Photographer: Anthony Devlin / Bloomberg

Photographer: Anthony Devlin / Bloomberg

Some of the world’s top money managers are promising a rise in spending following a pandemic that will boost real-world companies as economies reopen and people return to life normal.

Investors from Aberdeen Standard Investments Inc. and GAM Investments to UBS Asset Management are increasingly pouring money into companies where face-to-face interaction is the norm – things like travel agents, restaurants, offline shopping and “ customer experiences. ”

“A lot of people think this is going to lead to a new topic of‘ roaring 20s ’,” said Swetha Ramachandran, GAM fund manager of Luxury Brands Equity, commenting on growing views that mail spending will -pandemic dates back to too much of the 1920s. That’s when euphoric customers gathered to a wave of consumption after the First World War and the 1918 pandemic. “There will be a lot of puffing” when people start socializing, she said.

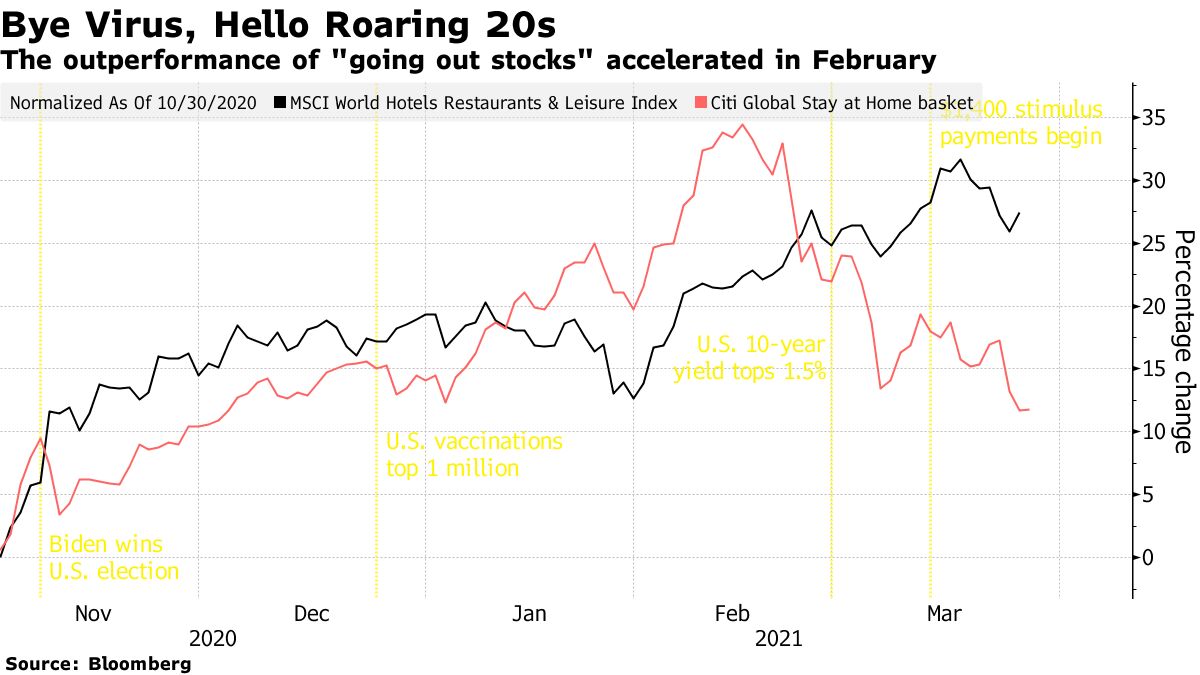

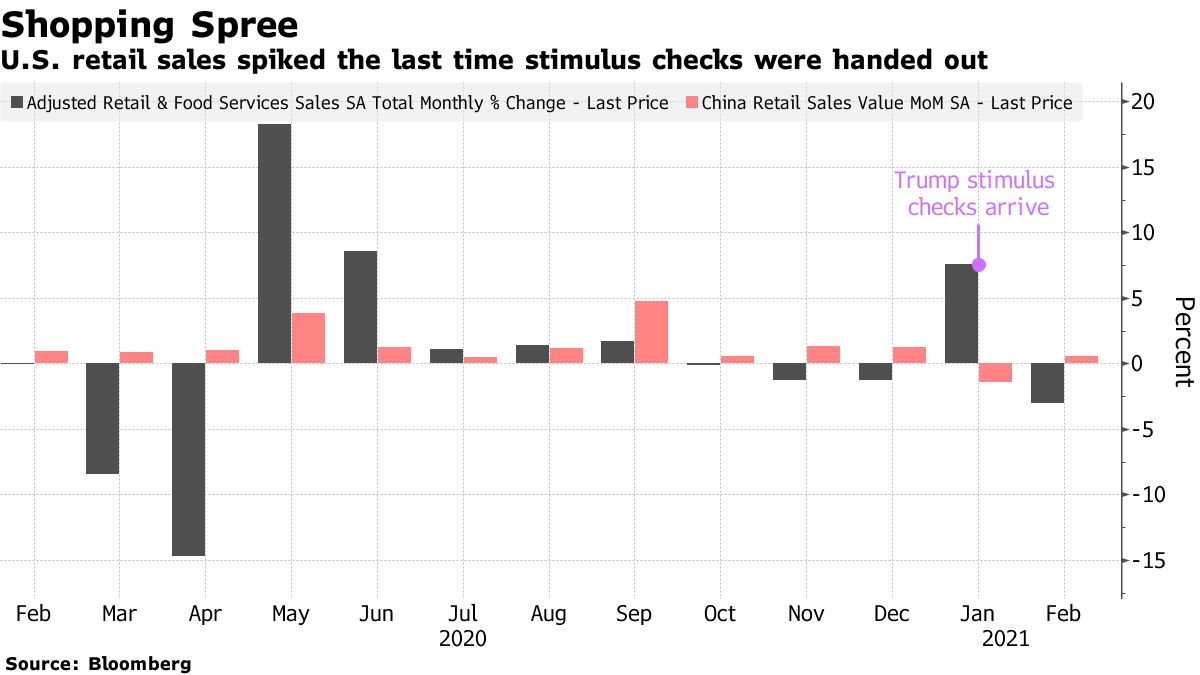

Investors began hoarding into volatile stocks benefiting from economic reversal late last year following good news about the vaccine front, withdrawing from high-value technology stocks high. Circulation accelerated as Treasury yields rose in mid-February. Now with stimulus studies paving the way across the US – the winner of half the $ 2.9 trillion in savings gathered across the globe through the pandemic – there is a stock of consumers to build even more.

To be sure, no one is saying that the disease is spreading nearby. Europe is looking at the slow release of vaccines, with an update restrictions on daily life in some countries, while an average of seven days of new US Covid-19 cases raised above, indicating that state – side issues are rising again and threatening to return to normal life. Digitization is here to stay – no vendor goes back to the world of pure brick-and-mortar.

