Photographer: Daniel Acker / Bloomberg

Photographer: Daniel Acker / Bloomberg

Everything they started innocently enough, back in 2019, with people on message boards changing opinions about a series of slow sources left to die.

Now it’s a lot bigger: for pundits who tend to the dramatic, David vs.. Goliath’s parable for the age of wealth inequality. Perhaps a vestigial legacy of Trumpism and the populist backlash against “the nobles. “

For parts of a hedge fund industry, it is a current emergency. For old-school investors who preach discipline and do your homework before they hit “buy,” it’s an awful story that they expect to end in horror. It’s at least part of the reason the entire stock market collapsed on Wednesday.

The saga that GameStop Corp. turned into a national sentiment, reaching the thresholds of both the new administration of President Joe Biden and Federal Reserve Chairman Jerome Powell. Each found themselves when asked strange questions about running a business that sells five used video games for $ 10.

“It shakes everyone because everyone benefits,” said Matt Maley, chief market strategist at Miller Tabak + Co.

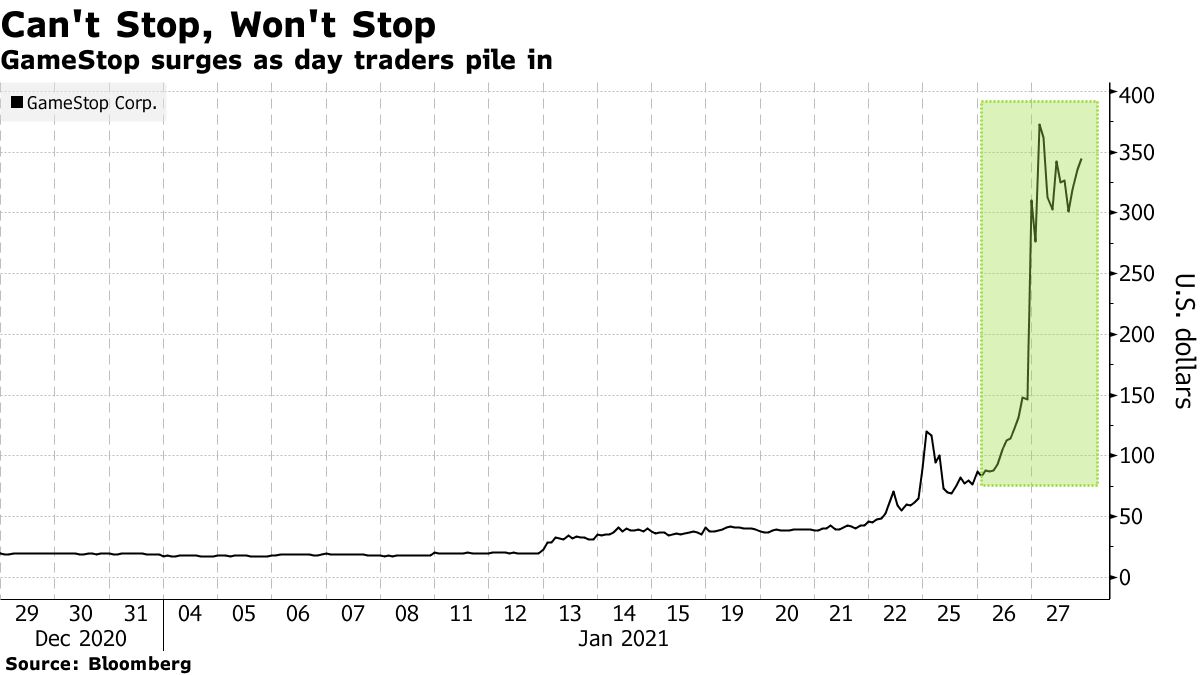

At first glance, it is difficult to explain how a company that expects their sales to decline in four of the last five years – and which is likely to announce third straight year of loss – its share price has risen almost 1,800 so far in January and 8,000% over the last 12 months.

Look closer, and it makes more sense. Warren Buffett’s mantra is “buy what you know”. So it’s easy to see why a handful of millennial traders – locked at home amid the pandemic, with savings reduced by a lack of opportunities to spend disposable money elsewhere or make payments government incentives – know a few things about gaming.

Especially when they come to market as a video game and their strategies include something similar to what gamers would call “fake code” – in this case, coming together and accumulating into individual stocks and options related to the way a tight team attacks. a room of dragons in “World of Warcraft.” All with the aim of getting short sellers and derivatives sellers to buy the stock, pumping its price beyond anything a traditional investor would consider reasonable.

For the almost 3 million group of self-described “degenerates” on the WallStreetBets Reddit forum and other social media sites where this new army of day traders gather and collaborate, the game is on spread quickly to a number of stocks that they intend to produce “the next GameStop. “

Naked Brand Group Ltd., a clothing manufacturer whose stock is up 618% this month. And AMC Entertainment Holdings Inc., the film theater company that sits on a gain of more than 800%. Macerich Co., a property investment trust, has more than doubled this month. This list goes on and on.

