a multi-million-dollar stimulus package on Thursday, which could help pave the way for a rise in inflation, against which gold is seen as a hedge.

The precious metal has lost ground so far in 2021 after posting its biggest annual gain in a decade on the back of the devastating effects of the pandemic, high stimulus, and high demand that has been to be there. Now, Federal Reserve officials states that increased fiscal support and a large spread of vaccines could lead to a strong U.S. economic recovery in the second half, setting the stage for a debate on reducing bond purchases by the end of the year.

Spot gold at $ 1,843.85 an ounce at 9:20 am in Singapore was little changed. It has fallen by 5.4% in the last four days. Silver climbed 0.7%, advanced platinum added 2.3% and palladium added 0.7%. The Bloomberg Dollar Spot Index was flat after gaining 0.5% on Monday.

Meanwhile in U.S. politics, Democrats Monday they submitted a resolution to impeach Donald Trump for the second time, setting up a vote this week in the wake of the Capitol unrest. Its president and vice president, Mike Pence they agreed to work together for the remainder of their term, according to an administration official, revealing that Trump will not resign or oppose his removal from his cabinet.