Christine Lagarde

Photographer: Martin Lamberts / ECB

Photographer: Martin Lamberts / ECB

The European Union’s path to fiscal co-operation doesn’t look as sure as it would like its money backers, throwing more clouds over a view already stifled by the bloc’s botched vaccination campaign .

The President of the European Central Bank, Christine Lagarde, last week issued a warning to lawmakers about the introduction of a 750 billion-euro ($ 896 billion) pandemic recovery fund. builds on colleagues’ warning. That will put pressure on the EU leadership to fix their flagship machine, especially with other parts of its emergency response failing.

A more positive U.S. vaccine push and a $ 1.9 trillion stimulus by President Joe Biden who is already posting surveys to citizens highlighting Europe’s various deficits. While America a splurge that encourages consumption cannot be directly compared to the EU’s long-term assets and focus on investment, it will still fuel faster.

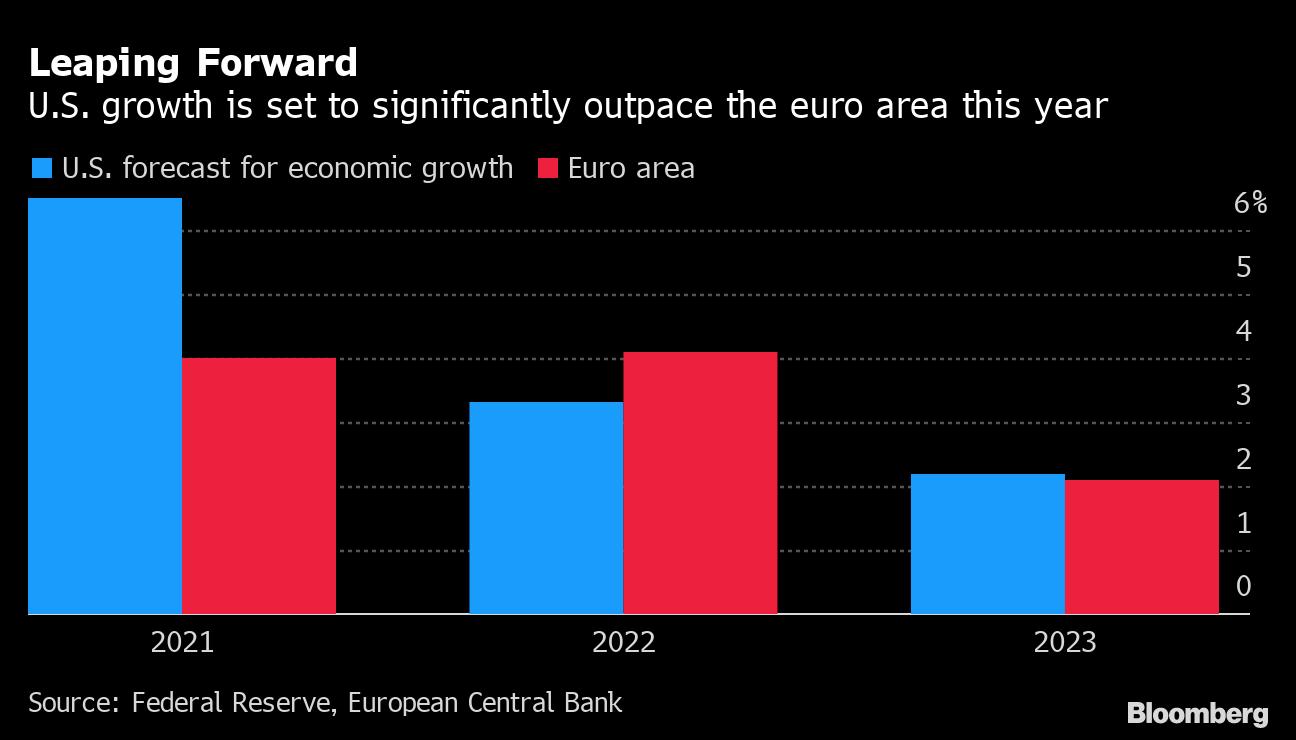

Jumping forward

The US is expected to grow much larger than the euro area this year

Source: Federal Reserve, European Central Bank

Federal Reserve Chairman Jay Powell reaffirmed the point last week when he said he would be “delighted to see Europe grow faster.” ECB officials could strongly agree, knowing that in the absence of fiscal assistance, they will have a greater responsibility to stimulate the economy.