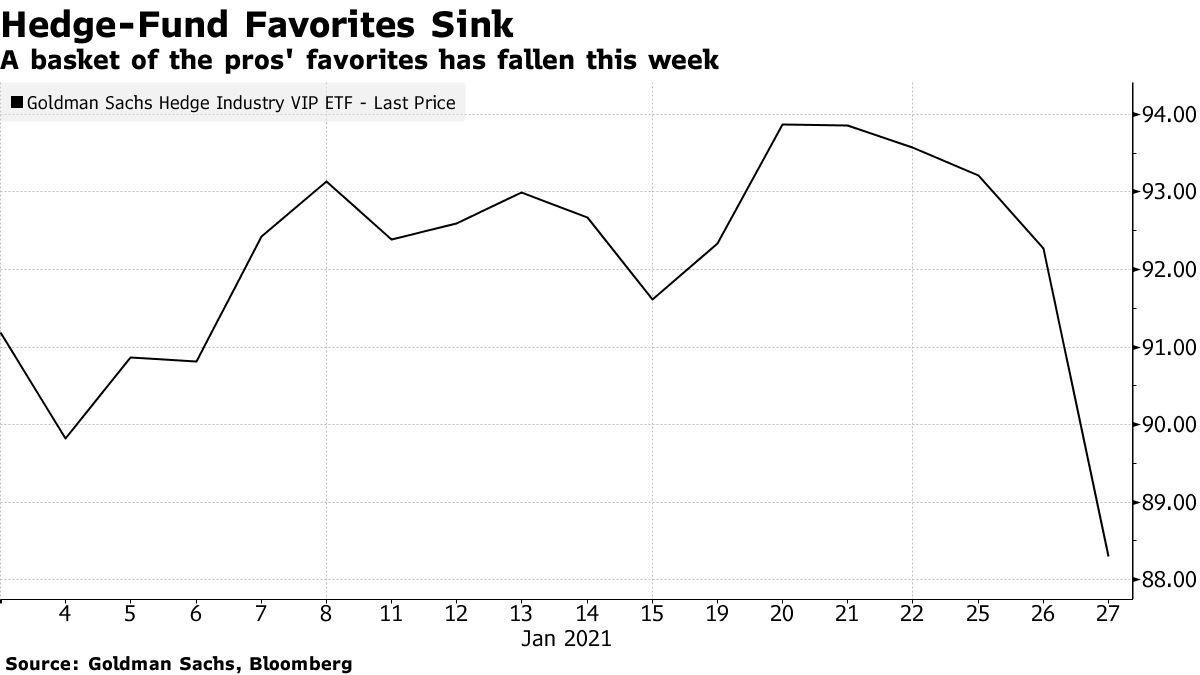

And yet, benchmark stock indices fell Wednesday. The S&P 500 fell nearly 3%, the worst decline since October. How can that be? One theory is that the hedge funds are forcing the companies to dump it in fact they are fond of raising money to buy the stocks they hate. Why? So they can end a bet shortly before a big loss comes as the rally goes against them.

An overall reduction, or measure of hedge fund risk exposure that takes into account long and short positions, is declining. Money was drained out of their pool of both bullish and bearish bets over the four sessions through Tuesday at the fastest rate since October 2014, data collected by Goldman Sachs Group Inc.

While there are plenty of examples of well-known short-term pressures in the past, including the volatility movement in early 2018, there are indications that the current one could have a lasting impact. current on market dynamics, wrote Michael Purves, founder and chief executive of Tallbacken Capital Councilors. Screening for smaller companies with high short-term interest, he found that there are hundreds of potential targets for retail investors and that there is evidence that “the tense tension” is growth from day to day.

That means it could continue to push long-term hedge funds to release their short sales and, by extension, eliminate their long books even if they are not involved in some. of the recently targeted names.

“Both of these decoupling processes – long and short – would have a significant impact on market activity in the coming weeks and have the potential to drive a significant shift within the market,” Purves wrote.

The speed with which the story moves is that trying to collect all the strands is futile, but for a start: the the impact of the tension on shorts sellers and their solvency; the search for the next one bull attack target; the challenge of measuring GameStop’s true fair value; what it really means for wealth inequality consider the rich reaching windy winds; an the impact of internet-based breaches and the role of commission eliminations played out in full; and even what Biden, Powell, secure regulators and Finance Secretary Janet Yellen think and do about it.

Of course, no short pressure can last forever. The market will eventually return to “normal”.

“Despite being the current marginal buyer, day-to-day traders do not have sufficient collection funds to continuously move global markets,” said Max Gokhman, Pacific Life Fund Councilorshead of asset allocation. “Small individual stocks? Absolutely. But will that change the whole investment landscape? Unlikely. ”