Pump jack will operate April 23, 2020 Eddy County, New Mexico. (Photo by Paul Ratje / AFP) (Photo … [+]

AFP through Getty Images

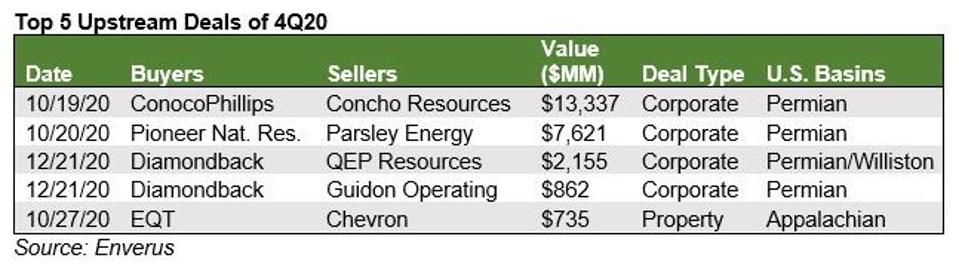

A new union and benefits report from analyst firm Enverus suggests that the hot M&A market in the oil and gas industry in the second half of 2020 is likely to slow significantly in 2021. Potential Using such contracts to reduce costs and increase efficiency through economies of scale is particularly attractive to investors, as a recent focus from building firms has been on increasing their own footprint in the oil-filled Permian Lake.

In fact, the Enverus report finds that the largest Permian region – including the Middle East to the east and Delaware Basin to the west – accounted for 83% of the value of its contracts. was made in the fourth quarter. That’s hardly surprising given that the Permian has been home to nearly half of the country’s active drilling rigs for nearly a decade now. With natural gas prices still in a narrow, low trading range, the focus remains on crude oil and other liquids, and the Permian is the richest region of liquids in North America.

“Wall Street appears to be supportive of E&P contracts, but with very specific expectations regarding the contract structure and quality of the union target,” said Andrew Dittmar, M&A Auditor for Enverus. “The limiting factor for consolidating in 2021 is the number of attractive participants that will remain at the end of a very active year.”

That last comment by Dittmar makes a very interesting point: After all the Permian activity in the second half of the year, who are the big takeover targets still standing? Taking that question back to 2019, Anadarko has joined Oxy, Noble Energy

NBL

CVX

COP

PXD

Top 5 applications, Q4 2020

Enverus

As a result, coupled with ongoing uncertainty centered around COVID-19 pandemics and as a result, Enverus is seeing a major slowdown in the oil and gas M&A field this year. But that doesn’t mean it will all stop.

Enverus noted this in a note summarizing its report: “Corporate consolidation is likely to continue as companies look to work together to reduce their cost structures. That’s especially true among small and midsize business partners, who desperately need scale. Companies that have gone through a Chapter 11 restructuring in 2020 could emerge as union partners now that debtors are entitled to their rights. However, there may be fewer major corporate contracts as so many of these have been fulfilled in the past year, winning the list of potential partners. ”

It seems that the focus of construction activity with the big players in 2021 could be on the small and midsize upstream companies that Enverus noted, especially those that leave Chapter 11 with debt loads. which has just been lowered. There is also potential for newly developed Diamondback energy

FANG

The bottom line in current market conditions seems to be that, in the upstream industry at least, growing more means getting better, especially when you are growing bigger with Permian assets.