“They are looking at what is happening on the other side of the Atlantic and it is clear that what Europe is doing is not appropriate,” said Nick Kounis, an economist at ABN Amro Bank NV in Amsterdam. “There are concerns that if there is no European fiscal effort, the output gap is going to remain in place.”

Lagarde fa-near the difference in strategy from the US in the European Parliament on Thursday, but they also suggested that it is a good reason that governments should not go through it.

“Instead of mourning enough, the different speeds, the different effects, we should all put all our energy into making sure we delivery, and that implementation will continue as quickly as possible without too much publicity, ”said Lagarde. “It’s important for the impact of confidence.”

What Bloomberg Economics Says …

“The sense of panic in the EU over the supply of adequate resources for all 27 member states combined with immunization is boosting economic confidence in the region.”

– Support our economies Europe, the Middle East and Africa. For their report, click here

Payments under the recovery fund should start around mid-2021 and are spread over several years, aiming for investment to put the block back for a greener and more digital future. Most government applications to the EU still have to work before the April 30 deadline, according to people familiar with the matter.

Similarly, only 13 of the 27 member states have approved an agreement that will allow the Commission to fund the funds in the bond market.

Read more: EU Recovery Fund threatens delay with spending plans judged sub-par

Observers maintain that the process is still within a long-planned timeline.

“The agreement was not just to give countries money and let them do what they want,” said Zsolt Darvas, a senior at the Bruegel think tank in Brussels. “If you don’t just want to throw the money out the window, but have a sensible investment and spend, you need to prepare detailed plans.”

