Photographer: Al Drago / The New York Times / Bloomberg

Photographer: Al Drago / The New York Times / Bloomberg

U.S. Federal Reserve officials will meet this week for the first time since Democrats took control of the Senate earlier this month, which is based on the views of new President Joe Biden and raising his conference friends passing a major pandemic relief package.

At the end of the central bank’s two-day policy meeting on Wednesday, Fed Chairman Jerome Powell will raise public awareness of how he and his colleagues will evaluate the impact of the fiscal move on the economic outlook amid rising sentiment. Treasury product and stock market output pushes to new record pride.

As a result 10-year Financial Notes above 1% for the first time since the pandemic hit, investors are increasingly thinking that increased government spending to support the economy will allow the Fed to start ‘tapering its bond purchase program as early as the end of the year. . That is despite Powell’s recent remarks that “now is not the time to talk about leaving.”

The government’s first look at official data on fourth-quarter gross domestic product, published on Thursday, will show what policy makers are working with. After an annual growth rate of 33.4% in the third quarter, the economy appears to have declined significantly. Forecasters made by Bloomberg project a 4.2% expansion rate in the last three months of the year.

Consumer spending, which accounts for about two-thirds of GDP, is seen to have grown to just over 2% growth – after a three-quarter annual increase of 41% – amid a further deficit relief from the government and a coronavirus outbreak near the end of last year.

What Bloomberg Economics says:

“Monetary policy makers should embrace a small development in the wider outlook when the FOMC calls for the first meeting of the year. Yet the Fed’s measured optimism falls far short of any idea that a shift in policy stance will be expected anytime soon, according to Powell’s recent remarks now is not the time to talk about leaving the policy. ”

–Carl Riccadonna, Yelena Shulyatyeva, Andrew Husby and Eliza Winger. For a full note, click here

