Photographer: Luke Sharrett / Bloomberg

Photographer: Luke Sharrett / Bloomberg

The U.S. labor market moved sharply higher in March as the country made progress in efforts to spread the pandemic in the rearview mirror.

Economists project a government report showing the biggest job increase in months as vaccines rise and economic activity, including strong manufacturing, picks up. The average estimate in Bloomberg’s study of economists is that the unemployment rate will fall to 6% as nonfarm payrolls rise by 643,000.

Policymakers include Federal Reserve Chair Jerome Powell and Finance Secretary Janet Yellen they expressed confidence last week in the path of the labor market reversal.

While the central bank sees unemployment fall to 4.5% by the end of the year – a relatively quiet forecast – Powell emphasized the “highly desirable outcome” of employee participation. expansion. Meanwhile, Yellen said no additional unemployment support would be needed later this year.

More than 2 million Americans are being vaccinated every day, and President Joe Biden has said that states should do it all adults eligible for bullet by May 1. At the same time, many states are reducing restrictions on industry and activity. Higher frequency data pointed out last week to a overcoming the labor market, as claims for regular unemployment insurance fell to a pandemic low.

Other parts of the economy have reached or even pre-pandemic levels. After a slew of advanced regional manufacturing data points, the Institute for Supply Management’s factory index, released Thursday, will look at the state of the sector in March. In February, it rose to a three-year high.

What Bloomberg Economics says:

“Economic data has already begun to move strongly ahead of slow social pace measures, widespread vaccinations and the latest round of fiscal stimulus. From sales activity to industrial production, strong recycling signals have been increasingly plentiful over the past few months. Nevertheless, the March jobs report marks a tense point, where the economy will clearly be moving at a much faster pace of growth – one not seen in a generation. ”

–Carl Riccadonna, Yelena Shulyatyeva, Andrew Husby and Eliza Winger. For a full analysis, click here

Biden Wednesday will present its long-term economic program, called Build back better, spanning infrastructure and technology investments to refresh the tax code to help widen income inequality. Before Biden spoke in Pittsburgh, his supporters have prepared proposals worth $ 3 trillion, according to people familiar with the matter.

President Joe Biden looks at a multi-trillion economic plan aimed at depleting infrastructure aimed at boosting the U.S. in the midst of coronavirus pandemic and ensuring competitiveness to China in the future.

Elsewhere, intense efforts to move a large ship stuck in the Suez Canal are threatening set up supply chains by blocking the vital trade artefacts of the world economy. World Trade Organization unveils new forecasts for global trade and central banks in Kenya, Angola and Chile set rates.

Click here for what happened last week and below is our coverage of the future of the global economy.

Asia

China The PMI reading for March Wednesday is the biggest spread of the week in Asia, with economists expecting a rise in activity after a pullback at the start of the year. Departmental reports follow the next day.

The Bank of Japan will release a summary of talks from it Monday most important meeting in 4 1/2 years. The comments will be closely scrutinized to see what measures could be further changed and for more information on the reasons behind the changes.

Unemployment, production and sales data from February show the high pressure on the Japanese economy at its recent highs state of emergency. BOJ’s Tankan industry study appears on Thursday to reveal that major manufacturers are reaching a level of optimism after the crisis builds and with global trade recovering.

South Korea export data for the full month of March should provide the latest indication of the strength of that recovery.

Europe, Middle East, Africa

With continental Europe still struggling to get its vaccination program going and fighting new releases of the coronavirus, eurozone inflation and economic confidence data show a state of recovery. Final PMI data is likely to confirm that German manufacturing increased at a fastest pace in March.

In the UK, Fourth quarter house price data and full domestic product segments are set to give a picture of the economic rebound.

Kenya’s central bank may hold a key interest rate unchanged for seventh straight meeting Monday as the country reports a rise in Covid-19 issues and inflation at a 10-month high.

Angola’s central bank, which last moved interest rates in May 2019, is expected to hold while trying to support the economy and reduce inflation by changing the amount of money in circulation, rather than through interest rates.

Russia, Botswana and Mauritius all report GDP figures for the fourth quarter of the week.

