General Electric is not the blue-chip titan it was back in the 1990s. But the more the company’s previous accounting practices become, the clearer it becomes that the company was under the legendary CEO Jack Welch ever as they were supposed to be.

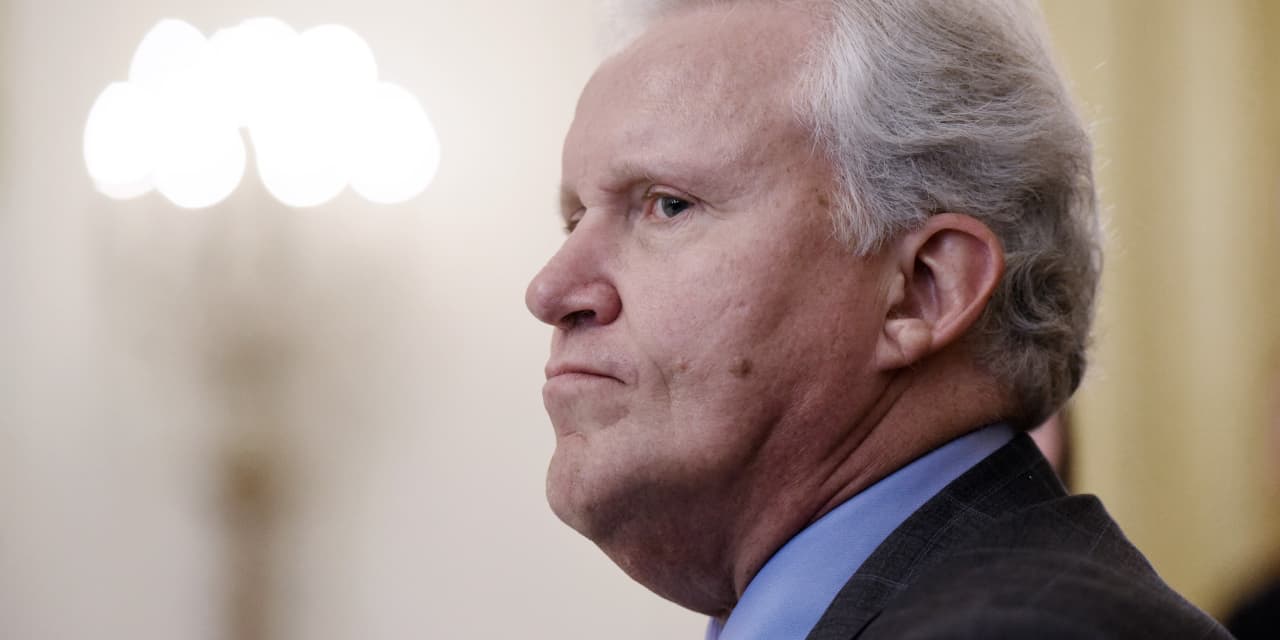

Welch’s successor, Jeff Immelt, who died last year, interviewed “Freakonomics” author and broadcaster Stephen Dubner, who asked Immelt whether the company’s “highly creative and aggressive accounting” was an institutional practice. fruitful.

Well, what I learned growing up in GE is how to be a good operator, how you can invest in growth, how to manage productivity, how to manage costs, those things. Interwoven in this story is always the growth of financial services. And financial services, so to speak, have historically just been more mobile because of the way repositories are made and things like that.

Dubner followed up, wondering how GE’s power industry was reacting to orders. Immelt’s sound was a little more protective. “We paid external auditors hundreds of millions of dollars a year to review our books. We had a 20-man publishing committee made up of midlevel managers who agreed on everything we said, everything we ever did. We were governed by the Fed for six years. I had two chairs of an audit committee. One was the retired CEO of JPMorgan, and the other was then the retired CSS commissioner. I know what was written, Stephen, but I can only tell you what we tried to do, ”he said.

Immelt retired in 2017 after 16 years as chief executive.

GE was fined $ 200 million by the Securities and Exchange Commission over alleged disclosure allegations in its power and insurance industries between 2015 and 2017. The SEC stated in a separate settlement that GE used non-accounting accounting methods. appropriate to increase its earnings or reported income and to report negative finances. results in 2002 and 2003.

Over the past 20 years, GE has owned GE stock,

has fallen by an annual growth rate of 3.8%, compared to the 8.1% gain for the S&P 500 SPX,

over the same timeframe, according to FactSet Research data.

Listen to the full interview with Immelt here.