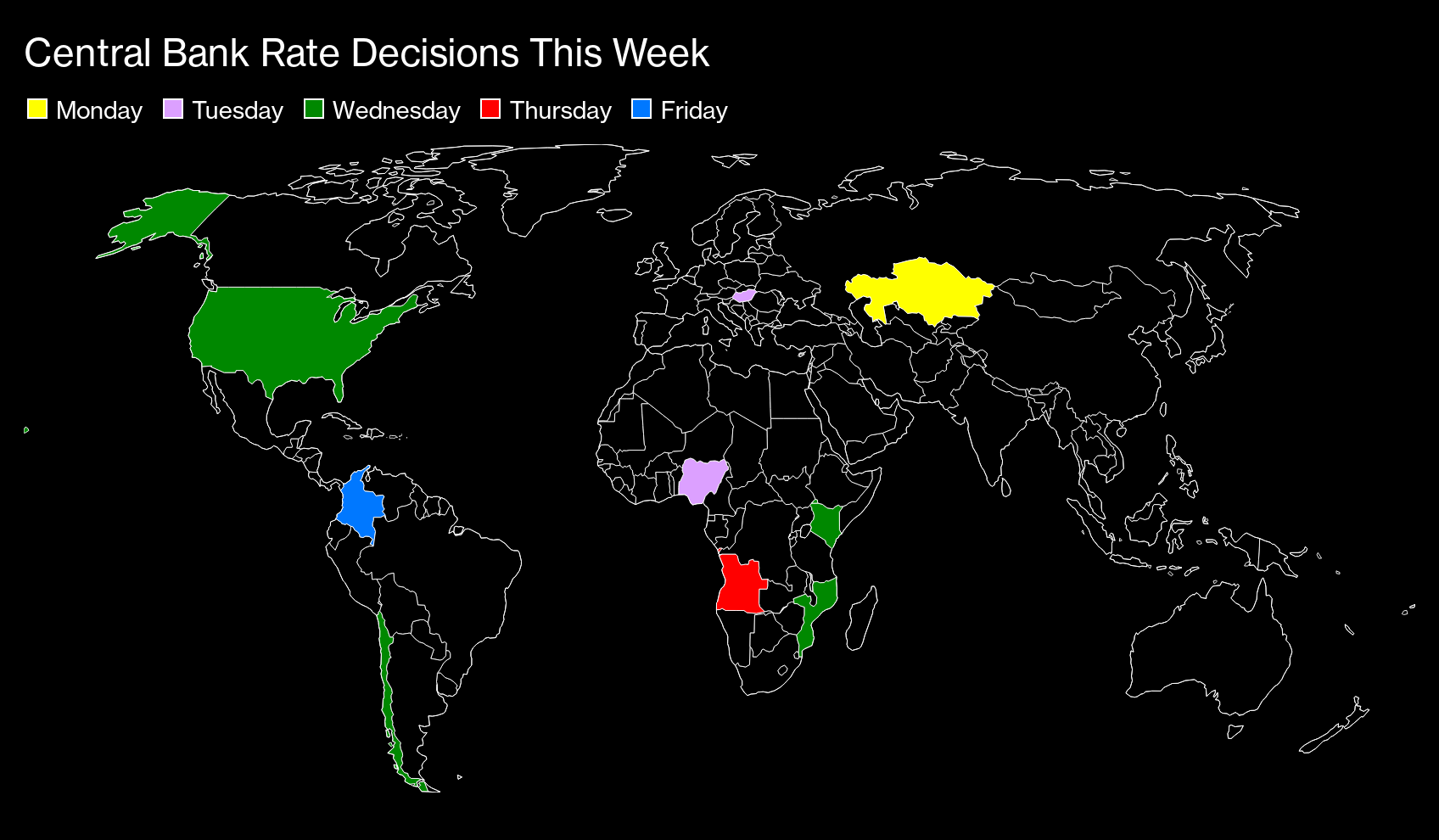

Elsewhere in the global economy, the International Monetary Fund will update its economic outlook this week, with a number of policymakers speaking at the Davos World Economic Forum virtual conference. Central bankers in Nigeria, Colombia and Kazakhstan also hold meetings.

Central bank rate decisions this week

Click here for what happened last week and below is our coverage of the future of the global economy.

Europe, Middle East, Africa

Data from France and Spain are likely to confirm their economies ended 2020 with another contraction. Germany, which also publishes GDP data, perhaps that adventure escaped, but only straight. The European Central Bank expects the euro zonethe economy contracted in the fourth quarter, putting the region close the second decline in a year.

Bad end to the year

Europe’s largest economies appear to have halted or held a contract in the fourth quarter

Source: National statistical institutes, Bloomberg studies

Top central bank officials will attend the WEF’s inaugural meetings, including ECB President Christine Lagarde and Bank of England Governor Andrew Bailey. Hungary’s central bank also holds a high-profile annual conference, with speakers including Chinese Governor Yi Gang and ECB Chief Economist Philip Lane.

Poland, Europe’s largest economy, will publish full-year GDP figures. Elsewhere in the region, the IMF mission is expected to end a review of Ukrainian economic policies. Perhaps that shows what steps the government needs to take before a staff-level agreement can be reached.

Nigeria’s central bank is likely to hold its main interest rate on Tuesday as it pits inflation at a three-year high. Officials can consider ways to encourage lenders to provide more credit to boost the economy. Monetary institutions in Kenya, Mozambique and Angola may keep their criteria unchanged following this week’s decisions.

Asia

South Korea will release GDP figures on Tuesday that are expected to show the economy escapes with much of the scarring that hit other countries as a result of the pandemic.

The The Philippines hasn’t fared as well – Thursday’s data is set to show a 9% shortfall in 2020 according to Bloomberg estimates.

Hong Kong and Taiwan will release GDP data on Friday. At the same time in Japan, a collection of data at the weekend, will show how the economy was holding up before entering the latest state of crisis.