Latin America

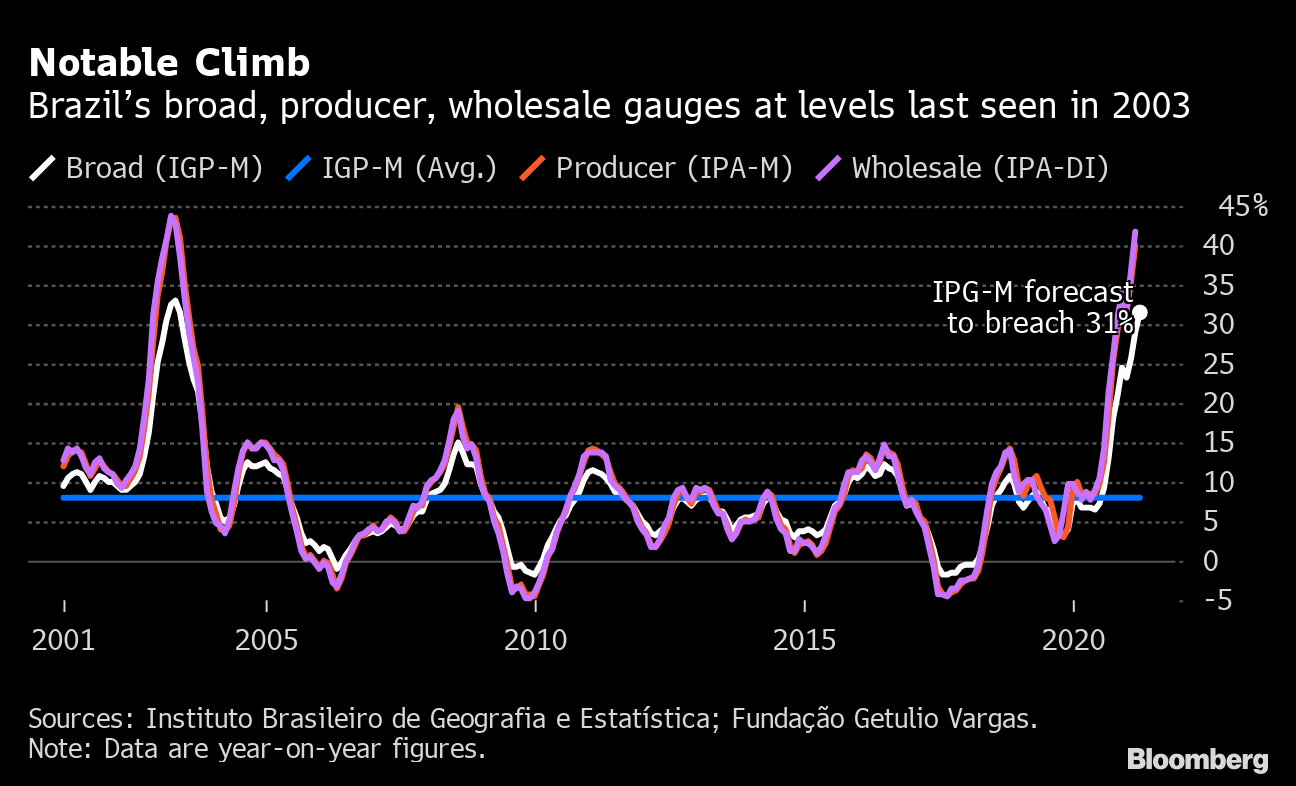

Brazil’s consumer price index is above target and the the central bank plays a catch. Figures posted Tuesday appear to show the March reading of the country ‘s widest inflation rate is near an all – time high.

Famous climb

Broad criteria, producer, wholesale Brazil at levels last seen in 2003

Source: Instituto Brasileiro de Geografia e Estatística; Fundação Getulio Vargas.

Argentina’s economic activity for January should show a ninth-month monthly gain. After 9.9% GDP fall last year, the economy could expand by as much as 7% in 2021.

Banco Central de Chile is in no hurry to tighten up, especially with Santiago, which has about 40% of the population, back in. population lockout. Analysts expect the high to remain at a low of 0.50% on Tuesday. Later in the week, Chile’s unemployment rate set closer to single-figure and economic activity may have posted a one-year gain in January.

