Photographer: Rolf Schulten / Bloomberg

Photographer: Rolf Schulten / Bloomberg

The European Union, which is set to become one of the largest issuers of green and sustainable bonds, will sell debt for the first time in 2021 behind higher demand than ever before. last year.

The block is likely to be issue 14 billion euros ($ 17 billion) of seven-year and 30-year social bonds for a work support program in the coming week. That’s just a taste for investors for the prime supply once it starts funding a pandemic recovery program in the middle of this year.

When complete, the EU will have sold around 800 billion euros of bonds – a third of which will be green – placing it firmly in the ranks of the world’s largest issuers. If recent eurozone contracts are about to pass, EU bids should be successful, and even cannibalize demand for debt from member states.

France outperformed higher orders for 50-year debt sales this month, while Italy’s 10-year syndication saw direct shy demand of its high. Last year the EU got the the largest order book ever, collecting 233 billion euros of bids for a two – part social bond contract in October.

“Demand does not appear to be in line with the numbers seen in the first issues, but they should be enough,” said Jan von Gerich, chief strategist at Nordea Bank Abp. “There are plenty of other investors out there than just the European Central Bank.”

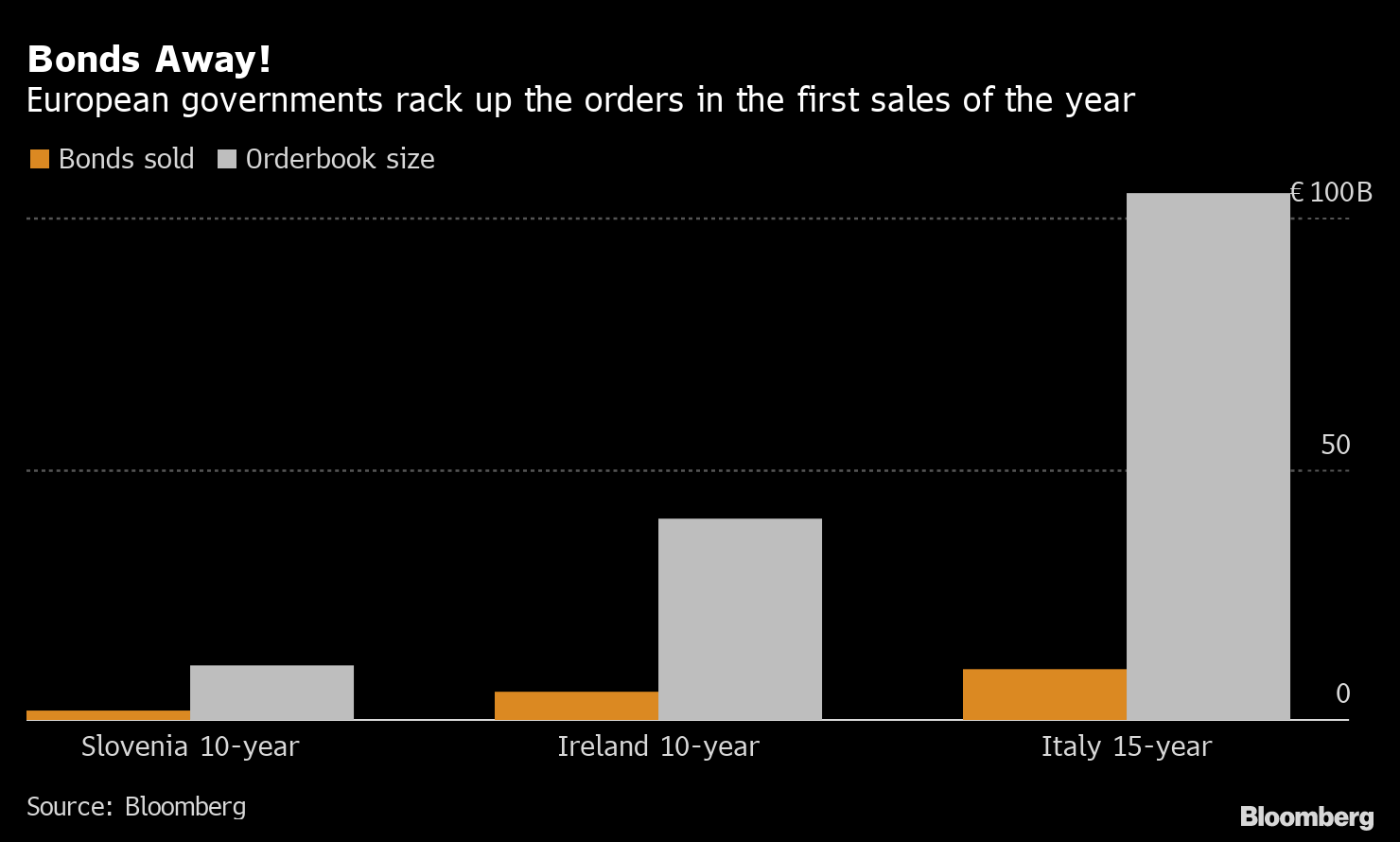

Bands gone!

European governments settle the orders in the first sale of the year

Source: Bloomberg

The sale comes after the ECB on Thursday maintained the size of its 1.85-trillion-euro bond buying program, which has raised the price of debt across the region. That leaves investors struggling with a shortage of high-quality investment-grade securities – something the AAA-rated EU is about to offer.

One week ahead

In addition to the announcement of EU debt, normal government bond sales are expected to slow next week, with Commerzbank AG estimating that around 16 billion euros will come to market from Germany, Italy and the United States. Holland. The UK will sell 2.5 billion pounds of 2035 bonds and 1.75 billion pounds of 2050 bonds on Tuesday, followed by inflation-linked bonds on Wednesday.

Wednesday’s first Federal Reserve flat rate decision marks Wednesday’s main event, with a rising bet in markets that the institution could be an early mover among major central banks to get started. tapering its asset purchase program. In Europe, the focus will also be on the buying speed of the ECB, with Italian politics still choppy amid the continued profiteering of new elections in the country.

- Portugal election by President Marcelo Rebelo de Sousa to lead two inquiries into voter intentions; volatility in the country’s bond markets is expected to be limited

- The World Economic Forum will also take place

- Money market traders are focusing on ICE’s consultation round on halting Libor’s closure on Monday

- Germany will start eurozone data with their IFO news on Monday, while CPI data from Saxony and Brandenburg on Thursday will track the figures for the wider eurozone next week

- High-level data for the UK were not recorded

- A busy week for ECB speakers, with President Lagarde speaking on Monday, with Panetta, Lane, Elderson, Weidmann, Centeno, Villeroy and Schnabel all making appeals

- BOE Governor Bailey will speak at the World Economic Forum 5pm on Monday