Latin America

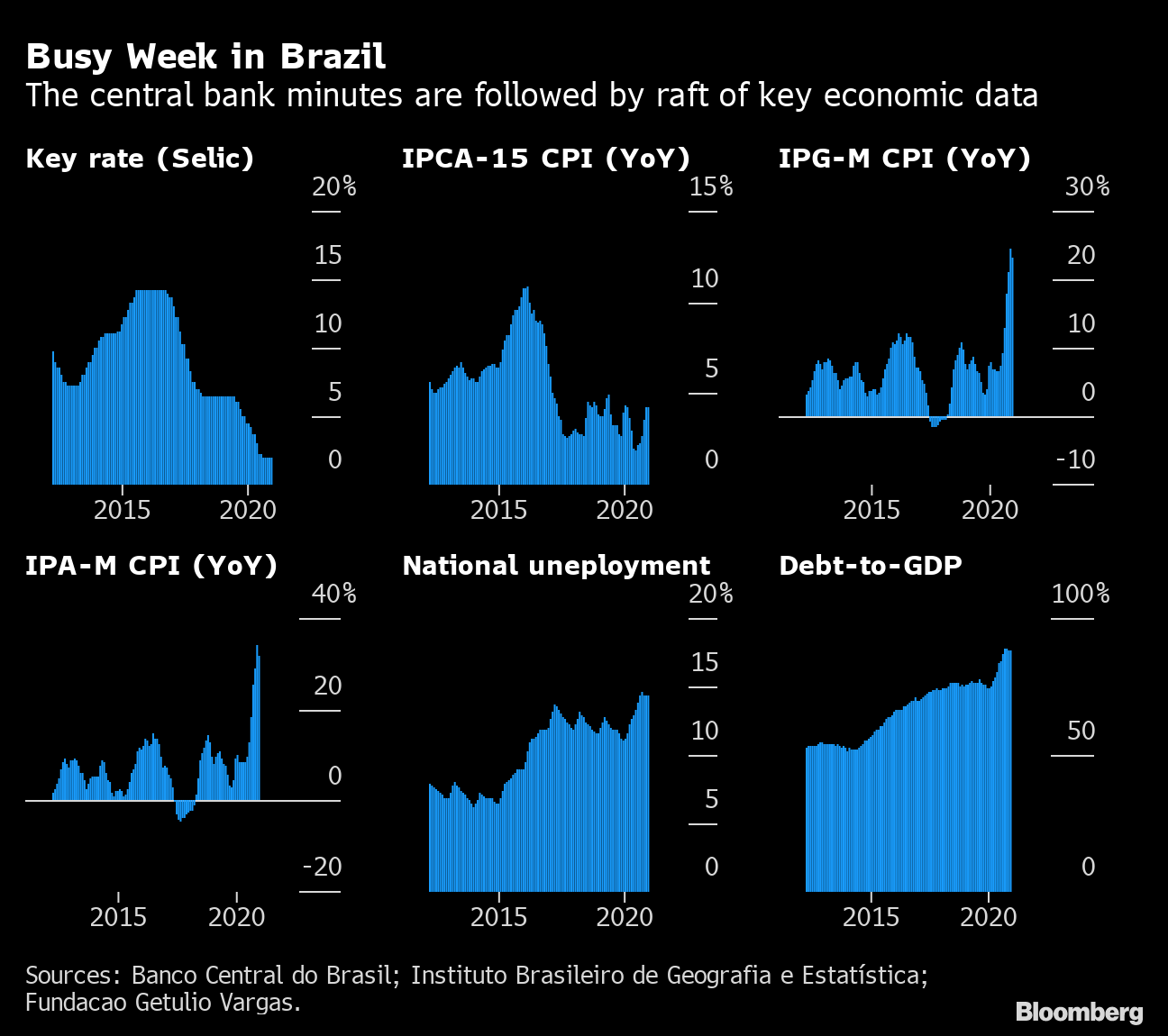

Brazilian central bank summary January 19-20 The meeting, scheduled for Tuesday, is highly anticipated after policymakers kept the main stage unchanged and issued guidance, noting that policy tightening is imminent. . Data from Latin America’s largest economy this week also includes several readings of inflation, the current account, unemployment, government debt and budget balances.

A busy week in Brazil

Following the central bank minutes are a number of key economic data

Sources: Banco Central do Brasil; Instituto Brasileiro de Geografia e Estatística; Fundacao Getulio Vargas.