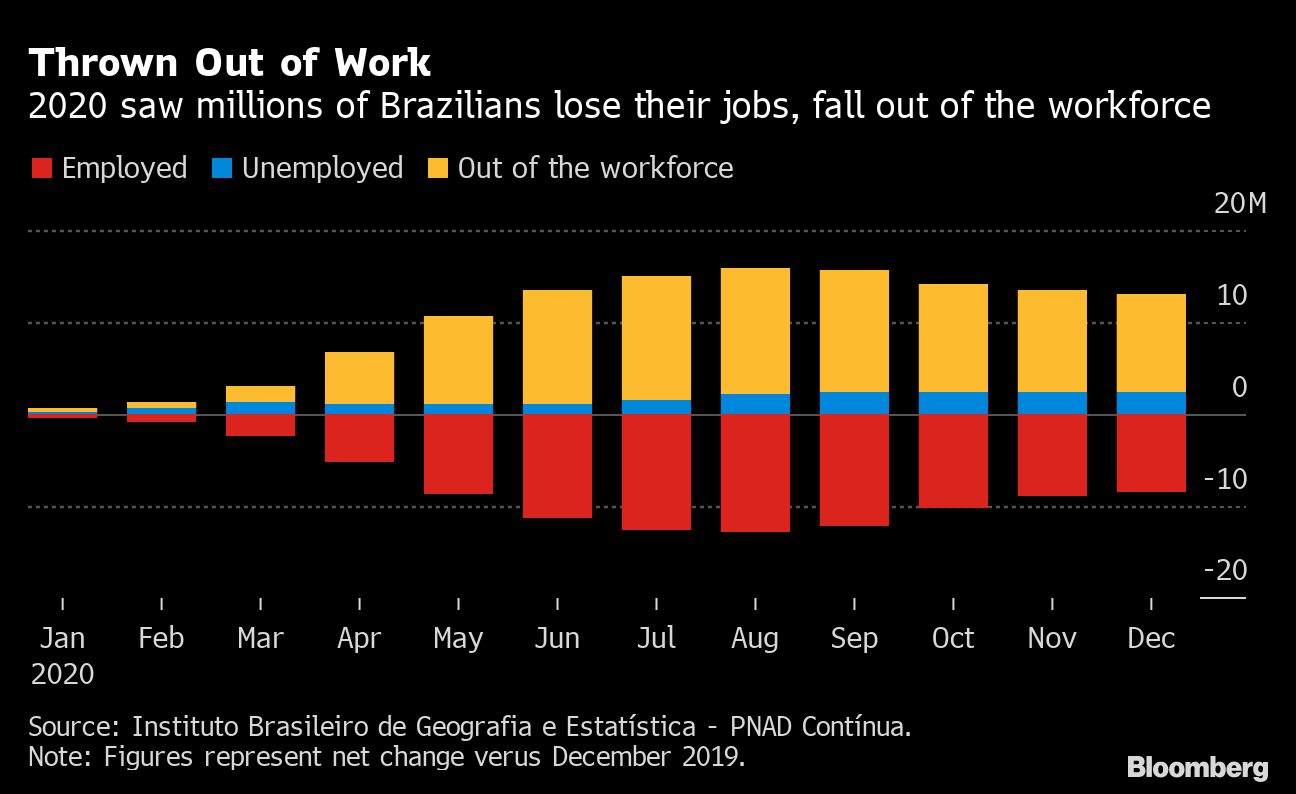

Thrown out of work

In 2020 millions of Brazilians lost their jobs, they fell out of their workforce

Source: Instituto Brasileiro de Geografia e Estatística – PNAD Contínua.

Jobs data for January from Brazil will most likely look part of a “K-shaped” recovery: gains in formal employment in the sector against a rise in total unemployment with millions still out of work.

For evidence that Brazil’s recovery is failing, look no further than the January business output data posted Thursday. The monthly and annual figures should be positive, but just straightforward.

– Supported by Benjamin Harvey, Malcolm Scott, and Chris Anstey