What exactly happened?

Of the bonkers details about the real bonkers that have passed 10-12 months, one in particular stands out.

Last fall early, when vaccination euphoria went against concerns that something might go wrong with a spread out, and because relief over the end of the presidential race gave a long-standing fear that it would not be co-opted. closing on Nov. 3, MarketWatch published its series of stories meant to help investors protect their records against major hits.

“Just launched: ETF made for black swan moments like these,” noted options-based stock ETFs, Simplify US Equity PLUS Convexity SPYC fund,

run in early September. On 1 October, we continued with ” Anything Can Happen: ‘Why the Hottest Investment Movement is Safe to Play,’ which considered a range of outcomes designed to mitigate major upside or down risks.

Flash forward five months or so, and pause to comment. Not only was the election contested, but it turned out to be incredibly brutal. Not only has the vaccine release been introduced, but it has gotten so bad that one public health official has issued a warning “Eternal disease” for most of 2021.

And what have markets done? In the months since the publication of that first “black swan” story, it could be said to have been a ceremonial time except that it was shortly after a small correction, through the end of the industry on Wednesday, the S&P 500 SPX,

up nearly 13%. Bond yields and oil prices have jumped, as have commodities – all normal signs of a growing economy.

It’s something baffling – a shift from the old adage “the stock market economy is not the stock”, to the billionth of power. Katie Martin, writer of the Financial Times column, said this week that it was “a boiling frog moment.”

“Investors are quite capable of avoiding signs of the extraordinary ones,” she wrote. As we said last week, time will tell.

Thanks for reading, as always.

Trade-exchange sundries

-

ETFs had a year higher, according to full-year data from Morningstar, released Wednesday. Inflows were $ 502 billion, with tax-bonded ETFs accumulating the majority of any division, nearly $ 195 billion. Separate assets saw $ 289 billion higher than outflows in 2020, but their $ 18.2 trillion total assets at the end of the year were still more than three times the total ETF assets.

-

Vanguard announced Tuesday that it will launch an active-regulated short-term bond fund with the lowest regulatory fee in the region. As MarketWatch has reported, existing funds, such as the JPMorgan Ultra-Short Income ETF JPST,

-0.02% ,

often used as money management tools. -

What is the best way to play ETF for Biden’s new administration? Many analysts have suggested infrastructure funding with the idea that fiscal spending will boost that sector. But what assets, in particular? An Informal Twitter bet between two ETF-land highs sets US Global Infrastructure Development X X ETVE PAVE,

-1.41% ,

Todd Rosenbluth was elected, against the FlexShares STOXX NFRA Global Infrastructure Index Fund,

-0.69% ,

Dave Nadig’s favorite. So far this year, PAVE is up 7.3%, and NFRA has gained 2.3%. It’s early innings, though.

Is there an ETF for that?

In June last year, amid the unrest following the assassination of George Floyd, MarketWatch reported a unique asset. The impact affects the power of the NAACP ETF minority,

the only financial outcome that specifically addresses racial inequality, relying on ideas from the National Association for the Advancement of Colored Persons to select stocks from companies that follow certain principles, such as workplace diversity, bargaining policies , community development initiatives, and more.

Recently, after nudge from an experienced analyst, it seemed like a good time to update the fund. We spoke to Marvin Owens, a former NAACP affiliate of the fund. In November Owens joined the staff of Impact Shares in a new position.

“My goal is to start realizing the mission of Impact Shares, which is a platform for communication,” Owens said. It intends to work with investors, social advocacy groups, and corporate America, “not only to grow assets under regulation, but also to demonstrate that capital can be used to create social change. . ”

Here’s some evidence: NACP returned 26% in 2020, passing through the S&P 500, which gained 18.4%.