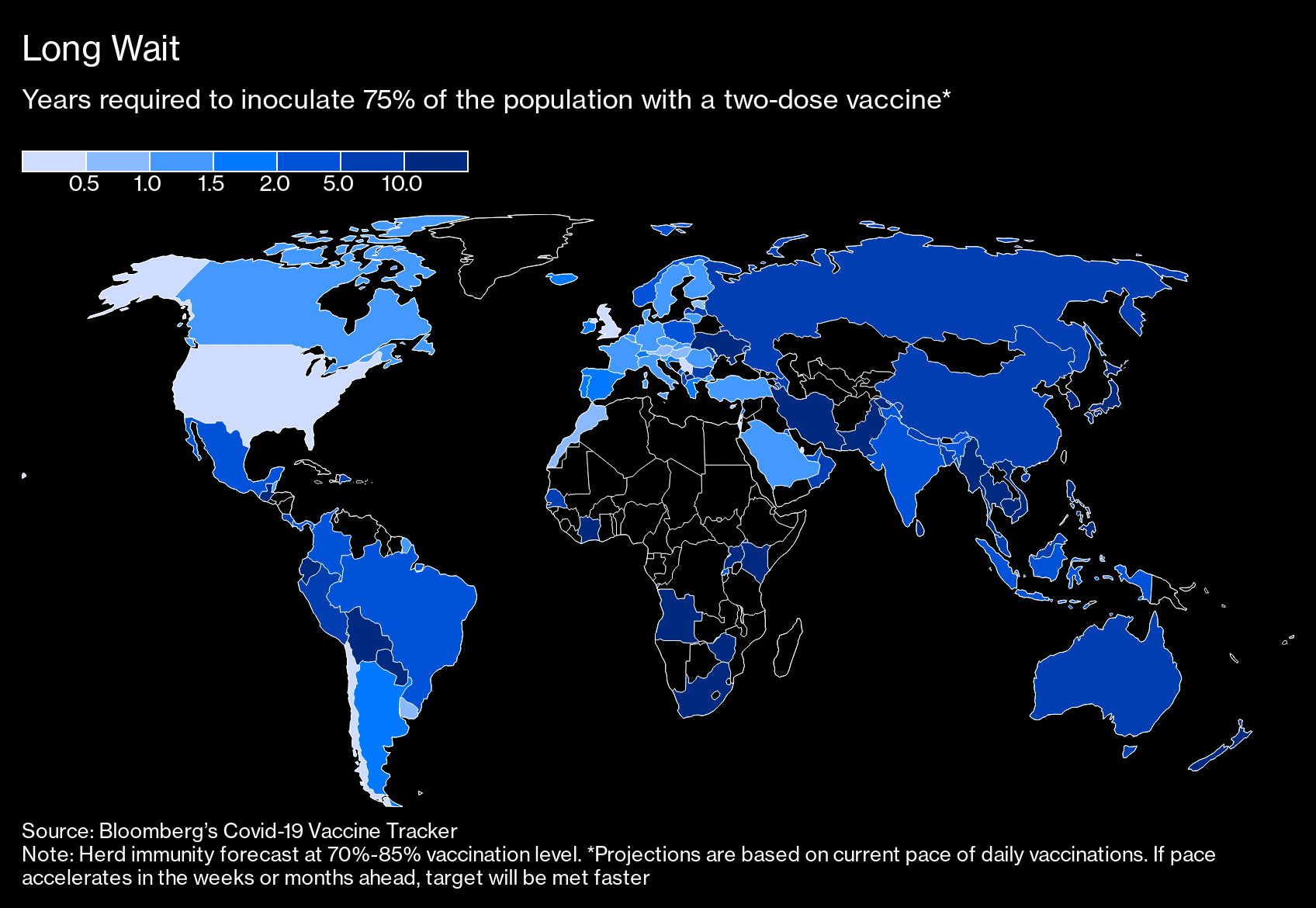

Wait a long time

Years required to vaccinate 75% of the population with a two-dose vaccine *

Source: Covid-19 Bloomberg vaccine detector

Confidence in the fund is even more important given that the slow spread of the vaccine has led to extended restrictions and almost certainly another economic downturn in this quarter, an idea that will focus on mindset at the EU summit Thursday. The economy is expected to return to its pre-pandemic size just in mid-2022, a year behind the US

Read more in Bloomberg vaccine administrator

“My concern is that, given the huge US fiscal pressure, the European influence will start with a long delay,” ECB Governing Council member Peter Kazimir said in a published interview. Wednesday. “Fiscal co-operation is coming to an end and it needs to build pace to support recovery. ”

In remarks to Les Echos the same day, ECB Governing Body member Isabel Schnabel also questioned whether the EU’s effort could be inappropriate.

“US measures are bigger,” she said. “European support could be enough. ”

Slowing forward

As the vaccination crisis progresses, so does the recovery fund, as in the meantime almost all fiscal support comes from national measures that are being implemented. -fair across the region.

Economists Morgan Stanley says if inoculations do not pick up soon, the second summer could suffer lockouts hitting southern countries that rely on tourism. The fund is “designed to support synchronous recovery by aiming to support the worst-hit areas,” they wrote in a report.

While Lagarde recognized spending plans should be “well-designed,” she reminded lawyers of her challenge while the EU Commission does its due diligence. Bond yields are rising as a result of rising U.S. inflation, prompting the ECB to accelerate incentives to stop higher borrowing costs for companies and households.

The recovery fund should “work without delay,” Lagarde said. “We shouldn’t be too stressed about ourselves, but we should deliver.”

– Supported by Viktoria Dendrinou, Joao Lima, and Zoe Schneeweiss