Bitcoin’s intriguing rise to record highs on investors is racing to be open to the rally – even though it means paying an absurd high mark.

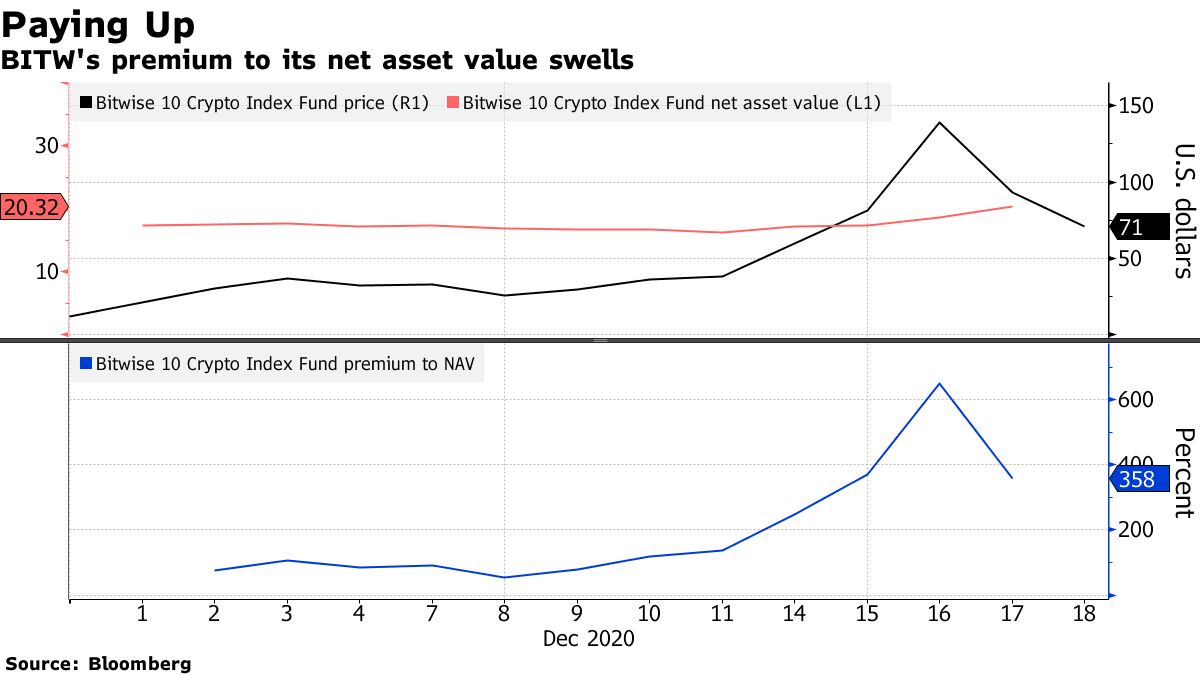

As the largest cryptocurrency appeared above $ 23,000 for the first time this week, the price mania pushed the Bitwise 10 Crypto Index Fund (BITW ticker) is as much as 650% above the value of its holdings and is currently trading nearly 350%, according to data compiled by Bloomberg. At the same time, the price of the Bitcoin Grayscale Trust (GBTC ticker) moved to 34% among the rally.

Such setbacks mean that large institutional investors and mom-and-pop traders alike have to pay heavily to buy shares, as opposed to buying the underlying holdings altogether. But with Bitcoin’s 200% rally so far attracting muscle attention and raising fears that it will miss out on the benefits, demand for anything with a crypto platform is growing. For those investors who are looking for access to Bitcoin but are unsure or unsure of how to get a direct disclosure, the ease of buying a product like BITW or GBTC through a breakout platform is cost the extra cost.

“The answer is not as simple as it makes sense to pay for that? in a vacuum. It doesn’t make sense to pay that price, ”said James Seyffart, Bloomberg Intelligence ETF analyst. “But I think there is some level of justification, and if you want access to Bitcoin, there are no better options. ”

BITW has gone up 165% since its inception the first time earlier in the month, far outweighed the gains in Bitcoin and Ether. GBTC has climbed around 40% over that period. That performance creates the gap between the prices of the products and the net asset value of their underlying holdings.

These shocks appear from time to time in the global $ 5 trillion trade fund universe – especially in times of higher volatility, as in March – but rarely exceeds 3% or so. When they do, certain traders called authorized partners step in to close the gap by creating or repurchasing shares of the ETF.

However, since the Securities and Exchange Commission has not yet approved an ETF for cryptocurrencies, such intermediaries do not exist for Bitwise and Grayscale products. None of the vehicles allow repurchases, meaning a fixed number of shares are issued, although high-end offers are allowed by GBTC for institutional investors who deposit Bitcoin. Nevertheless, this can lead to discounts or high prices in the event of an imbalance in supply and demand.

Companies that dabble in crypto-related businesses have been a surrogate for emerging from the Bitcoin bubble in 2017. Investors took that to a whole new level when a business intelligence company MicroStrategy Inc. moved. its financial holdings into the cryptocurrency in August, pushing its shares to more double.

The prices reflect “strong demand from investors to obtain Bitcoin exposure through means other than direct ownership or through crypto exchanges,” said Nate Geraci, president of ETF Store, an investment advisory firm. “It is entirely in their minds that regulators allow retail investors access to these products, but they do not allow a Bitcoin ETF to easily resolve the issue. ”

A rough calculation behind the envelope suggests that, at a price of 34%, investors pay the equivalent of $ 30,522 if the price of Bitcoin is $ 22,800 per coin. At a BITW prime price of 358% – which only Bitcoin holds – that amount is balloons to $ 104,424.

But still, for investors looking for crypto disclosure in retirement accounts or other packages, buying shares of BITW or GBTC seems to be seen as the easiest way outside of using high-throughput. digital asset trading platform, according to Seyffart.

“If you want Bitcoin in your bankruptcy IRA, the simplest way is through GBTC,” Seyffart said. “It simply came to our notice then councilors you cannot learn how to use crypto apps or Money App, but if you want to get Bitcoin in the legacy financial systems – where almost all money is – you need something that works in that system. “

– Supported by Vildana Hajric