Egypt left interest rates unchanged, halting monetary easing amid fears of the impact of a new strain of the coronavirus on global markets.

The Monetary Policy Committee kept the investment rate at 8.25% and the loan rate at 9.25%, it said Thursday in a statement. The decision was predicted by all 14 economists surveyed by Bloomberg after authorities cut rates by 400 cumulative points this year.

Along with the pandemic, the central bank also measured an increase in November inflation to 5.7%, the highest level in seven months. Despite the rise, the North African nation’s real interest rate is second only to Malaysia among more than 50 major economies that Bloomberg looked at – a key feature in attracting in- foreign flow to its local debt market.

Average inflation in the fourth quarter of 2020 is likely to fall below the 6% target floor, the MPC said, noting that Egypt’s economic growth is expected to recover albeit gradually, with structural measures are expected to support economic activity. ”

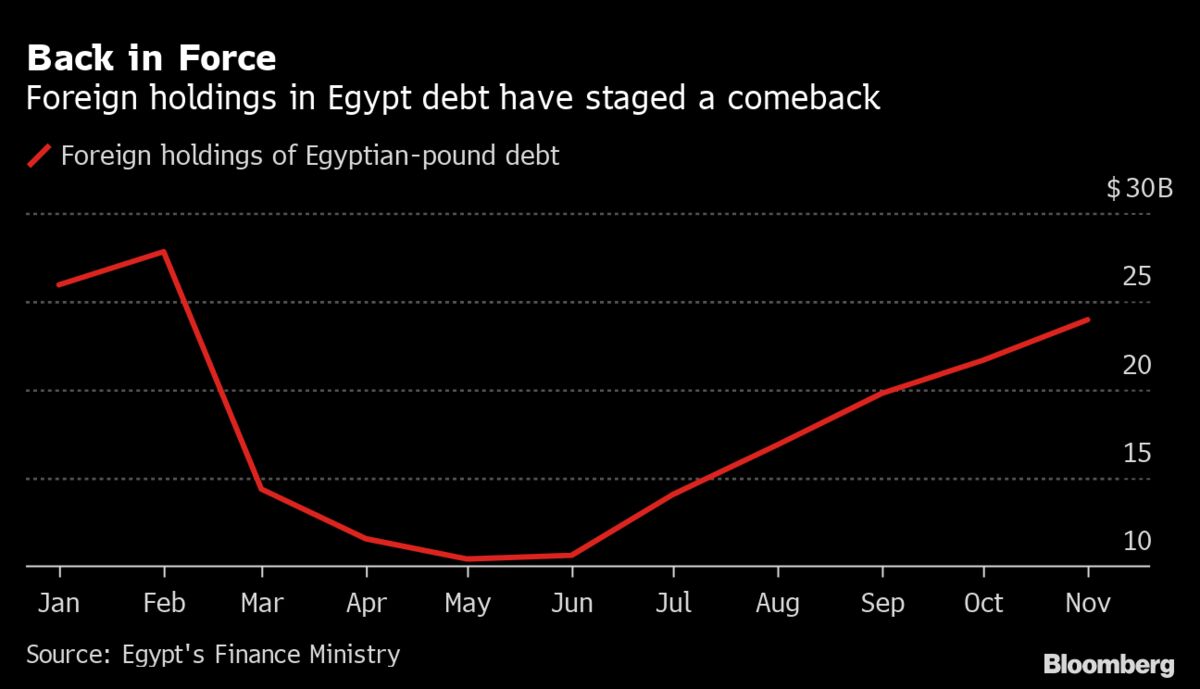

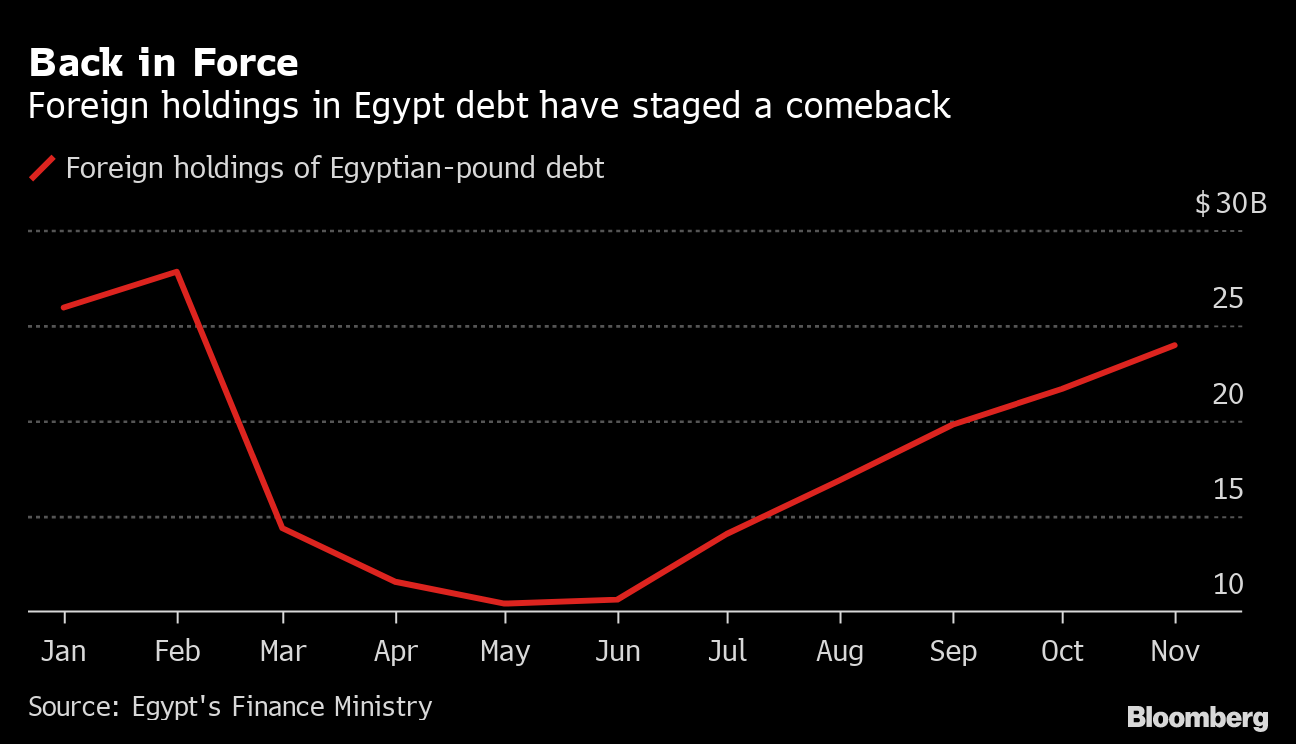

Back in effect

Foreign holdings in Egyptian debt have returned

Source: Egyptian Ministry of Finance

Overseas holdings in the country’s finance bills and bonds rose to $ 24 billion in November from $ 10.4 billion at the end of May, kicking back after spring-related virus sales and inspired by recent agreements with the International Monetary Fund. Two of Egypt ‘s other major sources of foreign exchange – tourism and Suez Canal receipts – have been hit by the pandemic.

Authorities have a role to play in launching cash rebates in 2021, but “the timing and scale of the cuts are entirely dependent on volatility in global markets,” said Radwa El-Swaify, Cairo’s head of research. Pharos Holding, he said before the decision.

Inflation rates may be “under the influence of adverse adverse effects associated with the normalization of monthly inflation rates in 2021,” but will remain around a target of 7%, more or less than two percentage points, for the fourth quarter of 2022, he said.

– Supported by Harumi Ichikura, Tarek El-Tablawy, and Abdel Latif Wahba