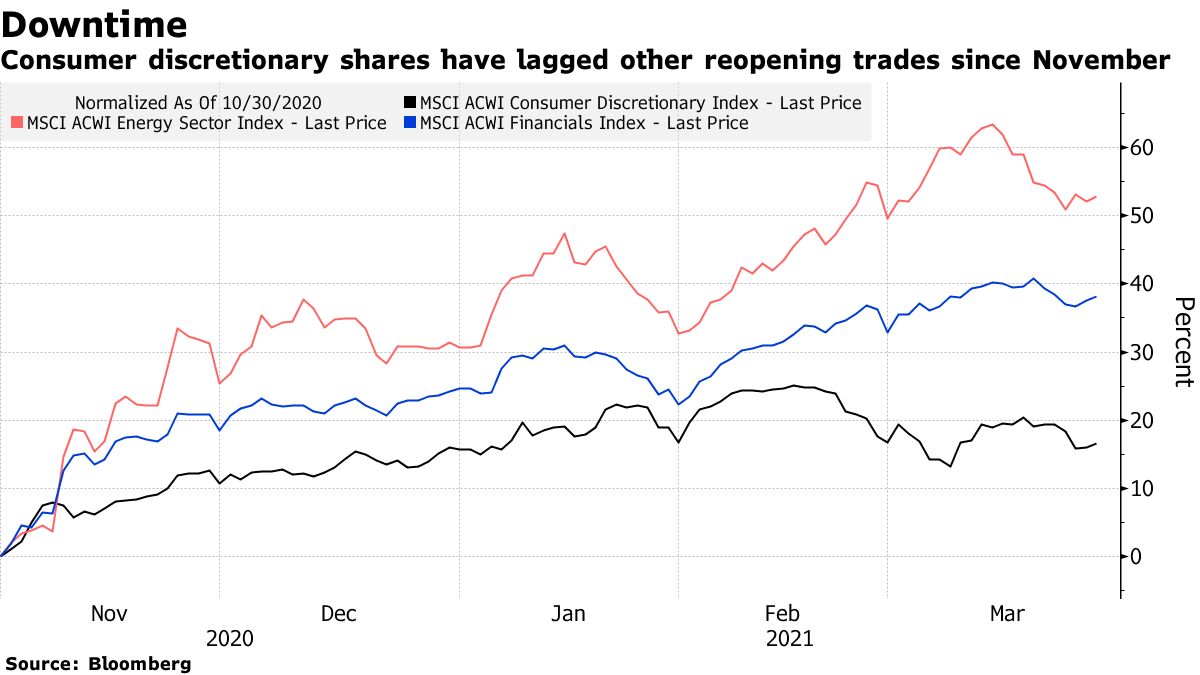

But a short-term shift to consumer selective stock in November, when “reopening” trading has become fashionable, there is room to go up. The underperformance of global energy shares is the best player by sector since the end of October, up 53%, and the index for consumer choice is only 17% higher.

In fact, the benchmark for global consumer choice segments is expected to return 17% over the next 12 months, according to data compiled by Bloomberg, while the index is projected to rise. S&P 500 targets 12%.

“People want to travel. They want to see a family they haven’t seen in a long time. They want to go out with friends, ”said Donny Kranson, European equality package manager at Vontobel Asset Management.

Theme parks, airlines, and even beer are back.

On the travel side, money is guaranteed on stay-friendly hotels like Marriott International Inc. and home-sharing company Airbnb Inc., theme parks like Six Flags Entertainment Corp., and even Chinese online travel group Trip.com Group Ltd., based on interviews with Miller Tabak + Co., the Scottish Investment Trust. Scotland and AGF Investments Inc.

Marriott has gained 11% this year, while Airbnb, Six Flags and Trip.com have risen 19%, 41% and 11%. They have all outperformed the S&P 500 in 2021.

Restaurant chains like Cheesecake Factory Inc., and popular alcohol brands in closed nightlife venues, bars and restaurants such as Heineken NV, Anheuser-Busch InBev NV and Pernod Ricard SA, which brewing Absolut vodka, also playing.

Large shopping centers, converted suburbs and allowing social distance shopping should also do well, said Calum Bruce, asset manager at Ediston Property Investment Company.

Perhaps the biggest change money managers are seeing in consumers’ minds is how life is going offline as “premiumization” of flavors in food, autos, cosmetics and clothing. Jimmy Choo, owner of Capri Holdings Ltd. is seen. in the U.S. and more affordable luxury brands like the French SMCP, which has Maje and Sandro labels, benefit if the theme of reopening plays out.

Even higher brands such as Gucci Kering SA owner and China’s largest stockholder, Kweichow Moutai Co., are critical as people trade up, some finance managers say.

“In markets such as China, strong prime trends are evident across sectors such as beer, dairy, spirits, cosmetics, condiments, branded food and four-wheelers,” said Shou-Pin Choo, portfolio manager for co Asian identity at UBS Asset.

– Supported by Suzannah Cavanaugh