Owens says such performance helps in making the case to investors “that you don’t have to skip results to make an impact. ”

There is still work to be done to attract investment dollars. When MarketWatch first covered the fund, there was an agreement that when a fund hit $ 20 million, they would start sharing money with the NAACP. (As of this writing, the fund is just over $ 21 million). That has been renegotiated, and the fund will now deduct taxes once it reaches $ 100 million.

Owens refers to the fundraising collection in terms familiar to many ETF viewers: as a “chicken and egg” problem. Institutional investors want money to meet certain criteria before considering investing, but it is often difficult to get by without deep investors.

Owens is not afraid, however. The fund is coming up on its three-year anniversary, which is one of the top goals that investors will often want to see, he said. “We’re really in the process of getting out and talking to people, being in the market, representing the assets and raising the profile.”

Read next: There is no such thing as ‘tolerating’ investing in America as deeply racist, says Rachel Robasciotti

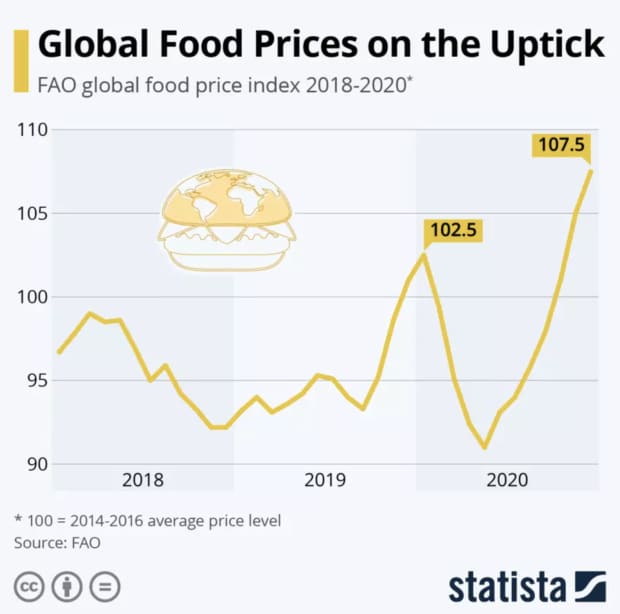

Visual of the week

Courtesy of Statista; original can be found here.

Weekly rap

| Top 5 winners of last week | |

|

Global X Cannabis ETF POTX, |

20% |

|

ETFMG Alternative Harvest ETFMJ |

14% |

|

Cannabis ETF THCX, |

12.7% |

|

Increase Seymour Cannabis ETF CNBS, |

11.1% |

|

Global X MSCI Nigeria ETF NGE, |

7.9% |

| Source: FactSet, through close trading on Wednesday, January 20, excluding ETNs and leveraged results | |

| Top 5 losers last week | |

|

iShares MSCI Global Silver Miners ETFSLVP |

-7.9% |

|

Major Cash Miners ETFMG ETF SILJ, |

-7.6% |

|

Global X Silver SIL ETF Miners, |

-7.3% |

|

United States Natural Gas Fund LP UNG, |

-6.7% |

|

Global Gold Investigators X ETF |

-5.6% |

| Source: FactSet, through close trading on Wednesday, January 20, excluding ETNs and leveraged results | |

| Top 5 inflows in the past week | |

|

iShares Core Total Bond Market ETF IUSB, |

$ 2.9 billion |

|

iShares MSCI EAFE ETF EFV Value, |

$ 2.35 billion |

|

Select Section SPDR FundXLF Finance |

$ 1.73 billion |

|

iShares Core MSCI Emerging Markets ETFIEMG |

$ 1.34 billion |

|

Dow Jones Average ETF business average trust Dow DIA, |

$ 1.27 billion |

| Source: FactSet, through close trading on Wednesday, January 20, excluding ETNs and leveraged results | |

MarketWatch has launched ETF coverage, a weekly newsletter that gives you everything you need to know about the trading sector: new asset discussions, how to use ETFs to make an investment idea, business rules and changes, inflows and performance, and more. Sign up at this link to get it right in your inbox every Thursday.