U.S. stocks look ready for small gains at Thursday’s opening following Wednesday’s tech sale on Wall Street.

Overnight, Chinese technical stocks were suddenly hit as the U.S. securities regulator said it has enacted a new law that could lead to a breakdown from U.S. markets.

Despite the recent pressure on stocks, our call of the day, Barclays said it was “all systems go” with the risky rally set to continue and global growth set at the fastest pace in four decades.

The bank, in its latest global outlook, said fears of a U.S. economy overheating would not risk the rally, urging investors to stay fat on shares.

“Yes, many equities have expanded over the past year, but much of the rally has been due to the real increase in employment,” said macro research head Ajay Rajadhyaksha.

He noted that the S&P 500 SPX,

employment was not expected to reach 2019 levels until at least 2021, but fourth quarter 2020 earnings surpassed earnings a year earlier. “Complete V-shaped recovery within a year despite a background of pandemic-related limitations,” he said.

The employment outlook, consensus for growth of more than 21% between 2020 and 2021 was another reason to be bullish, Rajadhyaksha said.

Equity market valuations may look high compared to history, but “the scale of the positive news expected in the coming quarters means that stocks are still not looking expensive for us,” said Barclays.

The bank held an end-of-year 2021 S&P 500 target of 4,000, and within U.S. stocks it was obese on industries and healthcare as well as hardware and semiconductors. The strategists said valuations looked more attractive in the UK and euro area, despite the slow introduction of the COVID-19 vaccine.

In Europe, the bank stocks fat value stocks such as finance and commodity-linked stocks, but more preferably on cyclical sectors, and defense sectors under pressure.

Even the first-quarter bond sale, which threatened to halt the rally, just showed a clearer growth picture, but Barclays said it was still a threat.

“Admittedly, the fly in the breeze is the bond sale and the fear that inflation will force Vietnam into an aggressive vicious circle that will push the rally into danger. We believe that these fears have been overcome, ”said the bank.

“The bond market got the best picture of eliminating the risky rally in Q1. And it failed. ”

The card

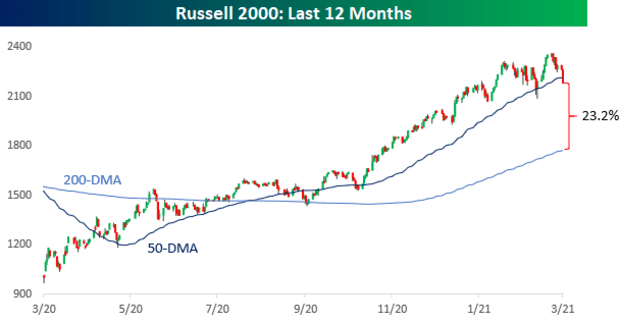

RUT Russell 2000,

closed below the 50-day moving average (DMA) but more than 20% above its 200-day moving average Tuesday, for the first time in the index’s 42-year history, Bespoke Investment Group noted . The worst day of the index in nearly a month ended its longest climbing close above its 50-day moving average in 10 years.

Special investment agency

Four out of the five hours the index has closed below its 50-DMA and more than 15% above its 200-DMA occurred “early in multi-east bull markets,” Bespoke said.

The markets

US stock futures ES00,

YM00,

NQ00,

marked slightly higher ahead of the opening, with Nasdaq futures up 0.2% after the tech-heavy COMP index,

fell 2% on Wednesday. European stocks declined lower as concerns about a third wave of coronavirus on the continent remained focused. Oil prices fell back early Thursday after firing higher on Wednesday amid the ongoing blockade of the Suez Canal.

The buzzard

AstraZeneca AZN,

he announced updated Phase 3 test data of his vaccine Wednesday night, saying it is 76% effective in preventing symbolic COVID-19. The UK-Swedish drug company first reported on Monday that its vaccine had a 79% efficacy rating.

H&M HM.B,

and other clothing and footwear brands, including Nike NKE,

and Adidas ADS,

There is a backlash in China for raising concerns about forced labor in Xinjiang province.

GameStop GME,

stock suffered its worst day in seven weeks Wednesday, after profit and sell – off in the fourth quarter fell short of expectations. Videogames retailer stock was also reduced by Wedbush analyst Michael Pachter.

The Suez Canal, one of the most important trade routes in the world, was still blocked by a large cargo ship when attempts to free the ship entered the third day.

The European Union has outlined proposals for stricter control of COVID-19 vaccine exports to the UK and other countries with better vaccine rates. The proposals will be debated on Thursday but tensions between the UK and the EU could be eased by a deal announced to co-operate.

Randomly read

The new £ 50 UK note honors Alan Turing’s maths reveals “GCHQ’s most difficult puzzle ever.”

Nice catch: Fisherman rescues boy trapped on ice.

Need to Know starts early and updates until the opening bell, but sign up here to have it delivered once to your inbox. The email draft will be sent out at around 7:30 am East.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning preparatory meeting for investors, including a special report from Barron and MarketWatch writers.