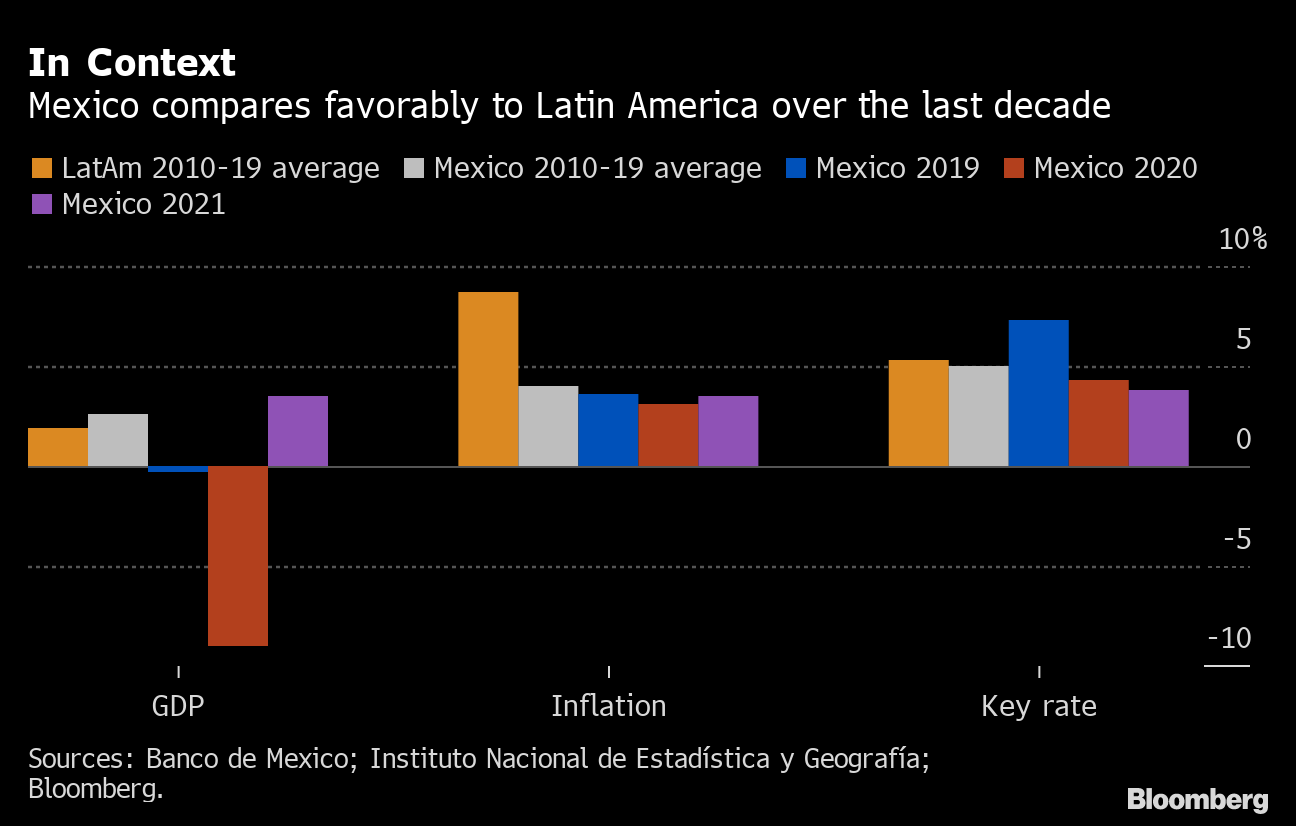

On Monday and Tuesday, Mexico will post economic activity and retail sales for November with the forecast for fourth quarter results due Friday. The recovery from the deepest recession since the 1930s has been uneven and misses some movement until 2021.

In context

Mexico compares favorably with Latin America over the past decade

Sources: Banco de Mexico; Instituto Nacional de Estadística y Geografía; Bloomberg.

The central banks of Chile and Colombia meet on Wednesday and Friday respectively: they both have no room to go but up with their main levels at the lowest levels, but are in no hurry to raise interest rates. past stop.

– Supported by Vince Golle, Rene Vollgraaff, Alaa Shahine, Malcolm Scott, and Robert Jameson